by James Paulsen, Wells Capital Management (Wells Fargo)

Defensive Stock Price Betas Rise

In the last several months, the price beta (stock price volatility relative to the overall stock market) of most defensive or conservative stocks has increased while for most cyclical or aggressive stocks price betas have declined. Indeed, among the 10 sectors comprising the S&P 500 Index, the average price beta of its three most defensive sectors relative to the average beta of its three most cyclical sectors has tightened to a level not seen since the stock market bottomed in early 2009. Although many investors have adopted overweighted positions in defensive stocks, the efficacy of these efforts has recently been thwarted by a rise in the relative risk (volatility) of defensive versus cyclical investments. Finally, rising betas among defensive stocks also suggests the stock market’s recent run may persist.

Defensive vs. Cyclical Betas

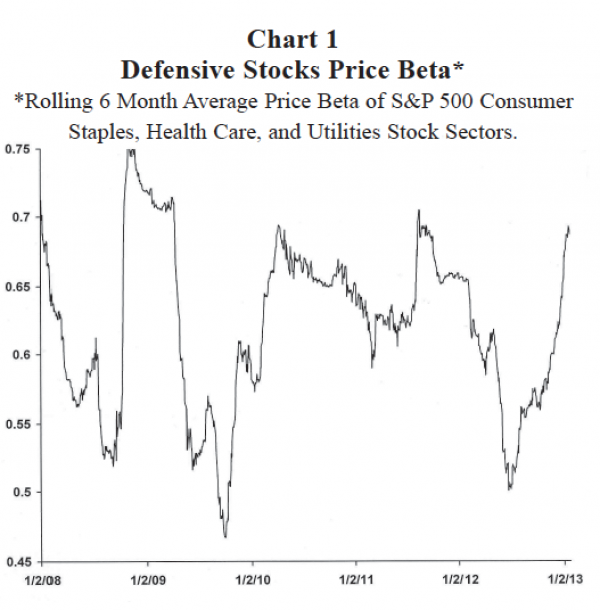

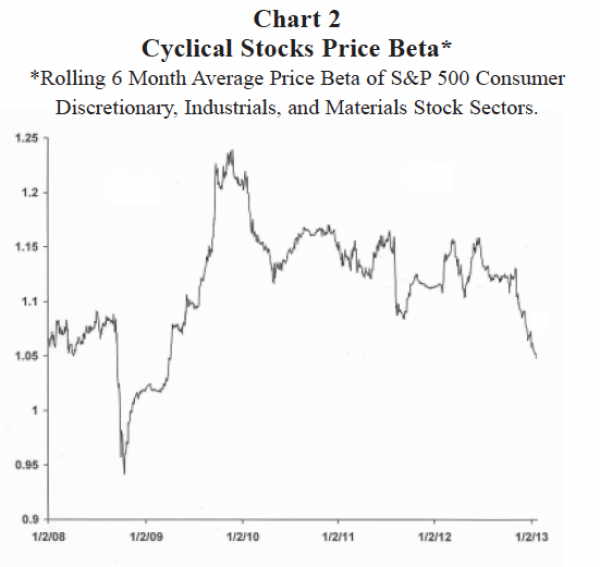

Exhibit 1 illustrates the rolling six-month average price beta of the S&P 500 Index’s three most defensive sectors (i.e., utilities, consumer staples, and healthcare) and the beta of its three most cyclical sectors (i.e., consumer discretionary, industrials, and materials). A price beta measures the percentage change in a stock’s price due to a 1 percent change in the overall stock market. As the charts show, typically, defensive stocks have a beta below 1.0 while cyclical stocks usually are more volatile than the overall stock market (i.e., their price beta is usually greater than 1.0). However, the price betas of both defensive and cyclical stocks have certainly oscillated during this recovery. The cyclical stock price beta has ranged between 0.95 and almost 1.25 and the defensive stock price beta has ranged between about 0.45 and 0.75.

While defensive stocks are almost always less volatile than cyclical stocks, the degree of relative risk aversion provided by defensive stocks varies. For example, in early 2012, the defensive stock beta was only about 0.5 and the cyclical stock beta was about 1.15—about a 0.65 differential. Most recently, however, the defensive stock price beta has surged to almost 0.7 and the cyclical stock price beta has declined to about 1.05. Consequently, the defensive stock price beta is now only about 0.35 less than the cyclical beta. Indeed, as Exhibit 1 illustrates, the price volatility of cyclical stocks is currently lower than at any time since early 2009 when the stock market first bottomed. Conversely, the price beta among defensive stocks is nearly as high as any time since the end of the 2008 crisis. Essentially, defensive stocks currently provide investors with some of the most volatile relative price action of the entire recovery while cyclical stocks offer a price beta which is only slightly more than the overall stock market. Since the total returns of most cyclical sectors have outpaced most defensive sectors recently, the “risk-adjusted” returns from cyclicals relative to defensive stocks has perhaps been more pronounced than at any time in this recovery. Will this continue?

Exhibit 1

Risk Isn’t as Risky... and ... Safe Isn’t as Safe

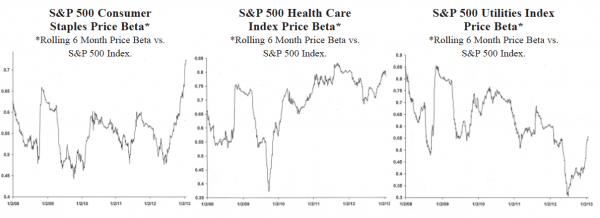

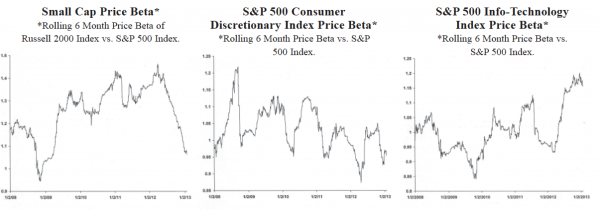

Exhibit 2 shows the recent trend of cyclical risk declining with defensive risk increasing is widespread throughout the financial market. The price betas on both consumer staples and healthcare stocks are at or near higher levels today than at any time in the last five years. Moreover, although the price beta on utility stocks is still low compared to the last five years, its beta has nearly doubled (from about 0.3 to 0.6) in the last six months!

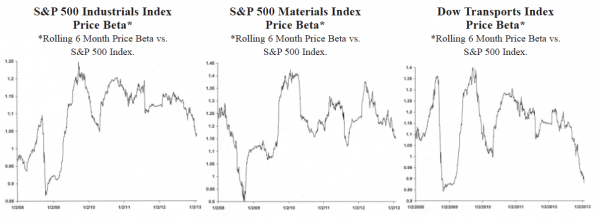

On the aggressive side of the stock market, the price betas of all three of the most cyclical sectors within the S&P 500 Index (consumer discretionary, industrials, and materials) are close to their lowest levels since the recovery first began. Moreover, other traditional cyclical investments (transport stocks and small cap stocks) have witnessed large declines in their price betas during the last year and now offer investors some of the lowest price volatility of the entire recovery.

Overall, in assessing portfolio allocations, investors should consider just how much relative price risks have been altered in the last year between traditional “safe” and “aggressive” investments. While price betas may change again in 2013, currently, risk (cyclical stocks) just isn’t as risky... and... safe (defensive stocks) just isn’t as safe!

Implications for Overall Stock Market?

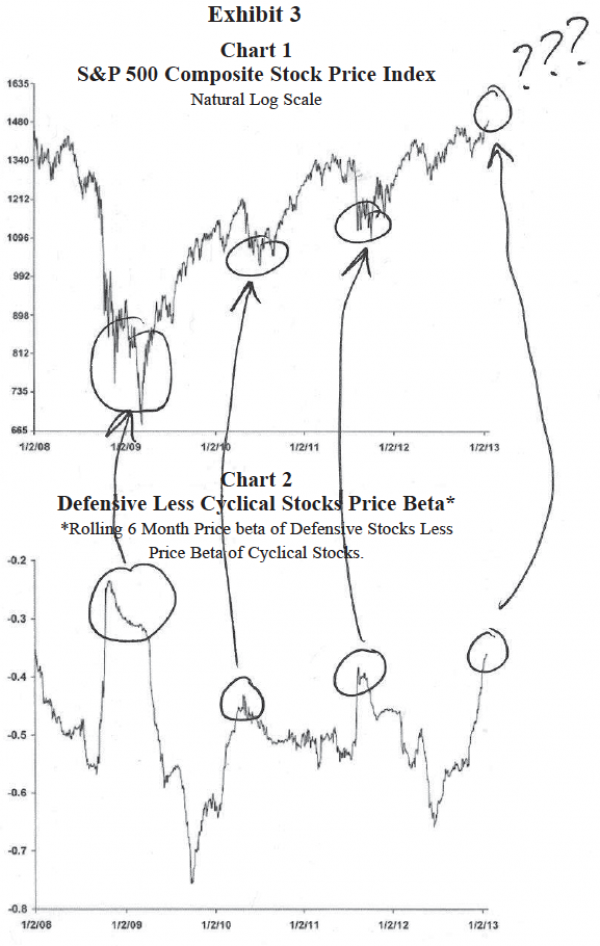

As illustrated in Exhibit 3, the stock market has typically done well when defensive stock price betas are high relative to cyclical stock price betas. Additionally, in this recovery, the stock market has not suffered a major selloff without the relative price beta of defensive stocks first declining. The stock market collapse of 2008 bottomed once the relative defensive stock price beta (i.e., the price beta of defensive stocks less the price beta of cyclical stocks) reached about -0.3. Similarly, the stock market bottomed in the spring of 2010 after the relative defensive stock price beta rose to about -0.4 in early 2010. The stock market bottomed again in 2011 once the relative defensive price beta spiked to about -0.35.

The S&P 500 Index is currently pushing ever closer to 1500 and has risen aggressively since late last year. Is the stock market ready for a breather? Perhaps. However, as shown in Exhibit 3, the defensive/ cyclical price beta spread is currently near about -0.3 suggesting further gains in the stock market would not be surprising.

Exhibit 2

Summary In the last year, “low-risk stocks” have experienced rising price betas while “high-risk stocks” have exhibited declining price betas. Indeed, the relative price beta of defensive stocks has not been as high as it is today since the stock market first bottomed in early 2009. Simply put, “risk isn’t as risky” and “safe isn’t as safe” as it use to be. Investors may want to consider this changing beta relationship in structuring portfolios and perhaps lift the weightings of cyclical stocks. So far in this recovery, when defensive stock betas have risen relative to cyclical stock betas, the overall S&P 500 Index has tended to rally. Perhaps lifting cyclical exposure and tilting toward stocks until relative defensive stock price betas diminish will prove a good investment strategy for 2013?

Copyright © Wells Capital Management