by Cullen Roche, Pragmatic Capitalism

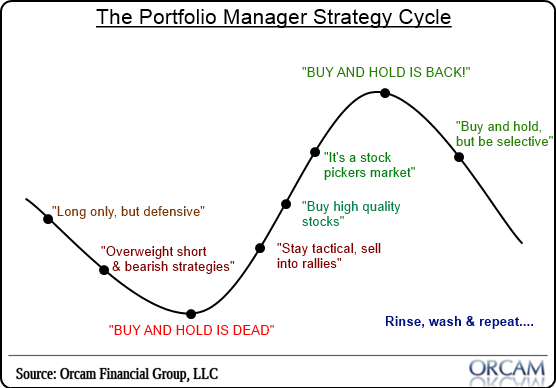

I get a kick out of watching how the cycle of emotions never changes over time. If there’s one guarantee in the markets it is that people respond to the same environments with the same cyclical thought process. And it’s funny to see how some portfolio managers think they’re immune to it. As if only the guy on the street is vulnerable to the rollercoaster ride of emotions. But nothing could be further from the truth.

Although the financial crisis might feel like it was a lifetime ago, the cycle of various strategic approaches to this market is fresh on my mind. We all know the cycle of emotions. You tend to feel euphoric at the peak, panicked at the trough and generally confused all the way inbetween. Don’t worry – portfolio managers are no better. They just express their emotions in varying degrees of active portfolio management with fancier sounding ways to express the rollercoaster ride they’re on.

So it’s been fun to watch how often we used to hear about certain approaches in recent years:

- In 2009 buy and hold died.

- Almost everyone became a trader at the trough of the crisis.

- Then it was “buy the dips, sell the rips”.

- Then it was all about high quality dividend names.

- Then it was a “stock pickers market”.

- Now buy and hold is all you hear about from anyone.

- “Stocks for the long run!”

- Then long only via defensive names will be the only game in town.

- Then buy and hold will die.

- Then short strategies dominate.

- Then tactical approaches win, hedge funds are your only savior, etc, etc.

Rinse, wash and repeat….Don’t worry, portfolio managers are just like everyone else. They just express their emotions in different & fancier money losing terminology.

Copyright © Pragmatic Capitalism