It has been a while since we have focused in on International Equity which is currently our second ranked asset class in the SIA Asset Allocation Model, so for this week, we are going to take a look at the top 2 ETF's from our Canadian ETF Global Equity Report.

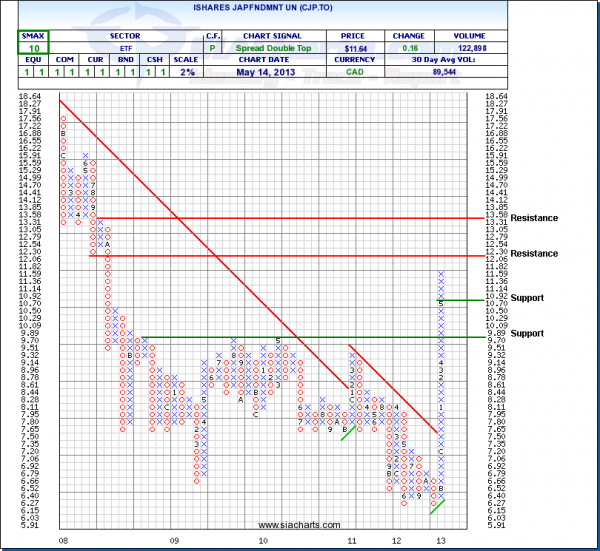

iShares Japan Fundamental (CJP.TO)

Currently sitting in the number 1 spot in the Global Equity Report, CJP.TO has seen a tremendous surge upwards over the past couple of months as the Japanese Government has taken aggressive action to try to end the stagnation that it has been plagued with for the last two decades by pumping money into the economy.

Looking at the chart, we can see that CJP.TO is rapidly approaching its next resistance level at $12.30, and further strength may then see the next potential resistance level at $13.58 come into play. To the downside, support can be seen at $10.70 and again below that at $9.70.

Click on Image to Enlarge

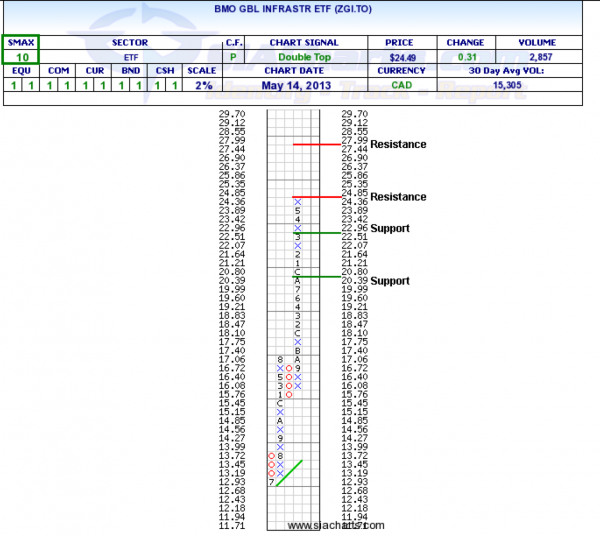

BMO Global Infrastructure ETF (ZGI.TO)

The BMO Global Infrastructure ETF has been a long time out-performer in the SIA Global Equity ETF Report and is currently ranked right behind the Japanese Fundamental ETF in the report. Looking at the chart, we can see that ZGI.TO continues to move on to new highs, with resistance closely overhead in the $25 area, which will be more of a psychological barrier. Above that there is room to move on to the next potential resistance at the $28 level.

Support can now be seen at $22.51 and again at $20.39.

Continuing to stay up in the Favored zones of the various reports, and in this case Global Equity, we continue to see outperformance and the reduction in risk. Also, by using Canadian based ETF's we can get the foreign exposure we are looking for witout having to deal with currency related transactions and taxation issues in client accounts.

Click on Image to Enlarge

Copyright © SIACharts.com