by Vadim Zlotnikov, AllianceBernstein

This year’s equity market rally was initially led by defensive stocks, as macroeconomic concerns persisted despite improved risk appetite. With valuations in these sectors looking stretched and cyclically oriented stocks starting to rebound in May, is a bigger shift starting to unfold?

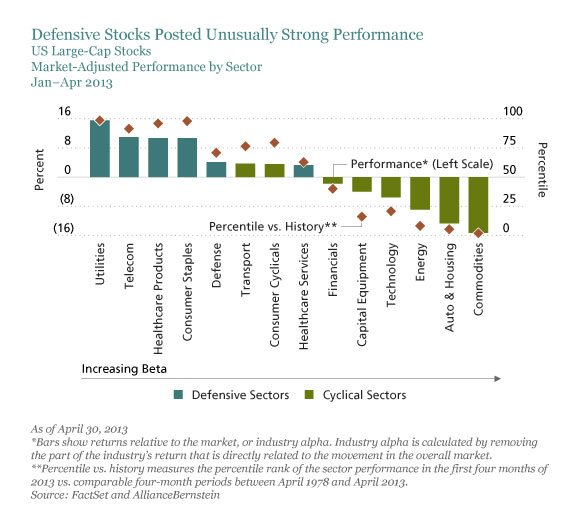

Defensive sectors—such as utilities, consumer staples and healthcare products—typically benefit from investor skepticism about the economic outlook. These sectors normally underperform in rising markets and have a beta of less than one, meaning they are less volatile than the broader market. Yet defensive sectors delivered well above expectations in the first four months of 2013 (display). Meanwhile, sectors more sensitive to economic cycles—such as commodities, autos and energy—underperformed the broader market. As Chinese economic growth disappointed, underperformance was particularly marked in sectors that are seen to be leveraged to emerging markets, such as commodities, energy and capital equipment.

Some people think this is a bad omen. Perhaps, they argue, an unusually strong run for defensive stocks might portend a collapse in market performance?

The problem is that there’s no evidence to support this argument. Our analysis of defensive-led stock rallies shows that they are no more or less likely to be followed by a broader market downturn than an upturn. However, it is true that after a defensive-led rally, the performance of defensive stocks themselves tends to be more muted.

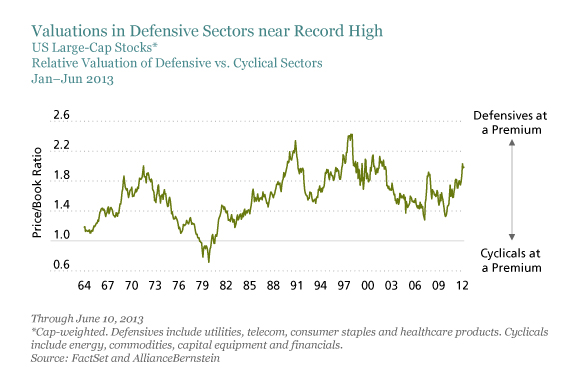

Might defensives continue to retreat? Valuations offer some clues to answer this question. If we look at price/book valuations, we find that defensive stocks are still trading near record highs in relation to cyclical stocks—even after the rebound in cyclicals since May (display). Price/forward earnings metrics show the same thing. Although the data I’m showing here are for US large-caps, similar observations can be made for international stocks as well. This may be a signal to start taking cyclically sensitive stocks more seriously again.

Still, for cyclically sensitive stocks to continue to outperform, some of the skepticism about future growth and profitability needs to dissipate. Trends in earnings revisions help illuminate the earnings outlook for cyclical stocks.

Still, for cyclically sensitive stocks to continue to outperform, some of the skepticism about future growth and profitability needs to dissipate. Trends in earnings revisions help illuminate the earnings outlook for cyclical stocks.

In the year through April, earnings revisions improved modestly in developed markets and deteriorated slightly in emerging markets, because of disappointing growth in China and India. However, high-volatility stocks—which are typically much more cyclically sensitive—saw significant deteriorations in earnings revisions across Europe, North America and Latin America. Sales growth decelerated across all regions, with developed Asia further affected by the yen’s depreciation.

I think this might be about to change. Over the next couple of quarters, comparative sales figures from the corresponding periods last year will be much easier for cyclical companies to beat. This could provide a near-term tailwind for profitability—and for a continued recovery by cyclical stocks in the coming months.

Given attractive spreads, significant recent underperformance and downward revisions, I think there could be more to come, and selective opportunities can still be found in economically sensitive stocks across various regions. In particular, I have my eye on high-beta stocks in companies with functioning business models, and with reasonable profitability and growth prospects, that have significantly underperformed in recent months on substantial downward revisions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Vadim Zlotnikov is Chief Market Strategist for AllianceBernstein.