by William Smead, Smead Capital Management

From 1997 to 2003 a show called,” Win Ben Stein’s Money” ran on the Comedy Central Network. The last five years, investors in the US have been playing a very similar game we are calling, “Win Ben’s Money”. The new game stars Federal Reserve Board Chairman, Ben Bernanke. The object is to win the money the Fed creates via Quantitative Easing (QE) through macroeconomic analysis. In this missive, we will look at how these investors chased Ben’s Money and consider what to do going forward.

Ben Stein parlayed his popularity from writing and acting—most notably in Ferris Bueller’s Day Off— into hosting his own game show. Contestant’s answered questions to outscore two other contestants in order to win $5,000 of Ben Stein’s money. The skill was in answering the questions and the goal was to win Ben’s money.

The new game is very similar, but greatly misguided. Institutional and high net-worth individual investors have been guided by contestants in the new game. Ben Bernanke is the foremost student of the Great Depression and concluded in 2008 that the Federal Reserve Board needed to do everything in their power to help us avoid the deflation and high unemployment of that period. He used an expansion of the Federal Reserve’s balance sheet to cause extremely low interest rates at both the short and long-term end of the yield curve. We believe most participants in US investment markets have feared investing in anything beside asset classes which are positively affected by Ben’s Money.

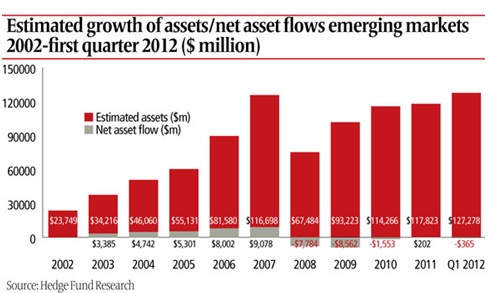

In an attempt to Win Ben’s Money, investors have chased emerging markets through China and its cast of dependent commodity producing underlings. They have accepted commodities as an asset class and piled billions of dollars into them like a major US stock index. The assumption was that Ben was expanding the Fed’s balance because of how bad things were going to be in the US economy. They craved growth elsewhere in the world (emerging markets) and sent the money Ben created into commodities, which hypothetically benefitted from their economic growth.

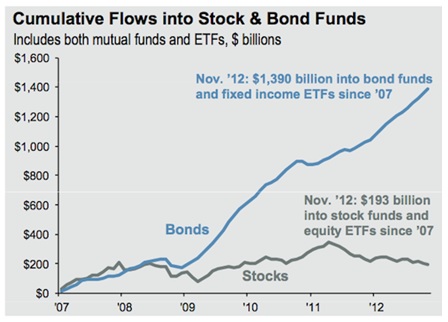

Investors gorged on US and International bonds to try to Win Ben’s Money, driving interest rates to levels last seen in the years just after World War II, sixty years ago. Their logic was divorced from the rate of interest and future mathematical possibilities. As Will Roger’s said, “There will come a day when people are most interested in the return of their money, rather than the return on their money.” Will was right and that day has been going on for five years.

Source: JP Morgan

There are a number of other ways which investors sought to Win Ben’s Money which we will not discuss. The point is everyone has been preoccupied with winning Ben’s Money. Since the purpose of investing is to postpone using your purchasing power today to have more purchasing power tomorrow, is winning Ben’s Money a worthy endeavor in a long-term plan of wealth creation? Is it a good plan for increasing the purchasing power of your asset bases?

Our answer to both questions is no. The first problem is that the analysis being used to Win Ben’s Money is all macro-economically based. Should I own US/international bonds, commodities, emerging markets, US multi-national consumer staple and cyclical companies? It seems to us that all the research going into these questions is macro-economic in nature. We see three million “brilliant” people wake up every day trying to figure out what to invest in with “macro” analysis to Win Ben’s Money! There are too many contestants in the game! In our opinion, there is no alpha in macro analysis because the trades are all too crowded. John Maynard Keynes said, “Economic forecasting was created to make astrology credible”.

The second problem is that Ben’s Money will cease to be available at some point and on June 19th, 2013, he explained that it could be sooner, rather than later. Win Ben Stein’s Money left the airways in 2003 and Win Ben’s (Bernanke’s) Money might end in the next 12 months. Warren Buffett says that the end of QE “will be the shot heard around the world”. Those who have attempted to “Win Ben’s Money” might have to do something else with their money and need a new agenda.

The last problem is the biggest one of all. What got neglected in trying to Win Ben’s Money was the practice of “long-duration” common stock investing. To create real wealth, we believe investors should be focusing on all the bargains created by the fear left by the two 40% bear market declines of 2000-2010. The purpose of long-term ownership of US common stocks is to dramatically increase purchasing power over the decades. To do this the last four years, you had to ignore where Ben’s money might go and focus on the wealth creation of companies. You had to believe that the US economy would ultimately recover and return to a “normal” which never existed in the first place. You had to try to find wonderful companies at cheap to fair prices and practice simple optimism in the process. To us, the only way Ben takes the money away is if the US economy is strong enough to stand on its own.

Going forward, we have to believe that Cabela’s (CAB) and Nordstrom (JWN) will double the number of stores, that echo-boomers will marry, make babies, buy houses and cars. We’d have to believe fully-employed carpenters, plumbers, electricians and brick masons will send their wife to Nordstrom’s Rack, their kids to Disneyland and they will sneak to Cabela’s for a new fishing rod. We have to believe that people will buy cars based on advertisements from Gannett (GCI) newspapers and network-affiliated TV stations. Now that we are preparing to take Ben Bernanke’s show off the air, it could be time for a simply optimistic outlook on long-term common stock investing.

Best Wishes,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management