Finding Opportunity Far and Near

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

Samuel Johnson once said, “The use of traveling is to regulate imagination by reality, and instead of thinking how things may be, to see them as they are.” Although penned by an 18th century English writer, the idea holds true in today’s highly connected world of search bars, tweets and breaking news. Our portfolio managers’ research trips to foreign countries authenticates the data from a Bloomberg terminal or an earnings report. Treks add tacit knowledge to our wealth of explicit facts.

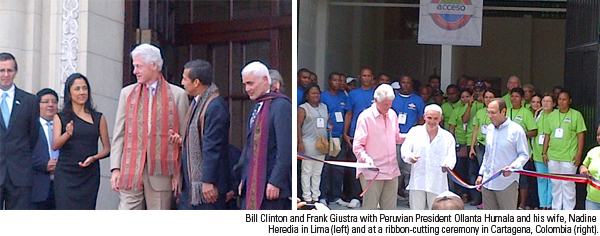

This week, I’ve been traveling in Peru and Colombia with former president Bill Clinton and Frank Giustra in conjunction with the Clinton Giustra Enterprise Partnership. I’ve been involved with this impressive organization since its inception. I love how it brings together private companies, government and communities in developing regions of the world to eradicate poverty by growing jobs and training local workers.

As part of the trip, Clinton signed an agreement between the foundation and Peru’s Ministry of Foreign Trade and Tourism to promote and reward hotels and restaurants that buy from local producers.

Each group will give $450,000 over the next three years to train local producers to become suppliers for Cusco’s hospitality and restaurant sector. All told, suppliers should bring in more than $5 million in income over the next five years and benefit more than 1,800 people, according to the Clinton Foundation.

In Cartagena, Colombia, Clinton and Giustra celebrated the opening of a warehouse that will provide a local supply chain for the area’s hospitality, restaurant, catering, and supermarket sectors, as well as the Acceso Training Center, which will train about 20,000 local residents over the next 10 years to work in the hospitality sector.

Moving beyond Latin America, other U.S. Global portfolio managers are finding exciting opportunities on their travels. When Michael Ding recently traveled to Thailand, he immediately identified a potential investment as soon as the plane touched down in Bangkok. See the video here.

And with emerging Europe growing faster than its western counterparts, Director of Research John Derrick, and Portfolio Manager Tim Steinle are headed to Warsaw and Prague to visit with local companies and management. We are optimistic about many expanding opportunities in this area and are excited to consider them for a holding in our recently renamed Emerging Europe Fund (EUROX).

Back in the U.S., no one needs to travel far to see the tremendous growth in domestic stock prices. Over the last four years, the S&P 500 climbed 21 percent annually.

But how much further should you expect them to go? The Federal Reserve Bank of New York had the same thought and delved deep into data to find out.

Would it surprise you to learn that a vast majority of equity valuation models state that stocks should head much higher over the next five years?

This is research based on 29 different equity valuation models and surveys that use varying economic and market-related data such as dividends or inflation to calculate potential future returns. Using a weighted average, the New York Fed estimated the equity risk premium over the following month.

Simply stated, the equity risk premium is the expected future return of stocks minus the risk-free rate, such as a Treasury bill. For example, if the estimated future return of stocks is 5 percent and a Treasury bond yields 4 percent, the premium is the difference between the two figures, or 1 percent.

Looking back over five decades of annualized results, there’s always some premium for stocks. This intuitively makes sense, because in exchange for taking higher risk, investors expect to receive higher returns.

During these 50 years, the premium nearly fell to zero two times. One time was in 1987, when investors’ exuberance toward the equity market caused stocks to rise quite sharply.

The most recent dip in the equity risk premium was at the height of the great tech boom in 2000. Many investors remember triple-digit price-to-earnings multiples. And some companies saw terrific price appreciation even though there were no reported earnings to be had at all. You’ll remember Fed Chairman Alan Greenspan coining the phrase, “Irrational Exuberance.”

Looking at the chart above, today we see an opposite picture. In fact, today’s equity premium is at 5.4 percent, as high as it was in November 1974 and January 2009.

And what happened in these two time frames? Well, we saw the dramatic increase in equity prices from 2009 to today.

Back in the 1970s, investors experienced the collapse of the Bretton Woods system and “a terrible case of stagflation,” says the Fed of New York. However, that didn’t stop the stock market, as gains were incredible, increasing nearly 15 percent on an annualized basis from 1974 to 1979.

The chart illustrates a tremendous case for U.S. stocks over the next five years. We’re not the only bulls in this field: Business Insider lists economist Jim O’Neill from Goldman Sachs, hedge fund manager David Tepper and Barry Ritholtz as experts who “all love this bullish stock market metric.”

One way to gain access to this potential growth at U.S. Global is through our All American Equity Fund (GBTFX). I encourage you to learn more about the fund and how you can incorporate it into your diversified portfolio. With half of the fund dedicated to our shareholder yield model, we believe investors get the two-fold benefit of growth and income. Take a closer look at its “All American” holdings here.