“Gambler’s Fallacy”

by Jeffrey Saut, Raymond James

March 18, 2013

Consider the gambler’s fallacy.

“It’s called a fallacy, but it’s more a glitch in our thinking. We pretend to put a tremendous amount of weight on previous events, believing that they’ll somehow influence future outcomes. The classic example is coin tossing. After flipping heads, say five consecutive times, our inclination is to predict an increase in the likelihood that the next coin toss will be tails – the odds must certainly be in the favor of heads. But in reality, the odds are still 50/50. As statisticians say, the outcomes in different tosses are statistically independent and the probability of any outcome is still 50%. Relatedly, there’s also the positive expectation bias – which often fuels gamboling addictions. It’s the sense that our luck has to eventually change and that good fortune is on the way. It also contributes to the ‘hot hand’ misconception. Similarly, it’s the same feeling we get when we start a new relationship that leads us to believe it will be better than the last one.”

... The 12 Cognitive Biases That Prevent You From Being Rational, by George Dvorsky

“My luck has gotta change” is a famous lament that has buried many a player on the crap tables. But as shown in the aforementioned “coin toss” quote, “The outcomes in different tosses are statistically independent and the probability of any outcome is still 50%.” While that’s true in gambling, it is not so true in the stock market. The fact is, there are certain historic precedents in the stock market that can tilt the odds of success decidedly in your favor. Take last Friday when I wrote, “It is rare for the Dow to go in any one direction for more than nine consecutive sessions, and yesterday was day 10 in this current upside skein. Indeed, in my notes of over 50 years, there have only been 25 occasions when the Dow has rallied for nine consecutive sessions (or more), the longest being 14 straight sessions that ended on 1/20/1987.” Almost on cue, the Dow ended its 10-session romp last Friday by closing down 25.03 points. Clearly, the odds of extending the skein to 11 sessions were remote given that out of these previous occasions where the Dow has rallied for nine consecutive sessions or more, seven have gone for 10 sessions, two have gone for 11; but, only one has extended for 12, and one for 14. Of course that begs the question, “Has the buying stampede also ended?”

That question will likely be resolved this week, for last Friday was session 52 in the current “buying stampede;” as repeatedly stated, the longest such stampede I have seen lasted for 53 sessions. For the stampede to end it requires three consecutive down days, preferably with one of them being a 90% Downside Day, so this week should tell the tale. Increasing the odds that the stampede will end is the fact that all 10 of the S&P macro sectors are overbought; and that most of the stock market’s internal energy has been used up in the D-J Industrial’s (INDU/14514.11) march to new all-time highs, along with the D-J Transports, thus registering another Dow Theory “buy signal.” Nevertheless, with low interest rates, central bank stimulus, ongoing strength in autos and real estate, and an improving employment environment, I continue to think that stock market pullbacks will be temporary and should be used for buying.

Speaking to pullbacks, following the Raymond James 34th Annual Institutional Investors Conference I wrote:

“Many of the attending portfolio managers were very bullish on the airlines, imbibed by the theme that the hitherto excess capacity has been rationalized via mergers. Accordingly, airlines now have pricing power and if fuel prices stabilize, or actually decline, the industry stands to make very good money. While that theme seems reasonable, most of the airline stocks have already had massive rallies.”

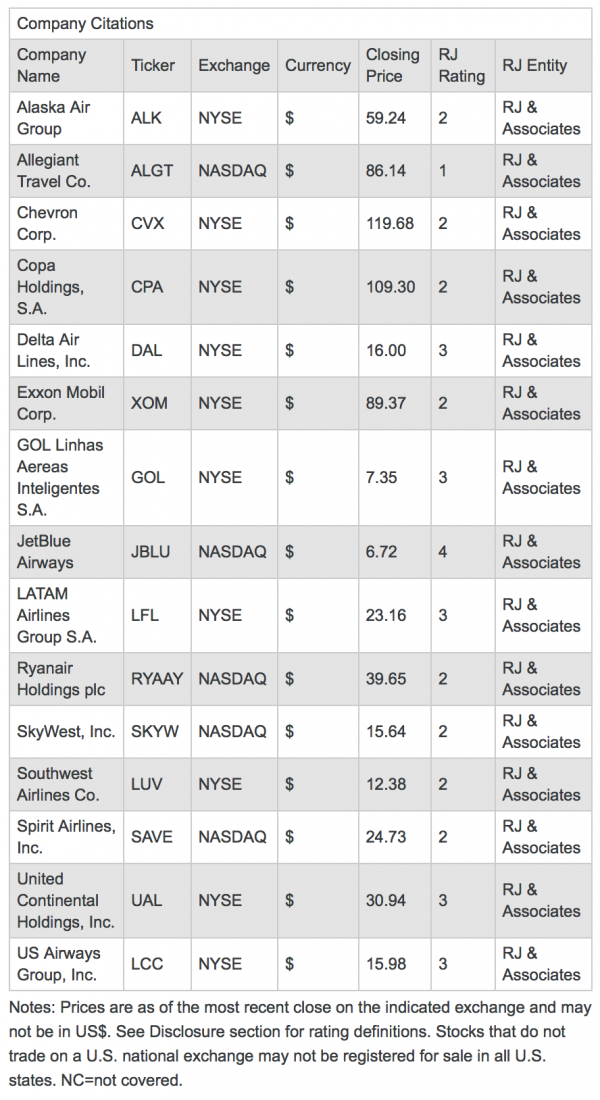

On Friday of last week our fundamental airline analysts embraced that same sentiment with a number of ratings downgrades in their airline research universe. They wrote:

“Airline stocks have been strong of late, with the AMEX airline index (XAL) up 26% YTD and 36% since December 2012 vs. 10% and 10% for the S&P 500, respectively. Moreover, Delta and United on average are up 35% and 58%, respectively, during these same two time periods. While we don't expect any negative catalysts impacting the industry, we see a dichotomy between carriers with growth that can support higher multiples and carriers with little to no growth that appear close to being fairly valued. As such, we are raising our target price for ALGT, ALK, SAVE, and SKYW, and downgrading DAL and LCC to Market Perform from Outperform. UAL remains Market Perform. The risk to the upside would be a meaningful pullback in oil prices or acceleration in economic growth.”

The chart on page 3 shows the price performance of airlines and the market YTD and since December 2012. For the full report, click here: Full Report - Airlines: Legacies Fairly Valued - More Upside for Growing Airlines.

Speaking to “oil prices,” imports into this country have experienced their sharpest drop since the Financial Fiasco of 2008 – 2010. This is a “structural change” spurred by the explosion of unconventional crude oil output in the Bakken, Texas, and the Midwest of the U.S. To be sure, after languishing at around 5.5 million barrels per day (bpd) of production, our nation’s crude oil production is currently above 7 million bpd, and rising rapidly. This is not an unimportant point considering that manufacturing plants are moving toward the low cost of energy nations to “fire” their manufacturing facilities. Consider this, if you are a corporation in America you can raise capital for less than the nominal rate of inflation. To wit, the nominal rate of inflation in this country is around 6% if one includes the costs of food and energy. Most companies can raise capital in the debt markets for less than 6%. Therefore if a company has an inflation-adjusted cost of capital of zero, and can reduce its cost of labor using automation and robotics, which actually creates jobs rather than eliminating them (see this article), there is NO reason to build a plant in China! Rather, you want to build a plant where you have the low cost of energy to “fire” said plant, and that is probably going to be here in the USA for the foreseeable future.

Last week, that energy independence seemed to resonate with investors causing a surge in select energy stocks. The causa proxima for last week’s energy eruption was a larger than anticipated decline in natural gas supplies, which caused natural gas to climb by 3.6% in one day with a concurrent spurt for many of the energy stocks. This is not an unimportant observation because the energy stocks have underperformed the overall averages. If that is changing, and the energy group comes back into vogue, it could be the sector that powers the S&P 500 (SPX/1560.70) above its all-time closing high of 1565.15. The reason is because Exxon Mobil (XOM/$89.37/Outperform) and Chevron (CVX/$119.68/Outperform) have a weighting in the SPX of just under 5%. I like the energy sector and am raising portfolio exposures to 15% from 8%. For a complete view of my recommended sector weightings, please see the chart on page 3.

The call for this week: The consecutive days of higher prices for the Dow ended at session 10 on Friday, which should have come as no surprise because it is rare for the Dow to go more than nine sessions in any one direction. The question now becomes, “Will the buying-stampede end at session 52 (last Friday) since the longest stampede chronicled in my notes of some 50 years was 53 sessions.” This week should provide the answer. However, I continue to think any pullback will be temporary and should be used for buying. That belief is bolstered by the often mentioned history of back-to-back 90% Upside Volume Days (12/31/12 and 1/2/13), which has seen the SPX 12.8% higher three months later 100% of the time; and the fact that since 1950 there have been 12 instances where the Dow has been up 8% or more in the first quarter and in all 12 of those instances the Dow has ended the year higher. And, in 10 of those instances the Dow was higher than where it was at the end of the first quarter. But, this morning the news is all about Cyprus and the imposition of a depositor tax of 6.75% for banking deposits under 100,000 euros and 9.99% on larger deposits. Cyprus is the home to “dirty money” with an estimated $18 billion of Russian and other Mafia money on deposit. This Black Swan event over the weekend looks to be a “trigger event” causing a bank run in Cyprus that could have collateral damage on other “Club Med” countries. That worry has the pre-opening S&P 500 futures down about 13 points as of 6:30 a.m. and reinforces my belief that the “buying stampede” has ended.

Copyright © Raymond James