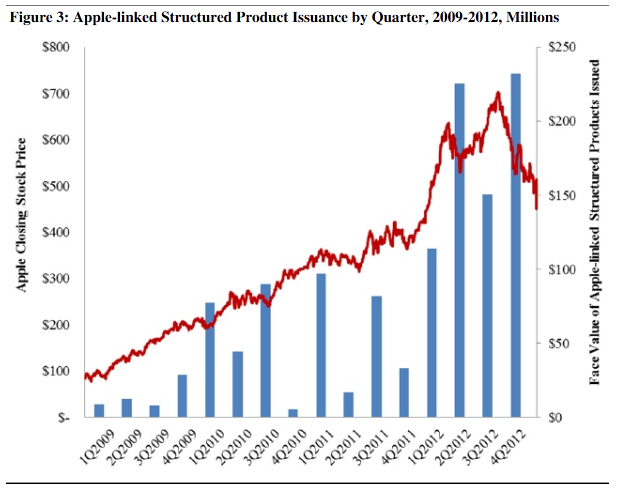

The Securities Litigation and Consulting Group just released a report which highlights the rise in Apple's stock price coinciding with the issuance of debt products linked to Apple's stock price. Turns out these products have cost investors $80MN, or over 20%, since issuance. The cabal responsible for issuance of the reverse covert's includes such White Knights of finance like UBS, Barclays, and the Morg.

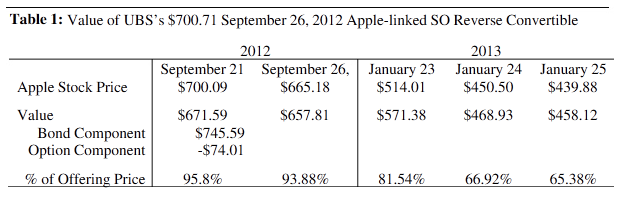

On the 23rd when expectations shanked, UBS's September 26, 2012 Apple-linked SO Reverse Convertible (8.03%, No Coup) was priced at $571.38 when Apple's stock traded at $514.01. Apple's stock closed at $450.50 the next day, Jan 24, and the SO Reverse Convert was worth $468.93, a whopping 66.92% of its face value. For investors to win, Apple's stock has to close above $595.60 on Sept 23, 2013.

This is just one of the nearly 650 Apple-linked products tracked by SLCG.

Enjoy this gem.

The Rise and Fall of Apple Linked Structured Products by

Copyright © Calibrated Confidence