by William Smead, Smead Capital Management

We have been making a number of arguments about various asset classes over the last three years and we would like to keep our readers very aware of the progress being made in these markets. We have argued that a secular bear market is in place for commodities and US company shares which are attached to the commodity cycle. Additionally, we maintain that there is a secular bear market operating under the surface in emerging equity markets. We believe that July of 2011 was the beginning of the secular bear market involving a number of asset classes beyond just commodities and emerging markets.

What triggered this thought was an interview with a major wire house market strategist on CNBC the morning of May 23rd, 2013 making the case that cyclical stocks in the US market are attractive because of how cheap they are compared to the market based on current price-to-earnings ratios (P/E) and modified 10-year Shiller P/E.

Secular bear markets, in our opinion, originate from massive over-capitalization and complete acceptance of a driving thesis. We believe the most recent thesis is the huge new middle class being created in emerging market nations and how it will put the wind behind the back of numerous markets. These include commodity markets, emerging markets like China and India, commodity-producing countries (Australia, Canada, Brazil, Russia, etc.) and multi-national US companies which are beneficiaries of this phenomenon. What perpetuates a seven to ten-year bear market, to us, is the ongoing belief in the driving thesis and the willingness of market participants to buy every dip in the ongoing bear market.

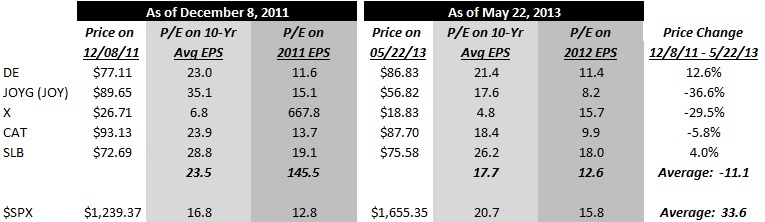

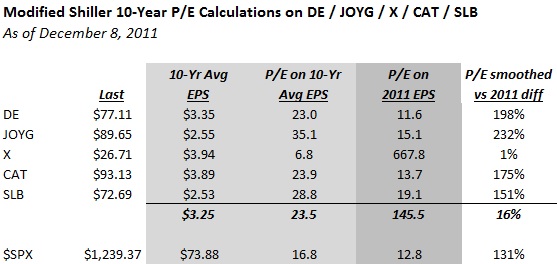

Recently, we’ve been hearing arguments that cyclical stocks and emerging market equities look cheap on a P/E ratio basis. We have done research in this arena. For instance, in December of 2011, we wrote a piece called Buying Cyclicals: Wisdom or Inexperience. Back then, we chose to isolate the shares of Schlumberger (SLB), Caterpillar (CAT), Deere (DE), Joy Global (JOY) and US Steel (X) as representatives to answer that question. Here is a look back at the piece, showing the share prices, P/E ratios and 10-year modified Shiller P/E ratios:

Data: Thomson Reuter: Baseline

This is where these same five companies stood on a P/E ratio and modified Shiller 10-year P/E basis on May 22, 2013 compared to the S&P 500 index and a rundown of price changes versus the S&P 500 Index over that period of time. Notice the 44% underperformance compared to the S&P 500 Index in price change.

Data: Thomson Reuter: Baseline

We believe it is critical for the “success” of the bear market in these asset classes for a large number of influential strategists and money managers to trumpet the virtue of the low P/E ratios of cyclical stocks and commodity-related companies and markets. As we have argued many times, you historically want to buy into cyclical industries and company shares when the current year P/E ratios are infinite, because there is red ink everywhere. For example, Joy Global came out of bankruptcy in 2001 and was a screamingly positive stock from 2001-2011. The commodity bear market of the 1990s put them out of business. If we are right, which cyclical companies might be the casualties of this secular bear market?

From our perspective things were incredibly bad in the commodity markets in the 1990’s, even though there were many more middle class people being developed in emerging markets, world population was growing and the US economy was growing nicely. By 1999, all these markets we are talking about had names starting with the swear word damn. Damn oil, damn gold, damn corn, damn copper, etc.

The 10-year average modified Shiller P/E for these companies is 17.7, while the modified Shiller P/E for the S&P is 20.7. While this appears to provide relative value, it is deceiving because the historical mean for the S&P 500 Index going back to the 1880s is approximately 16.47 for the modified Shiller. Is 17.7 P/E cheap compared to 16.47 P/E and does relative value trading above the historical mean really qualify as a bargain?

If we are correct and commodity prices fall, the earnings of these companies will plummet as capacity is reduced to bring supply and demand for commodities back in line. History would argue, and so do we, that these stocks won’t be cheap until their P/E multiple is high on a current basis because of the earnings dropping precipitously as commodity prices drop and inflict their will in the process. Ideal circumstances would be a combination of infinitely high current-year P/E and historically low modified Shiller P/E levels for those who want to be bullish about these cyclical market arenas.

As they do their work, we believe commodity/emerging equity market/US multi-national company promoters need to embarrass asset allocators enough for them to not want to move out of these asset classes and to provide a new group of bargain-hunting investors to get sucked in on the way down. We believe the only way to stop a secular bear market is for everyone to give up completely on the asset class involved! Think how totally and utterly disgusted investors were with US large cap stocks in late 2008 and early 2009 after letting their portfolios get smashed up by two bear markets of over 40% from 2000-2009.

Do we want to be a part of dismal long-term results in commodity and emerging market-related asset classes? Does this appear to be a good point to step in the way of a secular bear market in commodities, a secular bear market in emerging equity markets and a secular bear market in US multi-national shares tied to commodities and emerging markets? In our experience, hatred isn’t anywhere near being developed as of May 23rd, 2013 and we don’t think you should add money to these asset classes until they are brought up in conversation associated with swear words.

Best Wishes,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management