by Cullen Roche, Pragmatic Capitalism

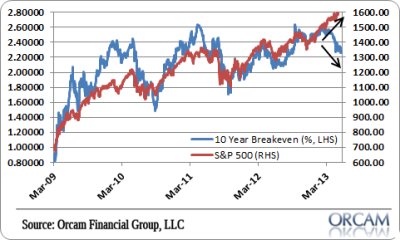

Another interesting divergence here via Societe Generale research. Like the commodity trend, we’re seeing a big divergence in US inflation expectations and the S&P 500. If deflation is truly a big risk then there’s an awful lot of faith being placed in the Fed’s hands at present through QE. Me, I’m more in the low inflation camp as opposed to the deflation camp, but it’s hard to ignore these divergences….

Here’s more via SG:

- While the S&P 500 is up 17% YTD, equity inflation is not in sync with the US economy, where inflation expectations fell below 2.3% to reach an 8-month low.

- Inflation has been sinking in the eurozone at an accelerated pace in the past few months, reaching a 3-year low of 1.2% in April

- Inflation has been trending down in many countries, including China where inflation accelerated a mere 2.4% in April 2013.

Chart via Orcam Investment Research: