by Don Vialoux, Tech Talk

Upcoming US Events for Today:

- Factory Orders for December will be released at 10:00am. The market expects a month-over-month increase of 2.4% versus no change (0.0%) previous.

Upcoming International Events for Today:

- Euro-Zone PPI for December will be released at 5:00am EST. The market expects a year-over-year increase of 2.1%, consistent with the previous report.

- China HSBC Services PMI for January will be released at 8:45pm EST.

- Reserve Bank of Australia Rate Decision will be released at 10:30pm EST.

The Markets

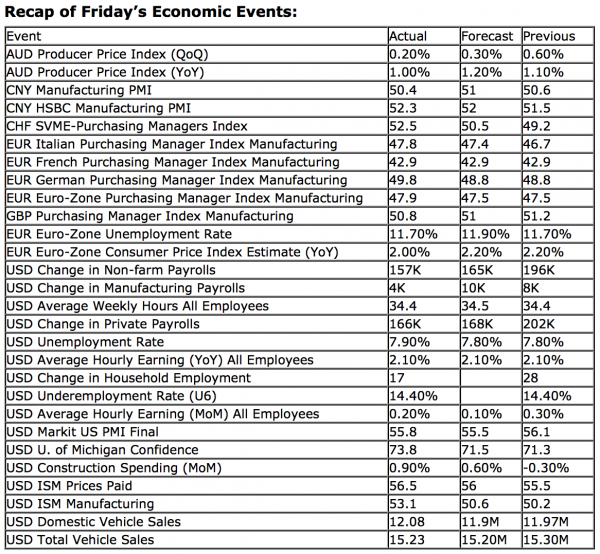

Equity markets surged higher on Friday following a series of upbeat economic reports. Payrolls for the month of January were reported to have increased 157,000, which actually missed estimates calling for an increase of 175,000. Significant revisions to data from 2012, however, had investors reassess their view of the economy. Econoday.com notes the following:

“The upward revisions are from annual revisions and indicate that job growth has been somewhat stronger than earlier believed. In 2012, employment growth averaged 181,000 per month. Most of the upward revisions were in the latter part of the year. Prior to the annual revisions, monthly gains averaged 153,000 for 2012.”

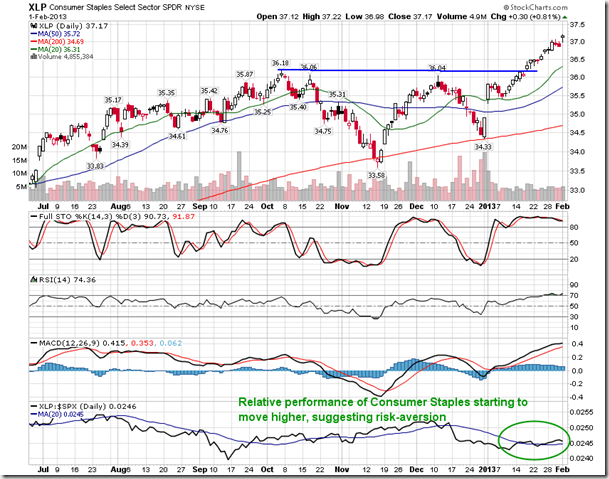

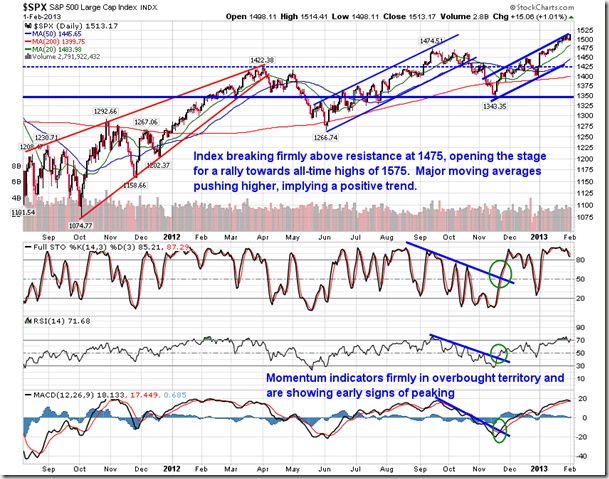

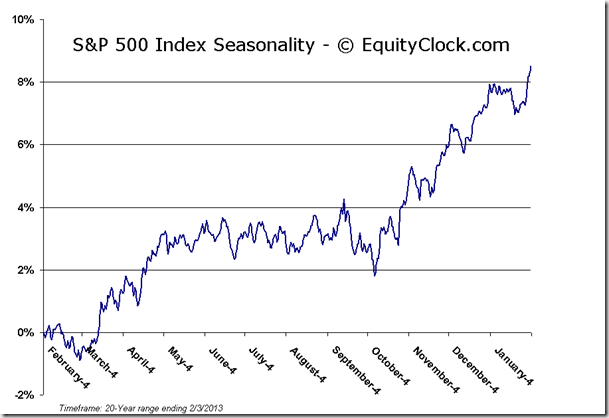

Stronger than expected consumer sentiment, ISM manufacturing, and construction spending rounded off the positive data points on the session, pushing the Dow Jones Industrial Average above the psychologically important 14,000 level for the first time since October of 2007. Overbought indications amongst the major equity benchmarks remain quite prominent, which increases the risk of a near-term pullback. The month of February has averaged a loss of 0.57% over the past 20 years, positive in 11 of those 20 periods. Could February provide the pullback that has been widely anticipated?

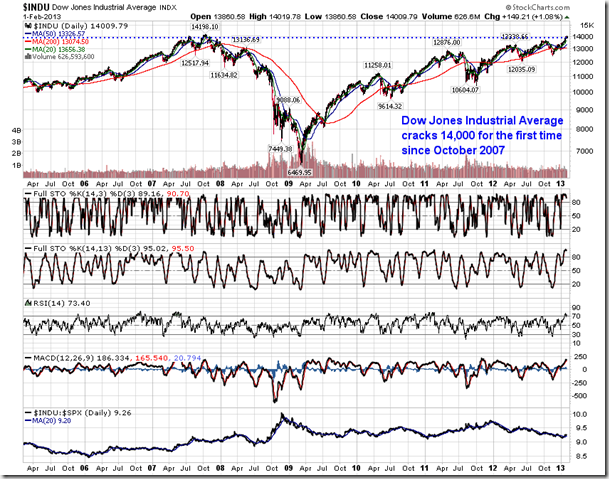

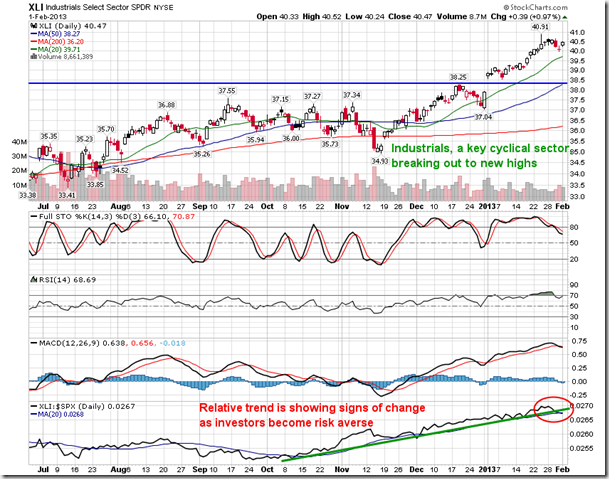

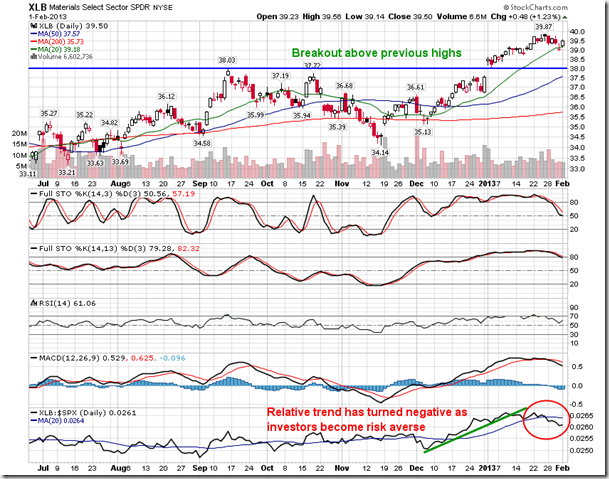

With equity benchmarks achieving significant highs, a “risk-on” sentiment could immediately be implied. However, signs of risk aversion are becoming evident. Defensive sectors (consumer staples, health care, and utilities) have recently shown signs of outperforming the market (S&P 500), while cyclicals are starting to underperform, including Materials and Industrials. Outperformance in the defensive sectors is typically a leading indicator of equity market weakness ahead. The trend for the market remains on a long-term positive trend, therefore recent rotation could just be a short-term phenomena as investors books profits following the strongest start of the year since 1997. Consumer staples, health care, and utilities seasonally underperform the market through to the Spring.

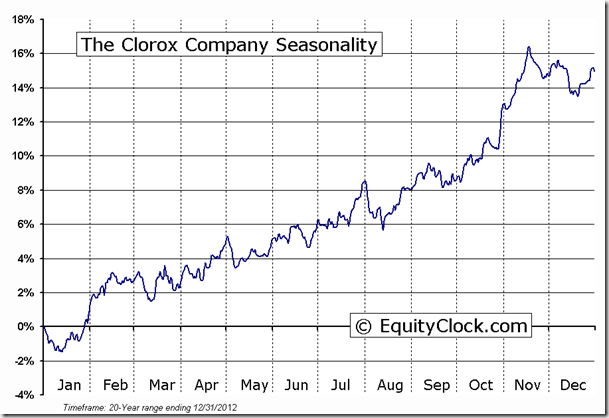

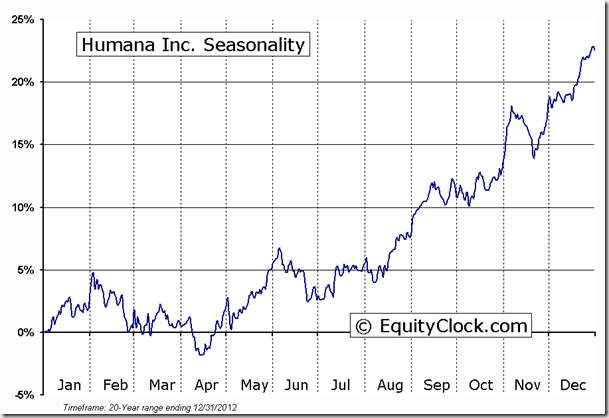

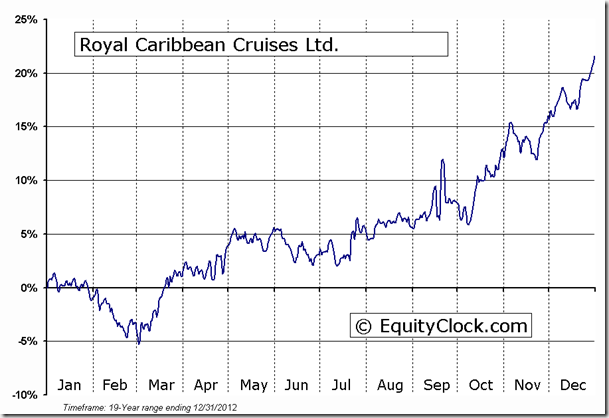

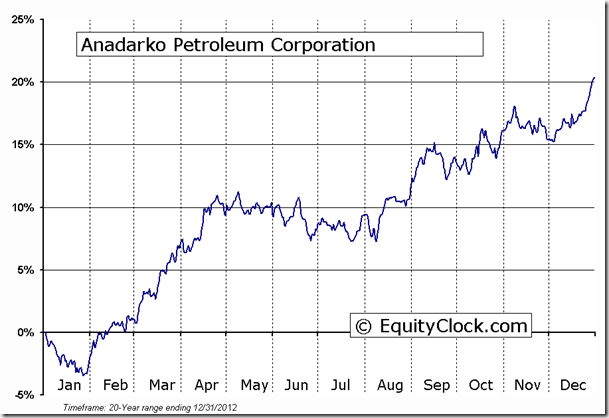

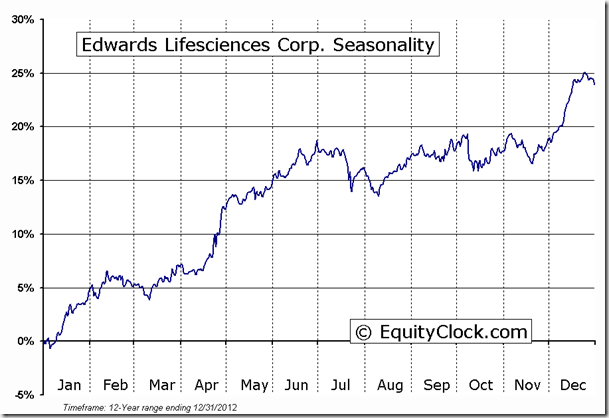

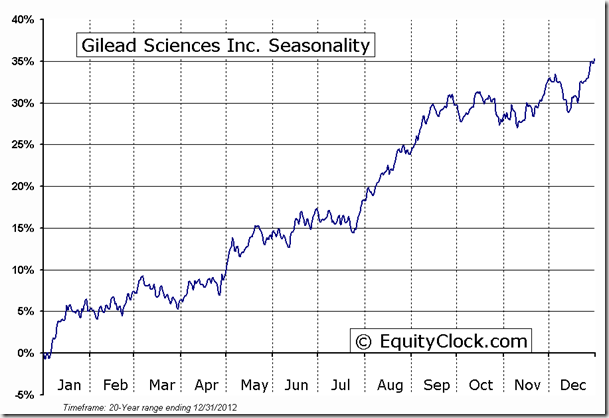

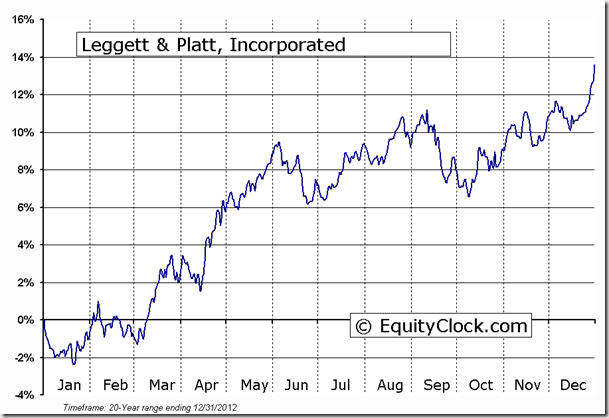

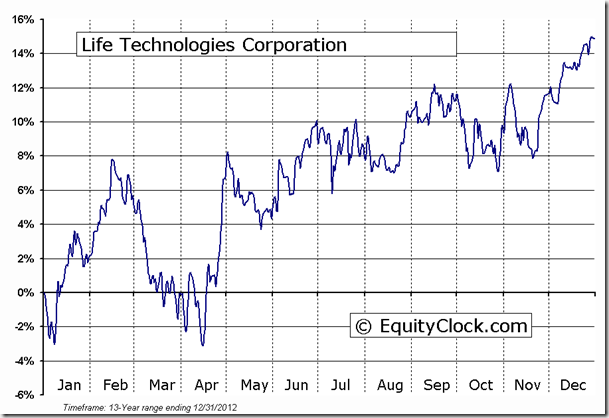

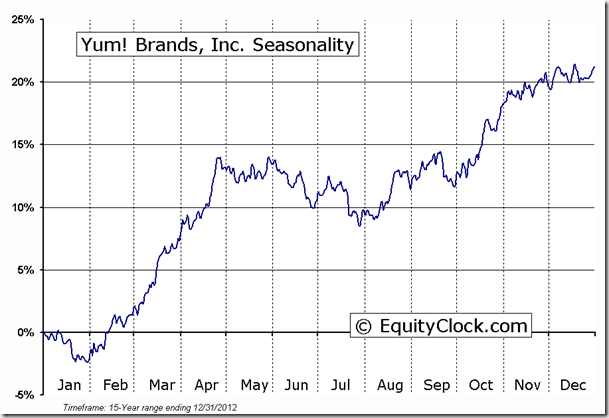

Earnings season continues with full force this week, starting on Monday with Clorox, Humana, Royal Caribbean Cruises, Anadarko Petroleum, Edwards Lifesciences, Gilead Sciences, Leggett & Platt, Life Technologies, and Yum Brands.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.90.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.43 (up 1.13%)

- Closing NAV/Unit: $13.38 (up 0.69%)

Performance*

| 2013 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 5.21% | 33.8% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.