Health Care

· Intermediate trend is up.

· Units remain above their 20, 50 and 200 day moving averages.

· Strength relative to the S&P 500 Index remains positive.

· Short term momentum indicators are overbought.

Utilities

· Intermediate trend is up.

· Units remain above their 20, 50 and 200 day moving averages.

· Strength relative to the S&P 500 Index remains neutral

· Short term momentum indicators are overbought.

Thackray’s 2013 Investment Guide

Thackray’s 2013 Investor’s Guide is here. Order through www.alphamountain.com , Amazon, Chapters or Books on Business.

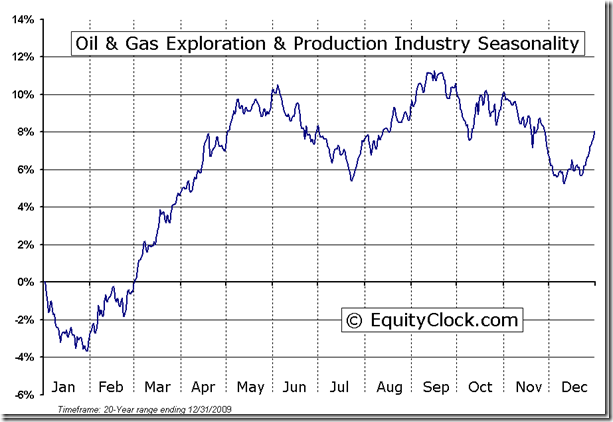

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Oil & Gas Exploration & Production Industry Seasonal Chart

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

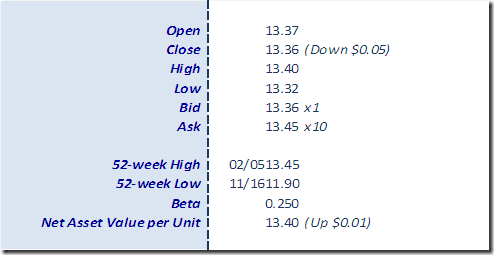

Horizons Seasonal Rotation ETF HAC February 6th 2013