by Cole Smead, CFA, Smead Capital Management

In the 1990 movie Kindergarten Cop, Arnold Schwarzenegger portrayed a police officer who goes undercover as John Kimble, a kindergarten teacher in Astoria, OR. Early in the movie, Mr. Kimble tells his class they are going to play a game called “Who is your daddy and what does he do?” After a myriad of answers, one of the children asks him if his ensuing headache is a tumor. Kimble replies “It’s not a tumor.” We at Smead Capital Management believe this was not only one of the more comical moments of Kindergarten Cop, but also a great question to ponder in today’s investment environment.

Our firm has been trying to help the investment community understand a misperception that has come under our purview. Most people believe the risk of a stock comes from the market it trades in; most people call this market risk or beta. The problem is that stocks like Microsoft, GE and Boeing don’t just trade on the US exchanges like the NYSE and the NASDAQ, but also EuroNext, the London Stock Exchange, the Hong Kong Exchange and Deutsche Bourse. Less important than where a business trades is where they take their company risk or put another way, their operating risk. This is where their cash flows come from. To us at Smead Capital Management, the value of a business is the present value of those future cash flows.

To illuminate our point, during a recent trip to London we came across a feature article in the Financial Times titled “P&G gambles on A.G. delivering the goods.” The article highlighted the return of A.G. Lafley to the helm of Proctor & Gamble. What caught our eye was the graphic to the left that was printed with the article. The numbers entailed in it get to the heart of our concern for quite a few US large cap companies that we believe will be problematic for index investors and can, in turn, create lots of alpha for stock pickers and asset allocators that take heed.

The graphic shows seven large consumer staples companies that have worldwide brands and the percentage of revenues that come from the emerging markets. Colgate-Palmolive derives 50% of its revenues from the emerging markets, followed by Proctor & Gamble with 40% of its revenues coming from emerging markets. It is our opinion that the last 10 years were a fairly poor economic period in the history of the US. We believe that in order for companies to report robust growth, they had to seek out growth away from US shores. This greatly benefited these companies, in our opinion, but that is in the rear-view mirror.

What we believe has been inherently lost on investors is that these are not what we would consider “US Equity Risk.” Yes, they are US-Listed stocks, but more than half of their business risk is coming from abroad. It may be more appropriate to call companies like Colgate-Palmolive and Proctor & Gamble “Foreign Equity Risk” or “Emerging Market Equity Risk”. No one in the US went without toilet paper, tooth brushes or ketchup in the last five years. What leverage do these businesses have in the comeback of the US economy?

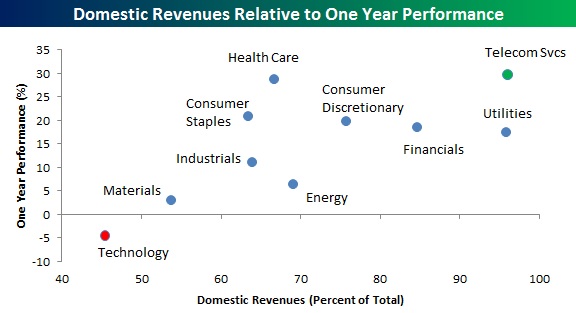

This missive is not to pick on these individual companies, but to show why this has become an index problem. Bespoke Investment Group presented the chart below on their blog on April 19, 2013. The chart shows the S&P 500 Sectors with one-year performance on the Y-Axis and the percentage of revenues in the US for those sectors on the X-axis. You can quickly see what our problem is today with certain sectors in the market.

Source: Bespoke Investment Group

We believe the best investment opportunity in the world is domestically-oriented (US) companies. We want the leverage from US consumers and accelerating household formation. This will come from the largest age group in America, the 86 million people in the 18-37 age group. Consumer discretionary and financial stocks have a very high portion of their revenues in the United States. We see them benefitting greatly from the comeback in the US. Technology, materials, industrials and consumer staples have a higher percentage of their revenues coming from beyond our shores.

We own companies like Nordstrom (JWN), Bank of America (BAC) and Gannett (GCI), whose revenues are heavily weighted to the US comeback. The most non-US equity risk we are taking is in companies like Merck (MRK), Pfizer (PFE) and Walgreens (WAG) due to their operations in Europe. We like this risk, because of the need for healthcare. More importantly, these companies have very little revenue in the emerging markets, especially compared to companies like Colgate-Palmolive, Proctor & Gamble or the Technology sector broadly-speaking. We believe investors should be asking “Who is your daddy and what does he do?” Where do your companies take their risk and where will their business expansion come from? We are making the case to advisors, family offices and institutions that these companies with low levels of operating risk in the US could be a “tumor” in their investment portfolios. We can almost hear these investors with their Austrian accent brimming with confidence saying, “It’s not a tumor.”

All the Best,

Cole Smead, CFA

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com