by UKarlewitz, The Fat Pitch

The main points in this post are:

- Individual and professional investors have already made a big move out of bonds.

- The price of bonds responds to changes in fund managers weighting and less to the absolute weighting levels. Fund managers weightings are now at the bottom of the long term range. A further big move down would be unprecedented.

- The recent change in treasury yields appears to be well out of proportion to both actual growth and inflation. In other words, the recent drop in bond prices seems to be an over reaction.

- Putting this altogether, bond yields are either close to stabilizing or, potentially, reversing lower. This would be a positive not just for treasury bond holders but for other yield assets like dividend-paying stocks.

In March, the 'Great Rotation' (out of bonds and into equities) was the dominant meme in the press. SPX was off to its best start in years and TLT was down 7% over the prior 4 months. It was the consensus view.

We suggested that was likely a crowded trade (read the post here). Over the next 6 weeks, that looked to be dead right. 10-year yields fell from 2% to 1.6%. TLT rose 6% and outperformed SPX by almost 500 bp. Large funds increased their bond weighting by 15 percentage points between March and May.

Of course, all that came to a screeching halt on May 2nd. SPX has since outperformed by 2100 bp. In short, the bond trade rolled into a ditch, flipped over, caught fire, exploded and then fell down a 10,000 foot crevasse.

Changes in investors' position drives bond prices, and they have already made a big move out of bonds

Investors are well aware of this, and have acted to get out of bonds. Trim Tabs estimates that US bond fund and ETF outflows in August will be the 4th largest ever. In just 3 months, almost 3% of total assets have left funds.

Individual investors' holdings of bonds in July fell to a 4 year low and will certainly be even lower now. That money has, in fact, rotated into equities: their equity holdings rose to the highest level since September 2007. To be clear, looking at the chart, both of those trends can continue.

Professional investors are even more sanguine on yields. According to BAML, among fund managers with $700bn in AUM, all but just 3% expect long term rates to be higher in the next 12 months (blue line). In fact, they have not been this bearish on bond prices since early 2004, which turned out to be the high point in 10 year yields for the next two years (green shading).

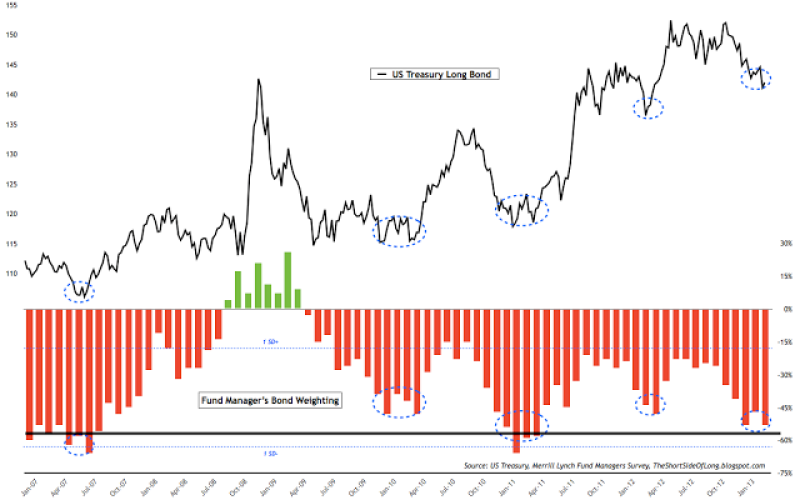

According to BAML, these fund managers are now 57% underweight bonds. This is the lowest since the start of 2011, which was also a turning point in bond prices (chart below, from Short Side of Long, March 2013; the black line is at 57%). This is a big change from May, when funds were 38% underweight bonds. In 3 months, funds have reduced their bond weighting by 19 percentage points. That's a big move.

Going back further (chart below is from 2011, black line again at 57%), fund managers were more underweight bonds during parts of 2003-07, although not by much.

The main take away from looking at fund managers' positions in bonds is this: the price of bonds responds to changes in weighting and less to the absolute levels. And for fund managers, the big move out of bonds has mostly taken place already. Fund managers weightings are now at the bottom of their long term range. A further big move down would be unprecedented.

Do fundamentals appear to support the recent move higher in yields?

Readers of this blog know that we track macro expectations. Recently, macro data has been surprising to the upside by the widest margin in nearly two years; in fact, since 2011, which was the last time funds were as underweight bonds as they are now. This matters, as upside surprises (blue line) correlate with better EPS growth, higher P/E multiples and with equity outperformance relative to bonds (yellow line).

The concern, however, is that this is more a reflection of low expectations than positive data. More specifically, bond yields should reflect future expectations of inflation and growth, neither of which appears to confirm the recent spike in yields.

Core price inflation is well below the Fed's target range of 2%. More over, it's falling. (Remember that core prices, which strip out the volatile price elements of CPI, are used because they provide the best basis for predicting future changes). The Fed prefers PCE (red line) to CPI (blue).

The most important driver of future CPI is wages. The correlation is high (87%).

But wages are growing less than 1% and the trend is flat over the past two years. In short, there is no wage-price spiral, at least not yet.

The bond market appears to believe the economy is at the 1987, 1995 and 2004 inflection point, where unemployment (red line) falls to a point where wages will shoot higher. Getting to that inflection point will require high growth in sales (GDP).

But GDP growth is less than 3%, the slowest level of year-over-year growth ever outside of a recession.

Looking ahead, economists have lowered GDP growth forecasts for 2013 to 1.5% from 2%. 2014 is expected to be better, at 2.6%, but note that the trend in the forecast is down and the rate is non-inflationary. This rate of growth means that unemployment will remain above 7% and the pressure on wages will therefore likely remain slight.

Outside of wages, the output gap in the economy remains high; in other words, there is plenty of spare capacity. This explains why companies have been reluctant to commit to capital expenditures (which, in turn, boost employment). Also note that the present situation is very different from the 1987, 1995 and 2004 unemployment-wage inflection points referenced above.

Net, the recent change in treasury yields appears to be well out of proportion to both actual and expected growth and inflation. In other words, the recent drop in bond prices seems to be an over reaction.

Putting this altogether, bond yields are either close to stabilizing or, potentially, reversing lower.

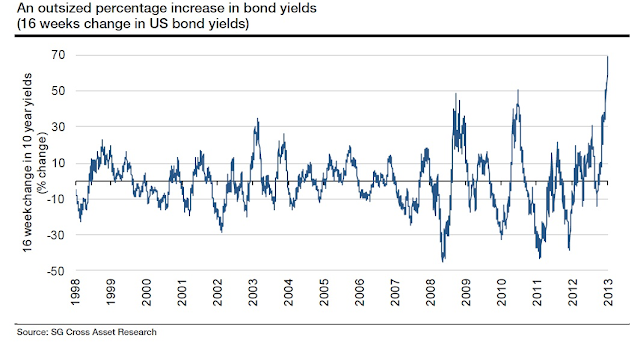

This would be a positive not just for treasury bond holders but for other yield assets like dividend-paying stocks and muni-bonds. The recent move in 10 year yields is one of the most extreme in more than 30 years; others like it in the past are highlighted in blue below. Reminder that bond prices move opposite to yields.

It would also likely stabilize or reverse the flow of capital into equities. Fund managers allocation to equities is near their long term highs and their allocation to US equities has not been substantially higher since 2001.

Corporate results confirm the sluggish macro environment.

The 2Q reporting is essentially over: EPS growth was 2%, the lowest rate in 4 years and in line with revenue growth. This matters, because expectations are for 7-10% growth for FY13 and FY14. Already, expected 3Q EPS growth has fallen to less than 4% from 7% on June 30th.

For the technology sector, the disconnect is much worse: 2Q growth was negative 8%, 3Q expectations have fallen to 1% growth yet FY14 expectations remain for over 10% growth.

Corporate results have been lagging for two years. More than 80% of the appreciation in SPX (green line) since 2011 is accounted for by multiple expansion and less than 20% by earnings growth (blue line).

(Disclaimer: the author is not a former IMF or World Bank official or chief economist of Goldman).