by Ivan Rudolph-Shabinsky, AllianceBernstein

With high-yield bonds at record high prices and interest rates so low they’re barely visible in some parts, investors have a lot of anxious questions. Our opinion: we think high-yield bonds still offer more income and fare better in rising rate environments than other bond types.

Now let’s tackle some of the questions.

Am I getting enough compensation for the fundamental risk I’m taking?

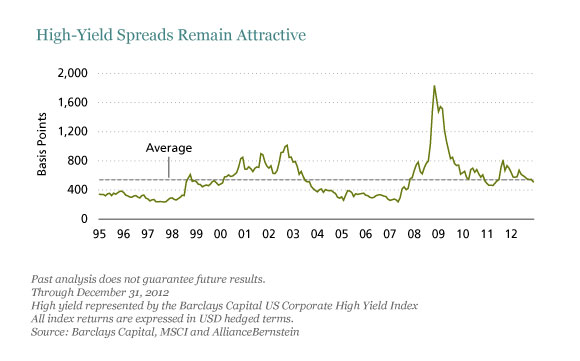

The yield advantage of high-yield bonds versus US Treasury bonds—the yield “spread”—is a lot lower today than it was in the wake of the global financial crisis (display below). But the spread is close to 3% above its pre-crisis lows, so there still seems to be a solid premium for investing in high yield.

We think this is especially true since we expect a low default rate over the near term. Most companies recently refinanced their debt at lower rates, reducing their financing costs. For struggling companies, this can provide valuable room to retrench: If a company can make payroll and cover expenses and interest, it may be in a tenuous position technically, but not in crisis mode. At least, not until it’s time to refinance or pay off a bond that comes due.

Since we don’t see another refinancing wave for at least the next two years, we don’t expect many companies to run aground and face default. Even if the situation in Europe continues to deteriorate and we head into a global recession, we still believe that companies have some time to get back on their feet.

Are there more attractive options for bond investors than high yield?

We don’t see many. Let’s be honest: with prices so high today, it wouldn’t be a good idea to bank on a repeat of the strong high-yield returns of the last few years. But look at the alternatives. Ten-year US Treasuries are yielding 2%, and investment-grade corporates aren’t much more generous. If the world economy continues on its low-growth trajectory and central banks keep the clamps on yields, mid-single-digit returns may be not only reasonable, but attractive.

What happens when rates rise?

By the numbers, high-yield portfolios have actually done well when rates have risen. Let’s start by breaking the yield on a high-yield bond into two parts. The interest-rate component is the smaller part and the yield spread is the much larger part.

These two components have a negative correlation—historically, they’ve moved in opposite directions. When interest rates have gone up, which is generally bad for bond prices, yield spreads have tended to fall, which works in favor of prices.

So, the yield spread has acted like a shock absorber against rising rates. For bonds with larger spreads—at least five percent—falling spreads can potentially offset any impact of rising rates. Typically, these scenarios happen when economic growth is improving, which can also bolster credit quality.

Is high yield going to blow up?

Some investors ponder the doomsday scenario where investors run for the exit and dump their high-yield bonds, causing prices to plummet and yields to soar. This scenario is possible, and it certainly wouldn’t be a picnic. But there are ways to manage a high-yield portfolio that can reduce the damage.

Long-duration high-yield assets would probably fare worse in a major market sell-off than would short-duration assets. But credit quality plays a big role, too. In a sell-off, lower-quality bonds would likely be hit harder. It’s possible to reduce the downside risk by both shortening the average maturity and duration of high-yield bonds and focusing on higher-quality issuers. Hedging strategies can also help.

While there’s a fair share of anxiety out there about high yield, historical performance tells a compelling story: over the last 30 years, high-yield bonds have exhibited about half the volatility of equities while generating similar returns. Our advice? Buy high yield, but be selective…and have realistic expectations.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. Past performance of the asset classes discussed in this article does not guarantee future results.

Ivan Rudolph-Shabinsky is a Credit Portfolio Manager at AllianceBernstein.

Copyright © AllianceBernstein