Submitted by Lance Roberts of Street Talk Live,

Last week I discussed the disconnect between the markets and the economy stating that:

"Since Jan 1st of 2009, through the end of March, the stock market has risen by an astounding 67.8%. However, if we measure from the March 9, 2009 lows, the percentage gain doubles to 132% in just 48 months. With such a large gain in the financial markets we should see a commensurate indication of economic growth - right?

The reality is that after 4-Q.E. programs, a maturity extension program, bailouts of TARP, TGLP, TGLF, etc., HAMP, HARP, direct bailouts of Bear Stearns, AIG, GM, bank supports, etc., all of which total to more than $30 Trillion and counting, the economy has grown by a whopping $954.5 billion since the beginning of 2009. This equates to a whopping 7.5% growth during the same time period as the market surges by more than 100%."

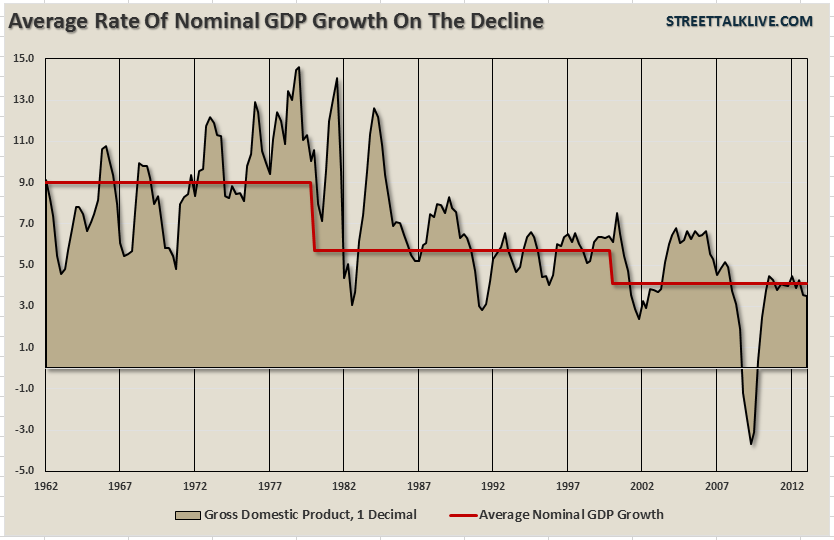

The reality is that the economy has been growing very weakly since the end of the last recession. The post-1980 norms of 5% annual growth has remained an elusive target despite the Fed's continued monetary interventions. As stated above, since the end of the last recession, the economy has grown at roughly 1.7% annually despite trillions of dollars of injections which have boosted Wall Street but has done little for Main Street. The chart below shows the decline in "nominal" GDP growth since 1962.

What is important to note is that GDP was, on average, expanding prior to 1980. However, since 1980, and there are many reasons for this, economic growth has been contracting. I addressed this specific issue in "Debt And Deficits - Killing Economic Prosperity" wherein I stated:

"From the 1950's through the late 1970's interest rates were in a generally rising trend with the Federal Funds rate at 0.8% in 1954 and rising to its peak of 19.1% in 1981. Of course, during this time the U.S. was the manufacturing and production powerhouse of the entire global economy post the wide spread devastation of Europe, Germany and Japan during WWII. The rebuilding of Europe and Japan, combined with the years of pent up demand for goods domestically, led to a strongly growing economy and increased personal savings.

However, beginning in 1980 the world changed. The development of communications shrank the global marketplace while the rise of technology allowed the U.S. to embark upon a massive shift to export manufacturing to the lowest cost provider in order to import cheaper goods. The deregulation of the financial industry led to new innovations in financial engineering, easy money and wealth creation through the use of leverage which led to a financial boom unlike any seen in history. The 80-90's was a period of unrivaled prosperity and the envy of every nation on earth.

Unfortunately - it was the greatest economic illusion ever witnessed.

The reality is that the majority of the aggregate growth in the economy was financed by deficit spending, credit creation and a reduction in savings. In turn this reduced productive investment in the economy and the output of the economy slowed. As the economy slowed, and wages fell, the consumer was forced to take on more leverage to maintain their standard of living which in turn decreased savings. As a result of the increased leverage more of their income was needed to service the debt, and with that, the 'debt cancer' engulfed the system."

The chart below shows the 10-year treasury rate and the Fed Funds rate overlaid against each other. You can clearly see the change from the generally rising trend in interest rates prior to 1980 versus the steady decline ever since.

What is important to note is that since 1980 each time interest rates have tried to rise, along with increases in the Fed Funds rate, the economy was eventually pushed into a recession and rates then declined. During economic expansions interest rates increased but to levels that were lower than the previous peak. Conversely rates have continually pushed to new lows after each previous peak.

If we put these two charts together we can see that interest rates can tell us much about the overall direction and strength of the economy.

Despite the mainstream analysts' calls for a "great rotation" by investors from bonds to stocks - the reality has been quite the opposite. While the 10-year treasury rate rose from the recessionary lows signaling some economic recovery in 2009, as I discussed in "Economy In Pictures," the decline in rates coincide with the evident peak in economic growth for the current cycle that begin in earnest in 2012.

"With rates plunging in recent weeks the indictment from the bond market concurs with the longer term data that the economy remains at risk."

Despite the calls for the end of the "bond bubble" the current decline in interest rates are suggesting that the real risk is to the economy. The aggressive monetary intervention programs by the Federal Reserve, along with the ECB and BOJ, continue to support the financial markets but are gaining little traction within the real economy.

However, despite the Fed's jawboning that they are targeting specific levels of employment and inflation rates to begin to unwind current monetary policy, the reality is that the Fed, along with everyone else, is trapped. For the Fed, rising interest rates are the enemy - not the solution. Higher rates of interest will further impede economic growth by raising borrowing costs, the housing recovery would grind to a halt as higher mortgage rates reduce purchases and freeze the re-fi markets, unemployment would rise as demand falls and the financial markets would decline as higher rates reduce profitability. Of course, each time the Fed has tried to withdraw monetary support programs in 2010 and 2011 - the economy immediately hit the skids. Of course, this is likely why the current quantitative easing program is "open-ended" because the Fed has finally realized that there is no escape. The next economic crisis is coming - the only questions are "when" and "what causes it?" The problem is that next time - monetary policy might not save investors.