Submitted by Charles Hugh-Smith of OfTwoMinds blog,

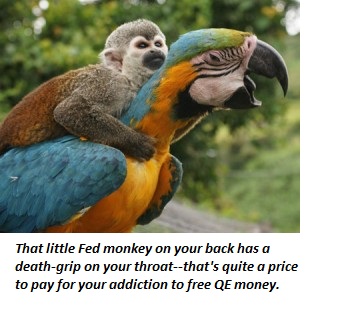

Mr. Market has one little problem: the Fed monkey on his back has a death-grip on his throat: "One hell of a price for you to get your kicks."

One of the enduring analogies of the Federal Reserve's quantitative easing (QE) program is that the stock market is now addicted to this constant injection of free money. The aptness of this analogy has never been more apparent than now, as the market plummets on the mere rumor that the Fed will cut back its monthly injection of financial smack. (The analogy typically refers to crack cocaine, due to the state of delusional euphoria QE induces in the stock market. But the zombified state of the heroin addict is arguably the more accurate analogy of the U.S. stock market.)

You know the key self-delusion of all addiction: "I can stop any time I want." This eerily echoes the language of Fed Chairman Ben Bernanke, who routinely declares he can stop QE any time he chooses.

But Ben, the pusher of QE money, knows his addict--the stock market--will die if the smack is cut back too abruptly. Like all pushers, Ben has his own delusion: that he can actually control the addiction he has nurtured.

You're dreaming, Ben--your pushing QE has backed you into a corner. The addict (the stock market) is now so dependent and fragile that the slightest decrease in QE smack will send it to the emergency room, and quite possibly the morgue.

But like all highs based on addictive substances, the stock market high cannot be sustained without an increase in the drug. But there is a diminishing-return dynamic to ever higher doses of QE smack--the higher doses are no longer generating the same highs. The addict (the stock market) has become desensitized to the QE free money injections, and higher doses no longer generate the desired state of bullish euphoria.

The more Ben talks about eventually decreasing the injection of financial smack, the more panicky the addict becomes. The more he increases QE, the less effect it has. The Fed is backed into a corner: increasing QE has no positive effect but decreasing it unleashes a catastrophic breakdown in the stock market.

Why Krugman and the Keynesians Are Lackeys for the Neofeudal Debtocracy (April 24, 2013)

You may recall the Keynesian parrot, who repeats the same demand for more free Federal money to be squandered on the cartels, grifters, embezzlers, toadies and lackeys of the Status Quo.

Here is the Keynesian parrot with the Fed QE monkey on his back: you may notice the Keynesian parrot is none too pleased with the Fed monkey's death-grip on this throat.

Unfortunately for the stock market, it's in a double-bind: the Fed monkey is choking it, but if the monkey falls off its back then the market goes into cold-turkey collapse.The other delusion of the pusher and the addict is that the endgame of addiction can be avoided. We all know the endgame of addiction; the 1970s rock band Lynyrd Skynyrd captured it very succinctly in their song Ooh That Smell:

One little problem that confronts you

Got a monkey on your back

Just one more fix, Lord, might do the trick

One hell of a price for you to get your kicksOoh, that smell

Can't you smell that smell?

Ooh, that smell

The smell of death surrounds you

The Junkie in the Pool and False Idols: Faith in Wall Street and The Fed Has Eroded(August 10, 2011)