Buy in May and be OK?

by James Paulsen, Chief Investment Strategist, Wells Capital Management

This week the calendar turns to May and most investors remember that for the last three years it has paid to “sell in May and go away.” Are we headed for yet another stock market correction again this May? Possibly. After all, the stock market has lost momentum in the last couple months, economic reports have turned more disappointing and fears of a pullback have risen.

However, is it possible, in the last couple months, the stock market has already experienced a refreshing correction? While its mild pullback of only about 4% from recent all-time highs does not officially qualify, its character during this period has been very “correction-like.” Although not widely recognized, several aspects surrounding the stock market in the last couple months suggest the long awaited correction may have already taken place. Therefore, this year, maybe you can “buy in May and be OK”?

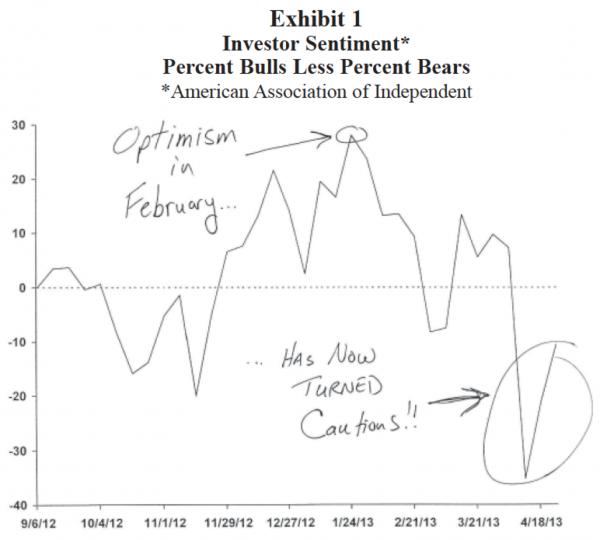

Optimism has been checked

In early March, the Dow Jones Industrial Average had already risen by 10% for the year and had broken to a new all-time high fueling a significant rise in optimism among investors. Some analysts raised fullyear target prices and for the first time in this recovery equity mutual fund flows turned persistently positive. A classic precursor to a correction—excessive optimism—was evident. However, similar to past corrections, investor optimism has recently been replaced by renewed concerns. Exhibit 1 shows in early March there was nearly 30% more bulls than bears whereas now bears outnumber bulls. Many worry about a significant deceleration in real U.S. economic growth this quarter due to the lagged impact of tax hikes and the ongoing fiscal sequester debacle. Concerns have also been elevated by a first quarter earnings season which produced numerous revenue misses and cautionary comments by corporate CEOs regarding future performance. In sum, similar to past stock market corrections, during the last couple months investor optimism has been checked. Will renewed investor cautiousness continue to sustain the current rally?

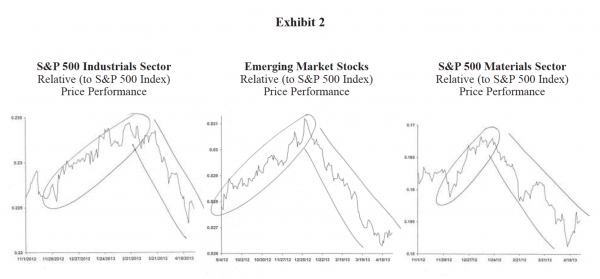

Sector rotations keep refreshing the rally

Since this rally began last November, leadership has rotated among stock market sectors. As illustrated in Exhibit 2, initially the overall stock market rally was led by cyclical sectors including emerging market stocks, industrials, materials, and small cap stocks while defensive sectors like consumer staples and utilities underperformed. However, sector leadership changed abruptly in the last few months—most cyclical sectors have underperformed and defensive sectors have dominated leadership.

This shifting in sector leadership has allowed the stock market rally to persist even though most sectors have experienced refreshing (at least relative) corrections. Although the S&P 500 Index has risen almost 18% from last November lows, since most sectors have experienced a correction along the way, they do not appear over-extended. Moreover, although consumer discretionary stocks have outpaced the overall market throughout this rally and perhaps do look extended and vulnerable to a correction which could challenge the stock market rally, the technology sector has acted as a balancing force. It has been consolidating since this rally began and may be nearing the end of its correction.

Overall, the rotating and refreshing corrections experienced by the internals of this stock market probably leaves the rally much less extended and much more sustainable than most appreciate. Indeed, as suggested in Exhibit 2, leadership may be in the process of changing yet again. In the last couple weeks, cyclical stocks have again been outperforming. Does this leadership change suggest the stock market pause since early March is ending?

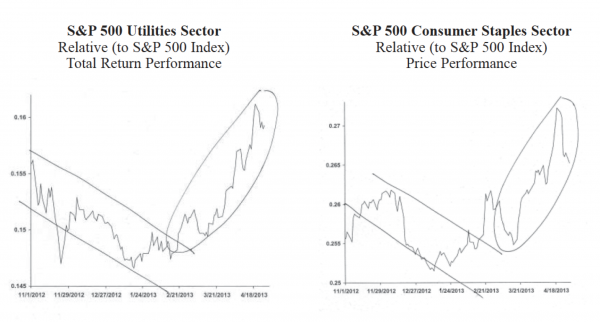

Stock market hurdles have been eliminated

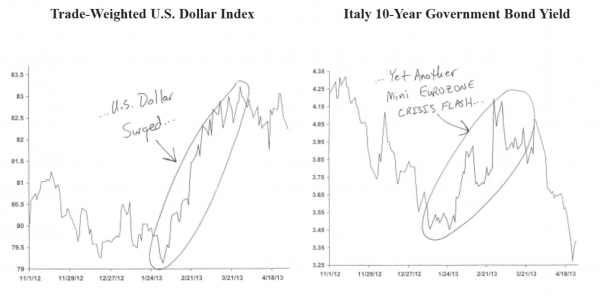

Often stock market rallies produce forces which bring their own demise. In early March, as illustrated in Exhibit 3, several challenges were beginning to pressure the stock market rally. Fortunately, the “pseudocorrection” of the last couple months has eliminated most of these hurdles.

When this rally began in November, the 10-year Treasury bond yield was only about 1.6%. By March however, the bond yield had risen above 2% and began to pressure the momentum of the stock market.

Similarly, growth in the U.S. money supply was very supportive for the stock market during the early part of this rally. Then, in the first quarter, growth in the M2 money supply stalled removing an underpinning for stocks. The value of the U.S. dollar was very low when this rally began late last year helping to fuel economic growth by boosting domestic manufacturing activity. The surge in the dollar since February however has removed this positive catalyst. Consumers were enjoying gasoline prices below $3.30 when the stock market rally began but their budgets and psyches were being challenged by almost $3.80 gas prices in early March. Finally, this stock market rally began last year once fears surrounding the eurozone had calmed. Less fear surrounding Europe was illustrated by the Italian 10-year bond yield declining from about 4.25% at the end of October to only about 3.45% by early February. Unfortunately, in February and March investors had to endure yet another European scare as Italian bond yields surged back to almost 4.25% in March.

In combination, by early February, these hurdles caused the stock market rally to pause, they renewed investor cautiousness, and shifted stock market leadership toward defensive sectors. Encouragingly, as shown in Exhibit 3, most of these hurdles have subsequently been reversed. The 10-year bond yield recently declined again almost back to where it was when the rally began last November. The U.S. money supply has reaccelerated again in recent weeks. While the U.S. dollar has not retraced its recent advance, it has stopped rising and has been flat for the last couple months. Gas prices have been declining again in recent weeks retracing almost one-half their advance since the stock market rally began. Finally, eurozone fears have once again been calmed as evidenced by Italy bond yields recently declining to new lows.

A couple months ago, hurdles facing the stock market suggested the potential for a correction. Today, however, these same forces now suggest potential for a renewed rally in stocks.

Another economic spring swoon?

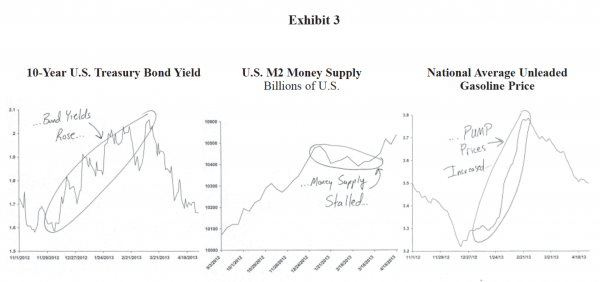

For the last three years, the U.S. economy has slowed each spring. Consequently, bolstered recently by several weak economic reports, anxieties have escalated concerning the chance of yet another U.S. spring swoon. Unemployment claims spiked in March, the March jobs report was disappointing, U.S. manufacturing activity has clearly slowed, reports out of China have caused concerns and recent commodity price declines have been perceived as evidence of global weakness. Recoveries inevitably ebb and flow and at any point in time, the economy is rarely universally strong or weak. Economic reports are also notoriously impacted by things—e.g., weather, seasonality problems, and other one-off events—which do not suggest a true change in underlying economic momentum.

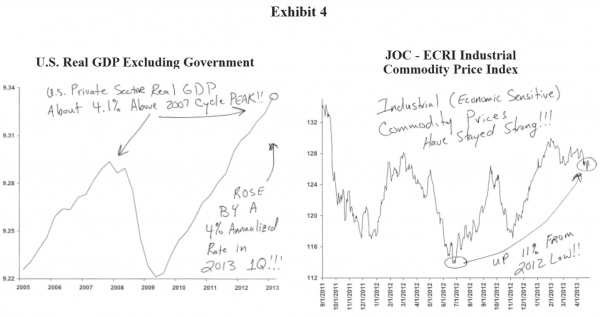

For example, the decline in overall commodity prices this year has increased concern that global economic growth has weakened considerably. However, most of the weakness in commodity prices is due to “noneconomic” reasons. Agricultural commodity prices have declined since drought conditions which boosted prices last year have normalized this year. Precious metals prices have recently declined because the Armageddon premium has been calming. Indeed, the drop in the price of gold primarily reflects increased confidence in the economic recovery rather than renewed economic weakness. Energy prices have been largely range-bound in the last few years after they surged earlier in the recovery. This dramatic increase in energy prices has led to an equally spectacular improvement in domestic energy capacity. This supply response has made energy price movements less sensitive to short-run economic growth. Finally, as shown in Exhibit 4, those commodity prices most closely associated with economic growth—industrial prices—have held up remarkably well. The JOC- ECRI Industrial Commodity Price Index is only down 2.7% from its yearly high, is still close to its highest level since 2011, is roughly flat for this year and is still about 11% above its 2012 lows. Industrial commodity prices simply do not portray significant economic weakness as many have suggested.

We continue to believe the private U.S. economy is functioning more broadly and is healthier than ever before in this recovery. The unemployment rate is declining, jobs are being created, consumer spending is decent, housing activity and home prices are rising, bank loans are rising, household net worth has been almost entirely restored while debt service burdens have declined near new all-time lows, aggregate state tax collections are at a new all-time high, corporate profits continue to grow after one of the best profit recoveries of the entire post-war era, corporate balance sheets have arguably never been stronger, consumer confidence is near five-year highs and the stock market is at a new all-time high!

The economy is certainly not booming compared to past standards. Nor will it anytime soon primarily because U.S. demographics are simply too weak to support considerably stronger economic growth. However, we continue to expect economic growth which is better than most fear (although not fast enough to please anyone), fast enough to keep the unemployment rate declining and convincing enough to keep stock prices rising. Currently, the U.S. manufacturing sector is growing very slowly perhaps reflecting relatively disappointing growth in the emerging world and due to the lagged impact of a stronger U.S. dollar earlier this year. However, the U.S. manufacturing sector is not in recession, nor headed there. Moreover, while industrial activity has ebbed recently, housing is booming and the consumer shows considerable strength. Certainly some of the weakness in current economic reports is real (reflecting the ebb in U.S. industrial activity and slower emerging economic growth) but overall, economic reports have mostly been disproportionately, but only temporarily, negatively impacted by early Easter seasonals and by a winter weather season across the country which has lasted much longer than welcomed.

Exhibit 4 shows a chart of real GDP excluding the government. In the last couple quarters, the real GDP reports have been significantly held back by record-setting declines in defense spending. While these headlines capture most of the attention, what is under-appreciated is that private sector activity has been much better than widely perceived. As shown, U.S. private sector real GDP is currently almost 4.1% higher than the peak of the last recovery cycle in 2007! Moreover, while overall first quarter real GDP grew only 2.5%, real GDP excluding the government rose at a healthy 4% clip! Despite an ongoing contraction in government spending, for the full year, we continue to expect real GDP growth will be close to 3%.

This Friday, another jobs report is forthcoming. No doubt, the stock market will struggle and perhaps a more conventional correction will transpire should we get another surprisingly weak jobs number. However, should job creation return to a healthy level, consensus concerns about a 2013 spring swoon should quickly dissipate and caution surrounding the potential for an imminent stock market correction may resolve into another rally to new highs.

Summary

Fears have recently been widespread, based on the experience of the last three years that the U.S. was headed for yet another spring swoon in the economy and a significant correction in the stock market. Maybe, however, the stock market correction has already occurred while everyone has been waiting for it to begin? Indeed, perhaps a continuation of the rally rather than a correction awaits us in May. Investor optimism has been checked, most stock market sectors have had refreshing corrections, hurdles facing the stock market have reversed, eurozone fears have again calmed, and perhaps soon improved economic data will convince most a spring swoon in the economy is not in the offing this year.

Copyright © Wells Capital Management

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000.

WELLS CAPITAL MANAGEMENT® is a registered service mark of Wells Capital Management, Inc.