by Martin Sibileau, A View from the Trenches

“…There are three main risks to this scheme that give the manipulation a systemic dimension. The systemic implication is tangible and should not be ignored, because we have proof of its actual costs….”

To read this article in pdf format, click on the following link: March 16 2013

This is the third and last of three articles I am posting on the price suppression of gold. In the first article I showed that, under mainstream economic theory, the suppression of the gold market is not a conspiracy theory, but a logical necessity, a logical outcome. Mainstream economics, framed by the Walras’ Law, believes in global monetary coordination which, to be achieved, necessitates that gold, if considered money, be oversupplied. The second article showed, at a very high (not exhaustive) level, how that suppression takes place and how to hedge it (if my thesis is correct, of course). Today’s article will examine the systemic impact of this suppression and test the claim of the gold bugs, namely that physical gold will trade at a premium over fiat/paper gold, commensurate with the credit multiplier created by the bullion banks.

I see two complementary ways to approach the systemic impact of gold manipulation. The first one would be to examine how the same affects the relevant prices. The second one would be to analyze the flows involved in the manipulation. With both ways, we should be able to reach a final conclusion on the sustainability of the manipulation. I will not keep the suspense: It is not sustainable. But if it isn’t, what is the end game? Without further ado…

Relevant prices involved in the manipulation

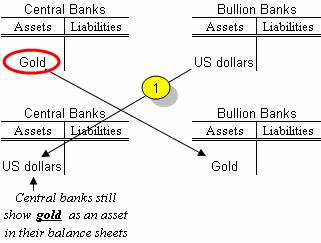

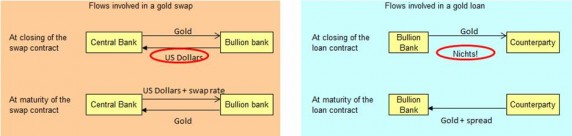

From the second article, we know that central banks “…hold gold as part of their assets. However, they can swap their gold holdings for liquidity, for US dollars. This swap is a mere exchange and is shown as step 1, in the graph. The official explanation is that such swaps would have temporary liquidity management purposes, because they remove US dollars from the market (i.e. from the Bullion banks). At a later date, not shown in the graph, the Bullion banks should return the gold to the central banks, and receive US dollars back (including an interest). For this reason, because the swap contract implies the return of the gold at a later stage, central banks are allowed to continue showing the gold they swapped in their balance sheets, as an asset…” The graph is reproduced below:

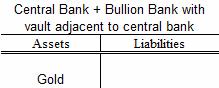

Note: Since my last article, Zerohedge raised the possibility that a bullion bank may have its vault adjacent to another one owned by a central bank. In such particular case, the graph above should be revised as follows:

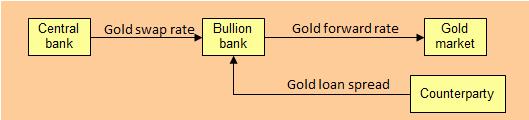

Humor aside and returning to our first graph, we can see that the swap obtains liquidity in exchange of collateral. Any profit maximizing agent would weigh placing gold as collateral for cash versus the cost of raising funds in the unsecured market. After all, anyone long gold could sell it, obtain the cash and buy it later, with a gold forward contract. Therefore, the liquidity cost facing (in this example) a central bank seeking to monetize its gold holdings, without selling, is expressed:

Cost of liquidity to a central bank = Min (gold swap rate, gold forward rate)

The gold forward rate is published by the London Bullion Market Association as the Gold Forward Offered Rate (GOFO). This rate represents the difference, in annual percentage terms, between the cash price and forward price of gold. Of course, the expression above implies that the central bank maximizes profit (i.e. minimizes cost). Just like a central bank does when it purchases bankrupt sovereign debt, to stabilize the liquidity in the system… (Temporarily, obviously).

On the other side of the swap, the Bullion Bank that receives gold as collateral must consider the transaction vis-à-vis providing liquidity in the unsecured US dollar market. The price for the latter market is Libor (London Inter-bank Offered rate), which is not really a price (because it doesn’t in itself clear anything), but a benchmark (The proof of this statement is simple: If Libor was indeed a price, the aggregate sum of the credit risk –as quoted in the credit default swaps market- of the panel banks that determine Libor should approximate zero. However, this sum is a positive number and far from zero). Indeed, the collateralized (with gold) lending should not be compared with lending in the unsecured US dollar market. Here, we have gold as collateral, which at the same time has storage and insurance costs. The benefit for a Bullion Bank for entering a gold swap is therefore expressed:

Benefit of gold swap = Max (gold swap rate, Libor)

When the swap occurs, both the central bank and the Bullion Bank agree on a price, the gold swap rate. Therefore:

Min (gold swap rate, gold forward rate) = gold swap rate = Max (gold swap rate, Libor)

Therefore, for the transaction to take place: Gold forward rate > gold swap rate > Libor

This implies that the GOFO should approximate Libor. Unlike what mainstream economics tells us, exchange does not take place at indifference points along so-called utility curves. The Bullion Bank will either lend in the unsecured US dollar market or through a swap. Choice will happen and will have a cost. Therefore, if it lends via swaps, it has to be more profitable than earning Libor. The question is….what makes collateralized lending more profitable?

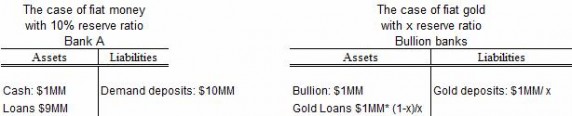

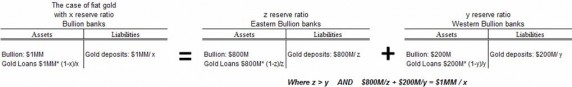

The answer is simple: the Bullion Bank not only earns the gold swap rate, but also a gold interest rate, as it uses the gold it receives to make gold loans. Hence, there is an extra benefit in swapping cash for gold, as the gold is loaned and earns a spread. As in the case of fiat money, where cash held by banks is used to expand credit, gold held by bullion banks is used to expand fiat gold:

The gold interest rate earned on fiat gold is commonly referred as the gold “lease” rate. This implies that the gold loan is not a loan, but a lease. The terminology is not coincidental. It allows the “leased” gold to be carried on the central banks’ books, as if the bullion was still in the vault. But this may certainly not be the case, because while I show gold in the asset side of the aggregate balance sheet of bullion bankS , this will not necessarily be the case at an individual level. For instance, let’s assume that the gold is loaned by what I will call Western bullion banks, but it ends up deposited in Eastern bullion banks. The aggregate position of the Bullion banks can be now shown as below:

At this time, it is important to understand the difference between gold swaps and gold loans. The graph below should help visualize it:

As can be seen, in a swap, the party that facilitates the bullion receives cash upfront. That cash is absent in a loan. This may be a reason for central banks to prefer swaps over loans: The swaps can become a liquidity management tool. They can be used for sterilization. As long as the gold swapped does not end up being sold in the spot market, gold swaps should be neutral to the price of gold.

From the perspective of a bullion bank, the gold loan leaves it “short bullion” vis-à-vis the gold swap obligation entered into with central banks. To hedge this risk, the bullion bank can use the gold swap rate received from the central bank to buy gold on a forward basis:

For the bullion bank to profit from a gold loan without the risk of being short bullion:

(Gold swap rate – Gold forward rate) + Gold loan spread > 0

In practice, Bullion banks quote these loans as: Cost of funds + x bps, where the cost of funds is defined as (Libor – Gold forward rate), for the applicable tenor (i.e. 3 months). This cost of funds is what is popularly called the Gold lease rate.

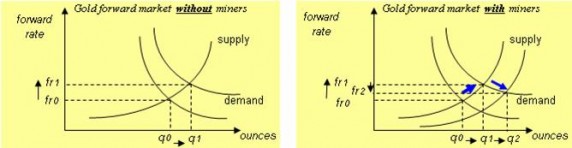

As bullion banks seek to hedge their gold loan counterparty risk, their demand for gold on a forward basis should raise the gold forward rate to the point where it is no longer profitable to expand the credit multiplier on fiat gold. That point can be expressed below as:

(Gold loan spread + Gold swap rate) < Gold forward rate

The pressure on the futures market for gold should therefore be the stabilizing mechanism that limits the expansion of fiat gold. However, this is only so under a static perspective. The dynamics of the process also involves gold miners. If, for instance, due to the expansion of fiat gold, the spot price of gold fell significantly, affecting the margins of miners, we could see consolidation in the industry via leveraged mergers in the current context of ultra-low interest rates. In this case, the same banks that led junior miners to become insolvent as they drove the price of gold down could be now selling their investment banking services to merge them with bigger players. In the process, the banks would demand that the new companies hedge their production, against further future gold price declines. This supply of future gold could offset the initial demand of the bullion banks, leaving room for a further expansion of gold loans…longer than most would believe.

As I wrote above, the collateralized lending rate (gold swap rate) should not be directly compared with the unsecured lending Libo rate. However, if a bullion bank loans gold and at the same time hedges with a gold forward contract, the resulting position can be comparable with unsecured lending.

If the gold lease rate is negative, it is expensive -ceteris paribus- to hedge the short bullion position, and the incentive to expand fiat gold decreases. This is supportive of the spot price of gold. If the gold lease rate is positive, it is relatively cheap to hedge the short bullion position and to continue expanding fiat gold. This is negative for gold. When fiat gold expands, we are likely to see a simultaneous bid for gold on a forward basis, to hedge. This should steepen the gold term curve, raising the gold forward rate. When fiat gold contracts relative to bullion, the gold forward rate should fall, flattening the term curve. If spot gold is more expensive than forward gold, in other words, if there is a bid for storage of gold: Gold enters backwardation. In backwardation, the term structure is that of money. There is an inter-temporal rate that discounts future vs. present purchasing power.

Why we can say that this is manipulation

At this point, we must ask ourselves what is wrong with all this. After all, why should the morphing of gold reserves into fiat gold (via gold loans) be called a manipulation? There is nothing different between the creation of fiat gold out of bullion and the creation of US dollars out US Treasuries.

The answer is simple: There should be nothing wrong with it, if it was not hidden. Let me explain myself: If the central banks did not show the bullion swapped as gold in their possession and if the bullion banks showed the reserve ratio of fiat gold-to-bullion, just like banks do with fiat money, this could not be called a manipulation. Even with consistent sell offs at 8:20am ET or 4am ET, we would still not be able to call this a manipulation (I challenge readers to do their own research and find out what the credit multiplier of fiat gold and the equity ratio of the bullion banks are).