Confidence Runs Through the Stock Market

by James Paulsen, Chief Investment Strategist, Wells Capital Management

For the first time in this recovery, confidence is dominating fear in the stock market. Rather than suggesting irrational exuberance, this show of confidence may actually be a step toward rationality. Perhaps, emotional health is finally returning to an investment community severely scarred by the 2008 collapse which produced an obsession over multiple and mostly unrealistic calamity scenarios and widespread symptoms of “Armageddon psychosis.”

For the first time in this recovery, confidence is dominating fear in the stock market. Rather than suggesting irrational exuberance, this show of confidence may actually be a step toward rationality. Perhaps, emotional health is finally returning to an investment community severely scarred by the 2008 collapse which produced an obsession over multiple and mostly unrealistic calamity scenarios and widespread symptoms of “Armageddon psychosis.”

Many remain baffled by a stock market which has risen to all-time record highs in an economic recovery whose growth rate has persistently been subpar compared to historic norms. A common refrain is the stock market cannot be rising because of economic performance so it must only be going up because of constant liquidity injections from the Federal Reserve. For many, the stock market is just one big sugar high which is entirely divorced from underlying economic performance and is therefore headed for another day of reckoning.

Since the financial collapse in 2008, however, the driving force behind the stock market recovery has not been the “speed” of economic growth. Rather, it has been a slow but steady recovery from the psychological depths of investor despair. Since 2008, the stock market has been priced for a depression, for another major bank failure, for massive municipal bond defaults, for a secondary collapse in the housing industry, for a run on the U.S. dollar, for a breakup of the eurozone, and etcetera ad nauseam— none of which actually occurred. Essentially, the stock market has mostly risen in recent years because, although priced for it, the “end of the world” never happened. Subpar economic performance while perhaps disappointing is still worth more than a depression.

Indeed, in the last 18 months, the U.S. economy has broadened significantly and is now firing on more cylinders than ever. This has created a sense the recovery is now much more sustainable and less vulnerable to external shocks. Over this period, the average monthly pace of job creation has been near the best of the recovery at about 175 thousand. The unemployment rate has declined steadily and by the largest amount of the recovery even while the labor force has grown at its fastest pace of the recovery.

Consumer confidence, which was mirrored at post-war lows earlier in the recovery, is now near a five-year high. U.S. household net worth has been almost entirely restored to pre-crisis levels and the household debt service burden has declined back close to a record low. After falling until late-2011, total U.S. bank loans have since been rising steadily. Similarly, both housing activity and home prices have finally come to life in the last 18 months. Aggregate state tax collections recently rose to a new all-time high probably ending a persistent loss of state jobs. Corporate profits continue a steady advance and are now more than 20% higher than the peak of the last recovery cycle in 2006. Recently, the greatly feared federal government deficit seems to be melting away much faster than anticipated and suddenly the U.S. has achieved energy independence. Finally, in just the last couple months, the U.S. stock market rose to new all-time record highs.

We disagree with those who suggest the economy has shown no signs of improvement or at least not enough to justify the explosive rally of the stock market. While the pace of economic growth remains slow, the character of this recovery has improved dramatically. Since 2008, most investors have chronically feared that the economic recovery could be violently and prematurely aborted by some calamitous event. Recently, however, the recovery has broadened and now appears more sustainable.

Consequently, investors have finally begun to “elongate investment horizons” producing a rally driven by rising valuations precipitated by recovering confidence. Even though not widely perceived, the rally on Wall Street is very much tied to performance on Main Street. Not to the speed of economic growth or profits, but rather to a significant calming in fears and a sizable improvement in Main Street and Wall Street economic psyches.

Evidence of rising stock market confidence

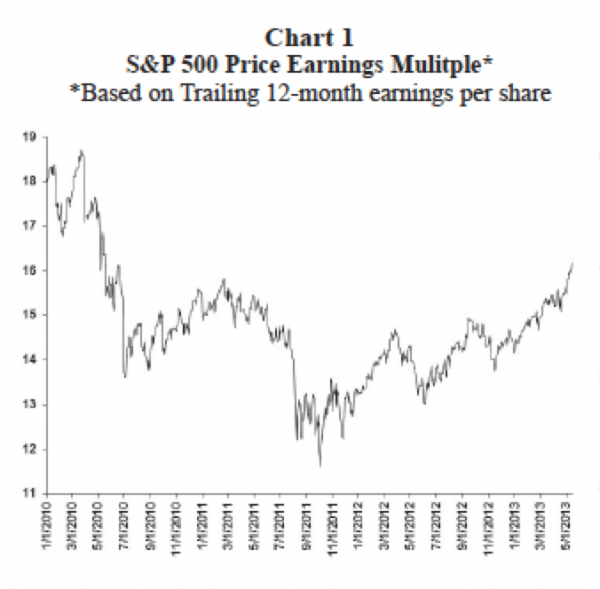

There are several examples of confidence recently running through the stock market. Chart 1 illustrates the trailing 12-month price-earnings (PE) multiple for the S&P 500 Index. In 2010 and 2011, the PE multiple chronically eroded as confidence was shaken by an eurozone crisis and by the U.S. losing its AAA rating among other apprehensions. However, since 2012, the PE multiple has risen as confidence in the sustainability of the recovery improved and as sensitivity to economic calamity stories diminished. In 2012, the S&P 500 Index rose by about 13%—about 10% of this gain was due to a rise in the PE multiple from about 13x at year-end 2011 to about 14.5x by the end of 2012. Similarly, the stock market has increased by about 16% so far in 2013 as the PE multiple has increased to about 16.3x or added about 12% to the year-to-date performance. As illustrated in Chart 1, since late-2011, this has been a confidence-driven stock market reflected in a steady rise in the PE multiple to its highest level in more than three years.

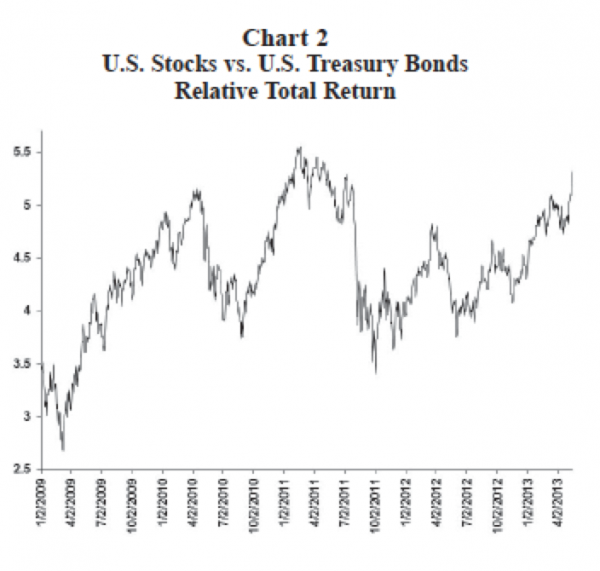

Another sign of rising confidence in the stock market is shown by the relative total return performance of stocks compared to bonds (Chart 2). Stocks have irregularly outpaced bonds since late 2011 and currently are near the highest level of relative cumulative outperformance relative to bonds since the recovery began. Often, when investor economic confidence is shaky—as it was most of the time during 2010 and 2011—bonds tend to outpace stocks. Rising confidence in the future is clearly illustrated by stocks nearing a new relative performance high for this recovery.

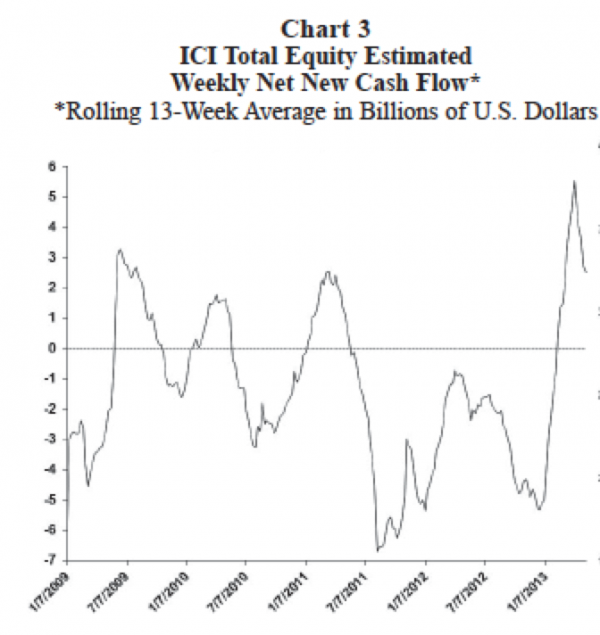

Repaired investor confidence is also portrayed by the largest and most sustained positive equity mutual fund net new cash flows of the recovery (Chart 3). Investors are not yet leaving the bond market, but confidence has improved enough to finally get them to begin returning to the stock market. Not only are recent stock mutual fund flows the best of the entire recovery but it has been almost two years since we have experienced anything but stock market redemptions.

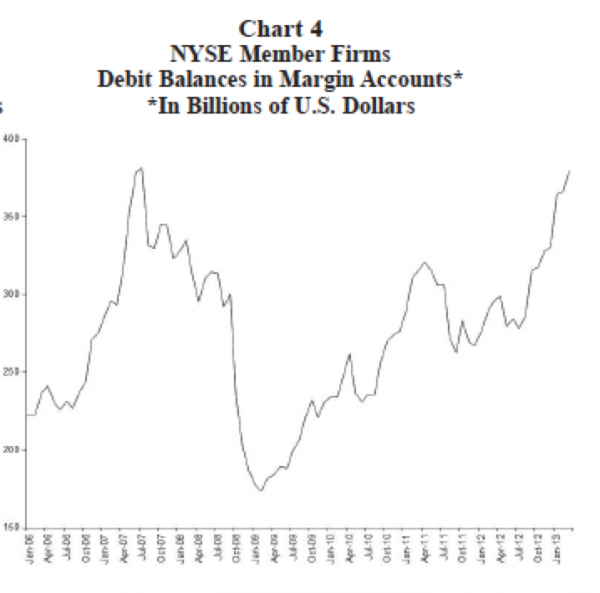

Chart 4 shows investor margin balances almost reached an all-time record high in March! Indeed, most of the recovery in margin accounts has occurred since stocks began rallying last fall. Finally, a recent resurgence in IPO activity (not illustrated) is yet another indication that “confidence” is dominating performance in the stock market.

Confidence also extending to other investment markets

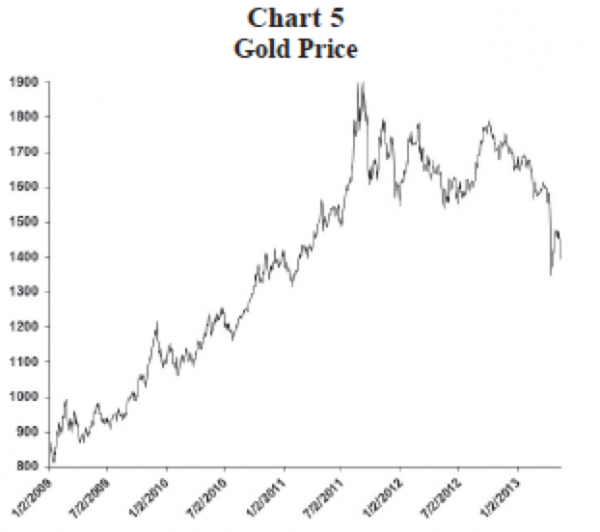

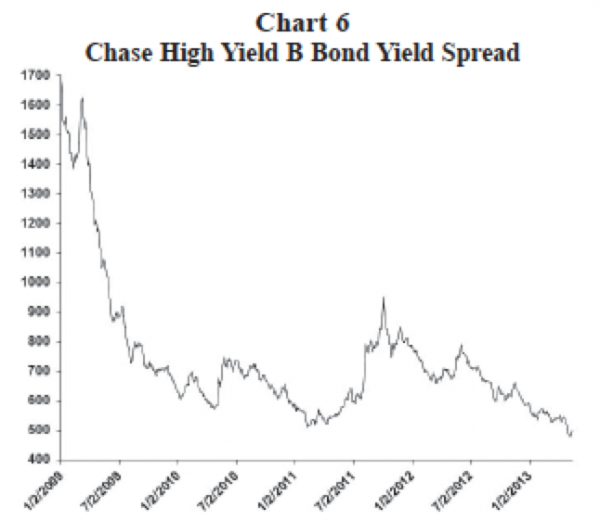

The improvement in investor confidence is not limited to the stock market. Chart 5 illustrates the revival in economic confidence is also running through the gold market. Just as rising investor confidence drives the valuation of equities higher, it is also eliminating the “Armageddon premium” which was embedded in the price of gold since the 2008 crisis. Renewed confidence is also evident among junk bond investors. Chart 6 shows that fear, as registered by junk bond yield spreads, has recently declined to its lowest level of the recovery.

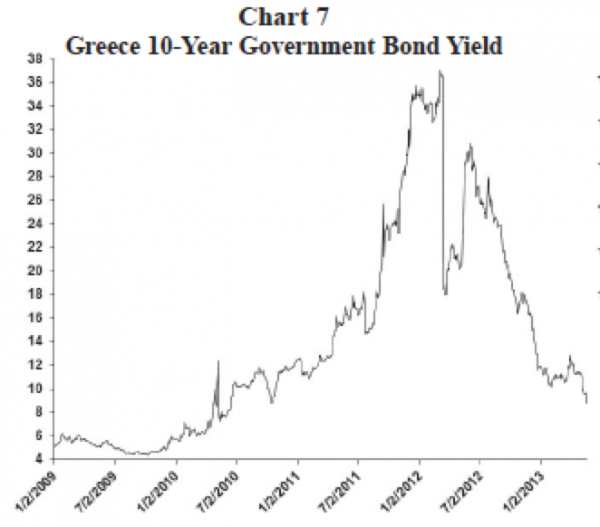

Even though the eurozone crisis continues, investor fears surrounding its ultimate impact have lessened considerably. The region remains in a recession but as illustrated in Chart 7, investors now demand only about an 8% yield on Greece government bonds compared to almost a 40% yield in early 2012! European fiscal problems remain and a regional recession persists but investor sensitivity to these problems has calmed as the perception of the eurozone crisis has moved from calamity to chronic problem.

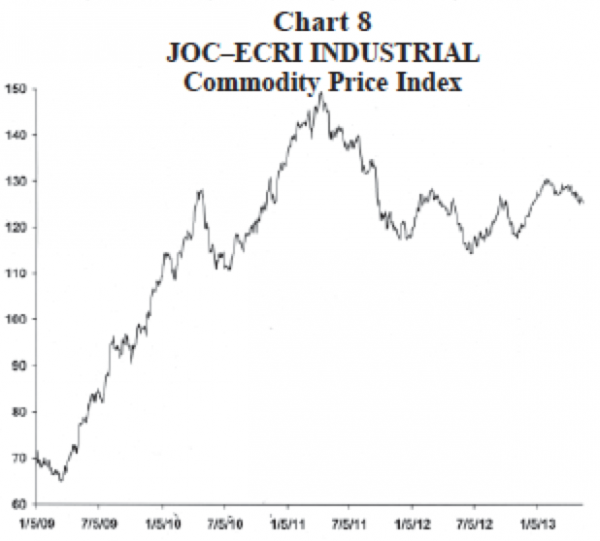

Finally, as shown in Chart 8, despite weakness in overall commodity prices this year, those commodities most closely tied to global economic performance—industrial commodity prices—remain near their highest levels since mid-2011. Most of the weakness in commodity prices has been due to noneconomic reasons (e.g., weather normalization for agricultural prices and a reduced safe-haven premium for precious metals). As Chart 8 shows, industrial commodity prices which are driven by and tied to economic confidence remain fairly strong.

Won’t confidence also run through the bond market?

The impact of rising investor confidence is increasingly dominating the performance of the financial markets—except for the U.S. bond market. This may be about to change.

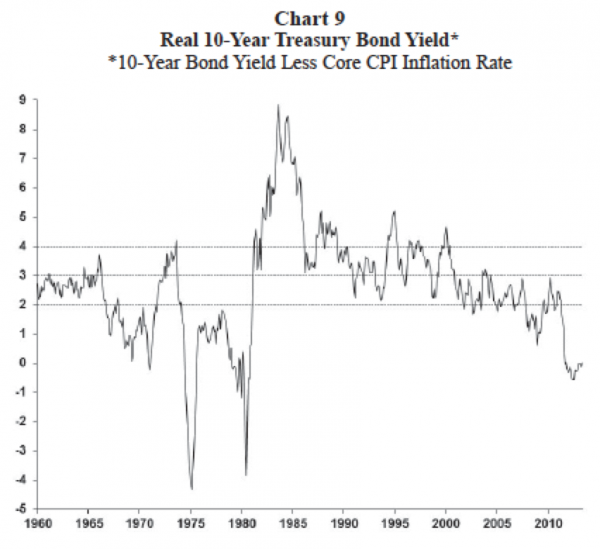

Historically, as shown in Chart 9, the 10-year U.S. Treasury bond yield is typically between 2% and 4% above the annual rate of core consumer price inflation. When the yield has moved significantly outside of this range, it has subsequently proved to be mispriced. For example, bond yields remained far too low in the late 1960s and this was eventually corrected in the early 1970s. Similarly, relative to inflation, yields were again too low in the late 1970s but the surge in yields by the early 1980s corrected this mispricing. Finally, the abnormally high yields evident in the early 1980s eventually led to a three decade bull market in bonds.

Today, bond yields are nearly equal with the rate of inflation and are therefore at least 2% below their normal historic valuation range (shown by the dotted lines in Chart 9). Based on the current core inflation rate of about 2%, a fairly priced 10-year Treasury bond yield should reside between 4% to 6%.

Calling for the end of the great bond bull has not been a successful investment call for some time. However, with improved investor confidence recently dominating the performance of stocks, gold, junk bonds, industrial commodities, and European investments, we think investors should prepare for an eventual “run of confidence” in the bond market. Obviously, the bond bull of recent years has been built on fear and confidence will be no friend for Treasury bond yields. A more difficult question, however, is what will be the impact of a sustained rise in bond yields on the stock market?

What’s a stock investor to do if confidence runs through the bond market?

Since last year-end, we have suggested the S&P 500 could touch 1700 this year. We felt economic growth would prove stronger than most expected boosting investor confidence and leading to rising PE valuations. Currently, the stock market is closing in on this target and while we still expect the stock market to breach the 1700 level in the next few months, we also anticipate a tougher environment for stocks during the last half of the year. As it has with other financial markets, rising confidence is also likely to soon run through the bond market perhaps pushing the 10-year yield closer to 3% before the year is over.

We do not expect any big selloff in stocks this year. The negative impact of rising yields will likely be tempered by economic growth which proves stronger than most now anticipate. Real GDP growth in the current quarter may be only slightly above 2%, but we continue to anticipate real GDP growth averaging 3% or more in the second half of this year. Better-than-expected growth and rising bond yields may simply produce a sideways trending stock market in the second half. That is, the stock market may experience a refreshing “correction by time.” A period of sideways oscillation which checks excessive optimism, improves valuations (as earnings rise while stocks are flat), and allows the stock market to adjust and assimilate to a revaluation (i.e., higher yields) in the bond market.

We also expect the combination of better-than-expected U.S. growth (despite fiscal tightening) and rising bond yields to intensify pressure on the Federal Reserve to end or at the very least significantly taper its quantitative easing (QE) operations. Ultimately, “normalizing monetary policy” is a good thing which, in our view, will eventually boost private sector confidence. However, investors and equity traders may have some consternation in the short-run with such a sudden change in public policy.

Since we do not expect any big decline in stocks this year, we would not recommend significant allocations away from the stock market. Where are you going to go? Bonds? Cash? Hardly! We are, however, focused on a couple investment strategies for the second half of this year. First, the most important impact of rising bond yields is what it may do to sector performances within the stock market.

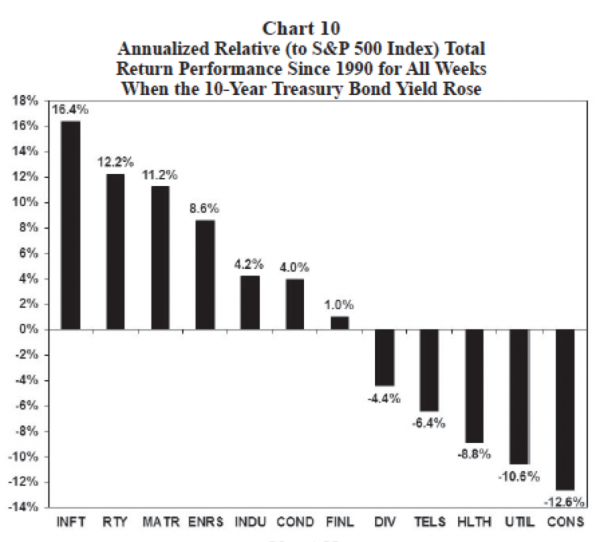

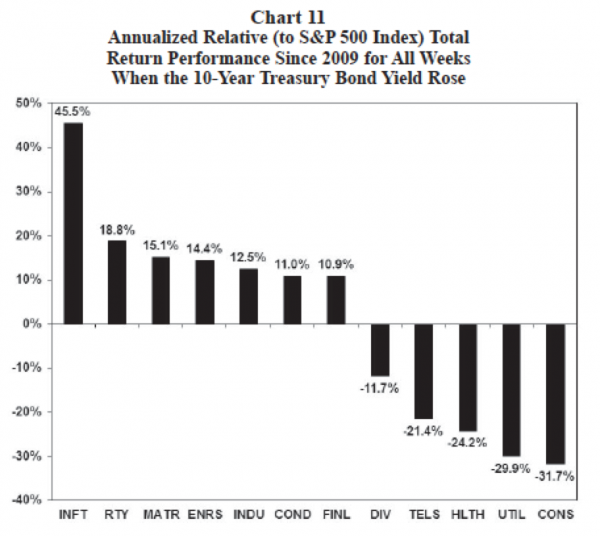

Charts 10 and 11 examine the relative total return performances for the 10 sectors of the S&P 500 Index, for small cap stocks and for high dividend stocks during those periods historically when bond yields have increased. Both since 1990 and also during just the contemporary recovery, cyclicals have clearly performed the best and defensive and interest-sensitive stocks the worst when bond yields rise. While this is not a surprising result, it is a good reminder of what may happen if confidence takes over the bond market. Interestingly, high dividend stocks (those often considered the most yield sensitive) have not historically been the worst relative performer when bond yields rise. Consumer staples, utilities, and healthcare stocks have tended to underperform the most. Also somewhat surprising is that financial stocks, even though widely considered highly yield sensitive, have actually outperformed historically when bond yields increase. If bond yields do begin rising in the second half of this year, sector reallocations may be the best way to prepare your portfolio.

Second, we anticipate a weaker U.S. dollar during the last half of this year. A strong dollar is currently a popular forecast primarily because it has been so strong so far this year. However, we think developed world countries will simply not tolerate Japan continuing to devalue its yen. We also suspect the Euro will strengthen mildly in the second half as “green shoots” on economic growth emerge in some parts of the eurozone. Finally, many believe the dollar will strengthen as the Fed winds down its QE program. Our guess is the U.S. dollar may actually weaken because although excess bank reserves may decline, the growth rate in the U.S. money supply may actually accelerate in the second half due to a lagged response from previous easing moves. In lieu of a weaker U.S. dollar, investors may want to consider increasing overseas exposures and also raising allocations to commodity investments.

Is this another “buy & hold” era?

The elements for a longer-term “buy and hold” stock market era are emerging. The biggest longterm risk for both the longevity of this economic cycle and for the continuation of this bull market is inflation. If, because of unprecedented and massive monetary easing in almost every corner of the globe, inflationary pressures eventually surge out of control both the economic recovery and the bull market will be prematurely ended as policy officials and bond vigilantes are forced to shut down inflationary forces.

However, should inflation remain moderate, the odds favor a very long economic recovery and eventually a much higher stock market. Why is it likely to be a long recovery? Because confidence was so thoroughly and utterly destroyed in the 2008 crisis! Recessions are primarily caused by overconfidence.

It is excessive confidence which causes private economic players, investors and policy officials to do dumb things which lead to the next recession. When people get comfortable and then confident, they overuse credit cards, buy the second lake home, blow through their savings, and overinvest in risky stock market assets. Likewise confident businesses overstaff, over-inventory, and overbuild to take advantage of the profitable future they are sure is coming. Finally, only when policy officials are more worried about over-heating than under-heating do they tighten enough to produce a recession. Today, despite being in the fourth year of this recovery, the attitudes of the players reflect a young recovery. The economy is currently being run by a bunch of “church mice” hunkered down and fully prepared for the Armageddon everyone tells them is coming. Households have reduced debt service burdens to record lows while fully restoring their net worths. Everyone is highly liquid, nobody is overpaying for houses and they certainly are not over-invested in the stock market. Businesses have considerable dry powder and lean staffs despite surging profits. Finally, the Fed is still employing full throttle crisis-like policies and tightening seems a long way off.

While confidence is finally beginning to improve, its recovery is still in its infancy and it will likely take several years before confidence reaches the level of cockiness required to produce the excesses which will bring the next recession. In the meantime, while managing the short-term ebbs and flows of the stock market, do not forget the likelihood we are still early in this bull market.

Copyright © Wells Capital Management