The following are the word from the G20 final communiqué that could weigh on the FX markets in coming days:

- We will refrain from competitive devaluation.

- We will not target our exchange rates for competitive purposes.

That sounds pretty impressive, right? No mincing words on the issue of the day.

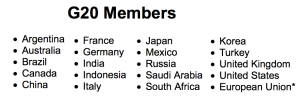

Well, you have to consider who is doing the talking. Follows is the list of G-20 countries. In my book, Canada and Australia have done a pretty good job of not manipulating their currencies (and they’ve paid a price). The other 18 players at this table are all messing with their currencies. They are doing it with either a) direct FX market intervention or b) through the backdoor, via QE in the domestic bond markets. The finance ministers all signed the communiqué with their fingers crossed behind their backs.

(Note: Add Switzerland and Hong Kong to the list of dirty floaters)

Another point from the G-20:

We will move toward more market-determined exchange rate systems and exchange rate flexibility to reflect underlying fundamentals.

Fundamentals? What the hell does that mean? I would argue that the “fundamentals” for Japan today would justify an FX rate of USDJPY 110. Did the G-20 just give a “green light” to another big move down for the Yen? That’s my read.

Then there is this final bit of G-20 fluff:

"We reiterate that excess volatility of financial flows and disorderly movements in exchange rates have adverse implications for economic and financial stability."

To me, the key word is “disorderly”. Once again, what the hell is meant by disorderly? If the past 4 months of trading in the Yen crosses was not disorderly, then what is disorderly? Do we need to shed 5 big figures a week for the rest of the month before things get disorderly? I read this to mean that unless things get really out of whack in the FX markets the “authorities” are going to let the markets sort things out.

So the G-20 has given the nod to the market players to push the Yen around. This is interesting as the “market players” are absolutely flush with cash.

It’s not just these big names that have gotten rich on the short Yen trade. It’s everybody who trades FX. Everybody loves a winning trade and the market always pushes beyond equilibrium levels.

We shall see over the next few days if the market agrees with this assessment of the G-20’s words. If we do see a big break to the upside for USDJPY and EURJPY, get your seat belts on. The first 10% of the Yen correction was “fun”. The next 10% will not bring the same laughs.

Copyright © Bruce Krasting