by Matt Tucker, iShares

Lately it feels like all I talk about here on the blog is the potential for rising interest rates – when it might happen, signs that a rate rise may be imminent, how to position bond portfolios in advance. While this is definitely a worthy subject – and one that spurs a great number of questions from our clients – I think it’s important to take a step back every so often to remember that interest rates today are still hovering at rock bottom. Rising rates may be a future challenge that investors need to prepare for, but the fact of the matter is, low interest rates are a challenge many investors are facing today.

It was with this challenge in mind that we launched the iShares Multi-Asset Income ETF (IYLD) a little over a year ago. IYLD is an ETF comprised of other ETFs, tracking an index that seeks to deliver high current income while seeking long-term capital appreciation. The objective: to deliver yield and balance risk through diversified asset allocation. Now that IYLD has been around for a year, and recently passed the milestone of $100 million in assets under management, it’s a good time to revisit this ETF to see how it’s doing.

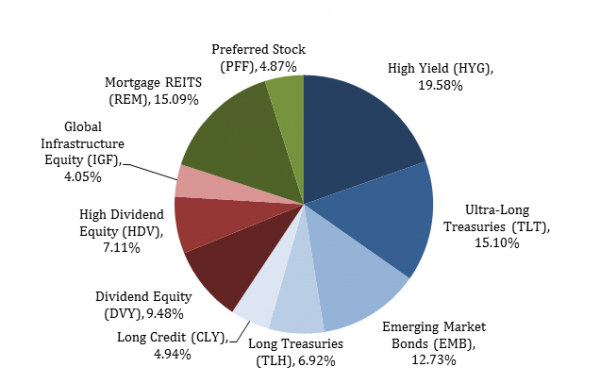

First, a quick review of how the fund works. The asset allocation of IYLD is set at 60% fixed income, 20% equity and 20% “alternative” income sources, such as preferred stocks and REITs. While those numbers remain static, the weights of the underlying ETFs that make up each asset class are rebalanced on a quarterly basis and are chosen based on historical correlations, returns, yields and volatilities. Only iShares ETFs that meet size, liquidity and income objectives are considered as potential holdings. Here’s a snapshot of the fund’s current holdings (as of 4/30/13)*:

A few discerning clients have asked us why a fund that targets “income” would have an allocation to the iShares 20+ Year Treasury Bond ETF (TLT), which is currently yielding a rather unimpressive 2.7%. The answer is that US Treasuries provide a diversifying exposure to the portfolio and, while they do add some yield, they’re actually included here primarily to reduce price risk and bring relative stability to the fund’s performance through varying market environments.

So how is IYLD doing today? With a current SEC yield of 5.43% and a one-year total return of 13.73% through the end of April, it appears IYLD has delivered on its objectives. As a comparison, the S&P 500 Index has returned 16.89% and the Barclays Aggregate Bond Index has returned 3.68% over the same timeframe – both with current yields around 2%. The upshot: Investors who are struggling to find yield but also want to balance risk might find IYLD to be an intriguing solution.

As for the inevitable question about rising rates, IYLD may be an interesting solution for that environment as well. While we would generally not expect a rising rate environment to be a tailwind for the fund (remember that it’s 60% fixed income), the benefits of diversification across asset classes could help it outperform a pure fixed income portfolio.

Source: Bloomberg, BlackRock

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to the iShares Blog. You can find more of his posts here.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling toll-free 1-800-iShares (1-800-474-2737) or by visiting www.iShares.com.

Index returns are for illustrative purposes only and do not represent actual iShares Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Asset allocation models and diversification do not promise any level of performance or guarantee against loss of principal. Investment in the Fund is subject to the risks of the underlying funds. There is no guarantee that the Fund will generate high income.

*Holdings are subject to change. Full fund names are as follows: PFF – iShares US Preferred Stock ETF; HYG – iShares High Yield Corporate Bond ETF; TLT – iShares 20+ Year Treasury Bond ETF; EMB – iShares Emerging Markets USD Bond ETF; TLH – iShares 10-20 Year Treasury Bond ETF; CLY – iShares 10+ Year Credit Bond ETF; DVY – iShares Select Dividend ETF; HDV – iShares High Dividend ETF; IGF – iShares Global Infrastructure ETF; REM – iShares Mortgage REIT Capped ETF