Guest Contribution by L.D. Salmanson, Systep

With the upcoming release of the Z10, many are betting on BlackBerry (NASDAQ:BBRY) - formerly Research in Motion (NASDAQ:RIMM) - to regain its once dominant position in the mobile market. With positive reviews of the new Z10 series, the old Diocletian of CEOs replaced, a pile of $2.7 billion in cash and no debt - as of the end of 2012 - and analysts such as Jefferies & Co.'s Peter Misek and Wells Fargo's Maynard Um reiterating a Buy rating on the stock with a $19-$20 price target, what could go wrong? Everything!

With the upcoming release of the Z10, many are betting on BlackBerry (NASDAQ:BBRY) - formerly Research in Motion (NASDAQ:RIMM) - to regain its once dominant position in the mobile market. With positive reviews of the new Z10 series, the old Diocletian of CEOs replaced, a pile of $2.7 billion in cash and no debt - as of the end of 2012 - and analysts such as Jefferies & Co.'s Peter Misek and Wells Fargo's Maynard Um reiterating a Buy rating on the stock with a $19-$20 price target, what could go wrong? Everything!

It's been over a year since I predicted BlackBerry's demise (and believe me, I get no joy out of this), and things have been playing out in a rather expected manner. If you recall, it was Daniel Ernst from Hudson Square Research, on MSNBC, explaining why he is keeping his $40 target for RIM in mid-2012, which was the genesis for that post. The genesis today is the recent upgrades to, and reaffirmation of Buy ratings for BBRY.

It's easy to look for silver linings that may spark a great turnaround story. Reviews of the new Z10 series are overwhelmingly positive, and the die-hard fans who have been awaiting a new BlackBerry for years are all on board. "The architecture we have built is true mobile computing architecture. It's not a downgraded PC operating system. It is a whole new innovation built from scratch. It's built for mobile." said recently Chief Executive Thorsten Heins, and I believe that the overall vision of building the next-generation of mobile computing platforms is solid. Unfortunately, to get to that vision, the company first needs to be around that long, and more importantly, it needs to successfully convince a fragmented market to adopt its platform.

It's easy to look for silver linings that may spark a great turnaround story. Reviews of the new Z10 series are overwhelmingly positive, and the die-hard fans who have been awaiting a new BlackBerry for years are all on board. "The architecture we have built is true mobile computing architecture. It's not a downgraded PC operating system. It is a whole new innovation built from scratch. It's built for mobile." said recently Chief Executive Thorsten Heins, and I believe that the overall vision of building the next-generation of mobile computing platforms is solid. Unfortunately, to get to that vision, the company first needs to be around that long, and more importantly, it needs to successfully convince a fragmented market to adopt its platform.

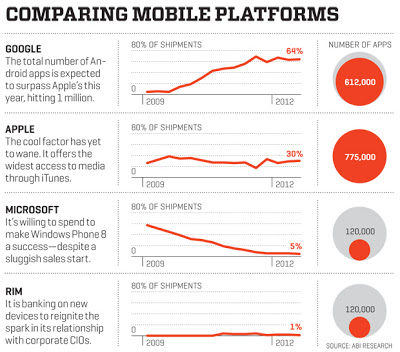

Calling this an insurmountable, up-hill battle would be sugar-coating the situation. For the new platform to be adopted, BlackBerry must increase its market share and actually sell enough units to turn around the money-bleeding trend. While reviews are positive, sales figures are less exciting. The reality is that the market has dramatically changed since the first BlackBerry was introduced, and it is now an incredibly fragmented space, with large incumbents, such as Apple (NASDAQ:AAPL), Google (NASDAQ:GOOG), and Microsoft (NASDAQ:MSFT), and with many new entrants on the platform front. Such incumbents completely understand Heins' shift to building a new platform - obviously, since they have been successfully doing so for the last five years. In fact, a Forrester Research survey from last year claims that 54% of 1,600 IT decision makers at North American and European companies were implementing a BYOD program, and this number is surely higher today. Heins' vision, despite being solid, is archaic for these giants who have been building technology and relationships to capitalize on this massive shift. BlackBerry has been losing corporate clients - its core revenue segment - faster than you can say Research in Motion, and if you're betting on personal consumers to fill this gap, guess again, as that trend has been declining as well. Last year I pointed to continued growth in foreign markets as one of the only positive trends for BlackBerry. However, for the first time in the company's history, BlackBerry recently reported a decline in subscribers - 79 million, down from 80 million last quarter - and a quick look at the segment breakdown of recent earnings would reveal that the company's hardware segment is the biggest laggard. Major U.S. carriers won't stock the Z10 until mid-March, and I doubt anyone is banking on Solavei to move the needle. Slow roll-out can't be a positive catalyst.

With 4.6% share of the market, BlackBerry will never recapture its place as a market leader or innovator, and that $2.7 billion cash-pile will get ever smaller as more resources are dedicated to experimentation. Heins recently told Reuters that "we need to decide where do we play? It could be a software play, a licensing play, an end-to-end horizontal play, we'll figure that out." Figuring it out is usually rather expensive. Few opportunities are really viable, and the company's current BlackBerry Z10 strategy is not one of them, I'm afraid. BlackBerry's network is far more robust than most of the large carriers, and is far more secure as well. A strategic acquirer looking to enter this space, such as Lenovo, Microsoft, or HTC, would find little value in the handset business unit, and would most probably be looking to acquire the company's enterprise software business and its robust IP portfolio, and take control of that cash pile before it disappears. Such strategic buyers might pay $15-$20 for BlackBerry shares on a good day. However, no such day is looming on the horizon. At best, BlackBerry shares is slightly overvalued, and, if my analysis is correct, I believe we will be seeing the $6-$10 range sooner rather than later. At that range BlackBerry would again become attractive to strategic buyers, as well as to financial sponsors - surely they have been covering BlackBerry for a while now. Analysts at Macquarie correctly pointed out that "Given the ongoing price negotiations between RIM and carriers on services fees, it would be nearly impossible for a financial or strategic buyer to currently value RIM's services annuity." As I mentioned, out of the 78 million users, it is estimated that less than 20 million are part of the enterprise software unit, and those users could easily be transitioned to other platforms, such as those offered by Microsoft, Google, or MobileIron. With that being the case, I believe we can expect low multiples in any M&A discussions that might be taking place, and I would also venture to say that not too many of those are taking place right now.

There is hardly anything that would allow BlackBerry to stay in the game. Had Good Technology not already been acquired, I would have been looking there. However, with Good out of the game, I would be looking seriously at the likes of MobileIron, AirWatch, and others to refuel R&D. Selling off the handset unit - if anyone would be inclined to buy - should be the first step. The next should be a massive M&A and integration-based expansion strategy that would focus on delivering enterprises with an open platform that meets their need for performance and security, and at the same time meets consumers-employers evolving demands for new devices and integration capabilities. These challenges are real, and if BlackBerry is able to position itself as a service-providing leader in this space, it would have a real value proposition to pitch to CTOs who are begging for some guidance. Unfortunately, I don't believe the company can pull off such a strategy, and shareholders will be even less inclined to play along. Blackberry may enjoy this bump in share price and PR for a little while longer, but those optimistic days will soon come to a melancholic end.

Copyright © Systep