by Wesley R. Gray, Turnkey Analyst

- Nilufer Caliskan and Thorsten Hens

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

Over the last decades the value premium has well been documented for various time spans and countries. It is proven to be a consistent asset pricing anomaly. This study presents the largest international study on portfolio returns formed according to the book-to-market ratio and examines how cultural differences affect the magnitude of value returns. The cultural differences are measured in two dimensions: patience and risk aversion based on the data collected by the International Test on Risk Attitudes (INTRA). In accordance with a consumption based Gordon model we find that risk aversion is positively and patience negatively related to the magnitude of value profits. Similar results hold for the average stock volatility. Although patience is positively related with the degree of economic development, its relation to value returns does not disappear after controlling for general economic and financial development measures. Furthermore, we find that the value premiums are also positively associated with the country price earnings ratio and negatively related to firm size.

Data Sources:

Datastream

Alpha Highlight:

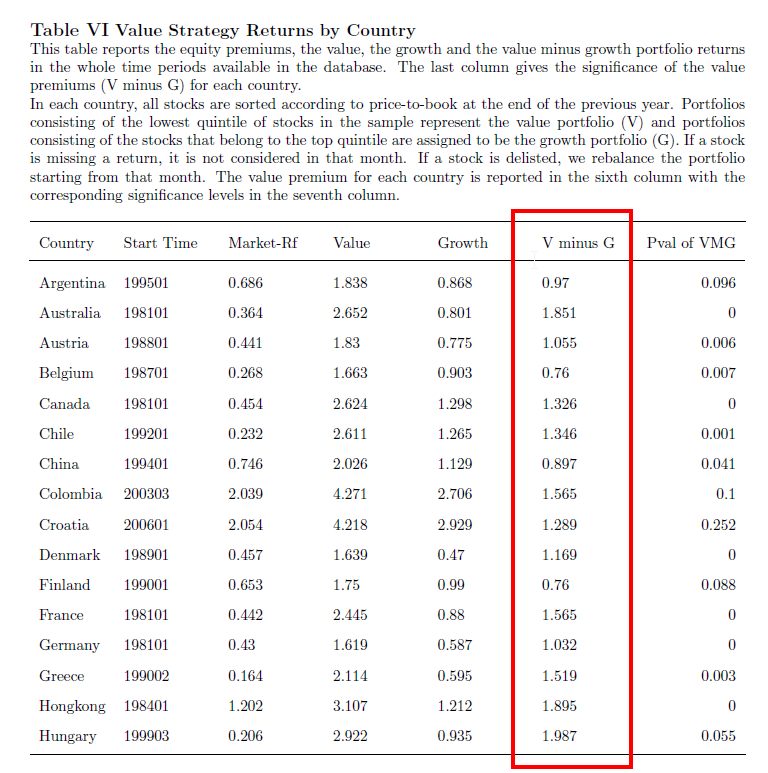

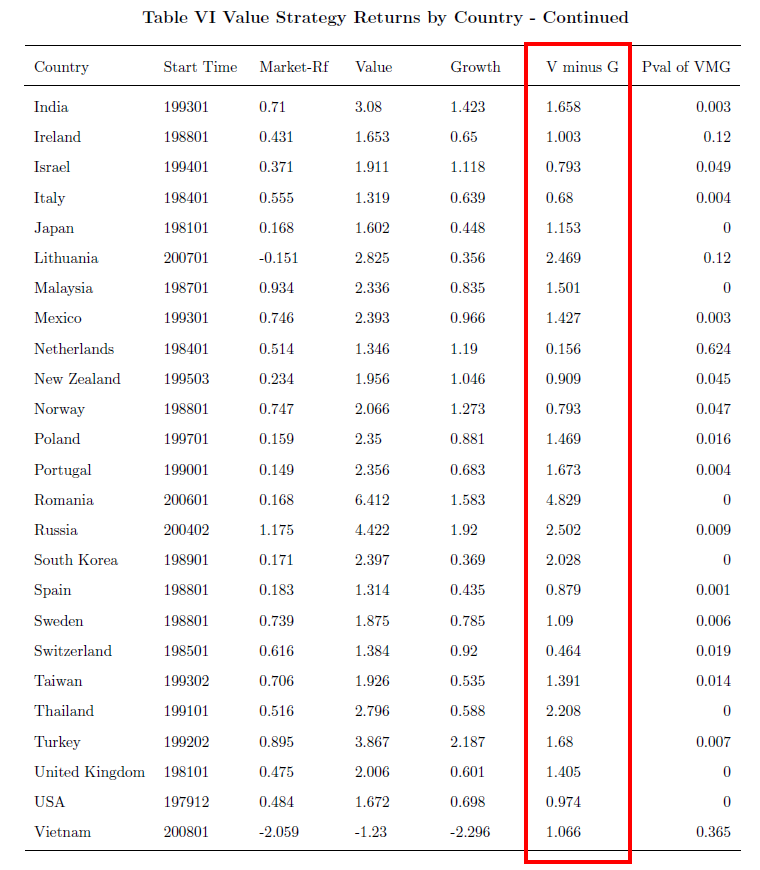

The table below outlines the monthly premium (in $ terms) for 41 different countries.

Value: 41/41 wins.

Growth: 0/41 wins.

Strategy Summary:

- Buy cheap stuff

Commentary:

- Let me reiterate: Buy cheap stuff