by Rick Ferri

The stock market doesn’t care what you think. Investor sentiment has little bearing on whether prices go up or down. Even former Fed Chairman Alan Greenspan’s 1996 quip that the stocks may have reached the “irrational exuberance” level didn’t stop the market from doubling again by 1999. Sentiment only makes a difference during extreme market periods.

CXO Advisory analyzed individual investor sentiment relative to stock returns going back 25 years. They looked at 1,326 surveys and 51 independent 6-month forecast intervals using American Association of Individual Investors (AAII) weekly surveys. According to the AAII website, the weekly Investor Sentiment Survey “measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months.”

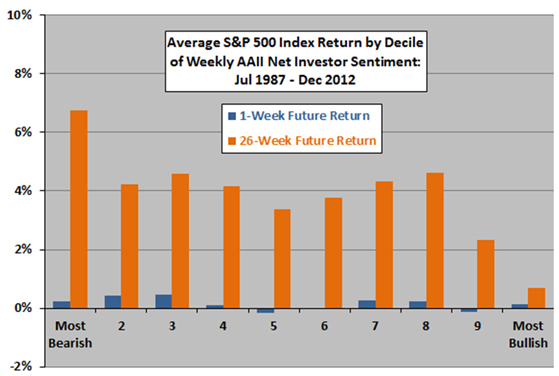

CXO found that investor opinion about market direction is non-correlated with future one-week stock prices or six-month prices, except when extreme bearish or bullish sentiment exists and then it’s negatively correlated. This means the market doesn’t react to day-to-day fear and greed. It only reacts long-term when people are super scared and ready to jump, or fearless and ready to quit their day jobs to become stock traders. It’s at these extremes that market tends to move opposite the sentiment.

Figure 1: Investor Sentiment has No Impact in the Middle and is Wrong on Both Extremes

Source: CXO Advisory

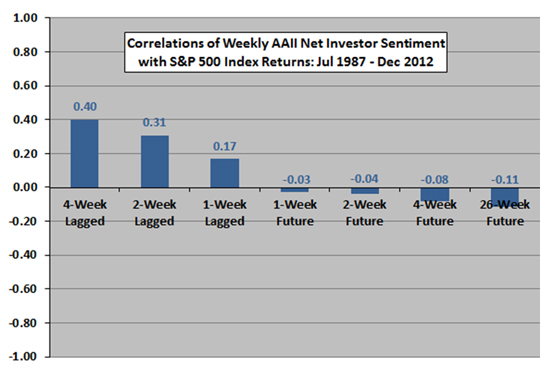

Like most investors, including professionals, the AAII membership tends to trend followers. If the market was up in the previous week, more people will say it’s “going up” in the future. If the market was down in the previous week, more will say it’s “going down.”

The first full trading week in 2013 is a perfect trend following example. The S&P 500 was up over 3 percent through January 9. Forward-looking AAII bullish sentiment increased 7.7 percent over the previous week and bearish sentiment decreased by 9.3 percent. The survey was taken after the market had already risen, not before. We are a nation of trend followers.

Figure 2 highlights the protracted trend-following behavior among AAII membership. It compares investor sentiment looking forward and backward. Compared to future S&P returns, sentiment has slightly negative correlation, which basically means there isn’t any actionable information in the survey number. The correlations jump significantly when sentiment was compared to lagged S&P returns, meaning they are basing future forecasts on past market trends, and gaining no advantage from it.

Figure 2: Investor Sentiment is Trend Following

Source: CXO Advisory

The idea that the market ignores investor sentiment is not new. The AAII website has a 2004 article by Wayne Thorp, an AAII editor at the time, who says the sentiment indicator can be used as a contrarian model. According to Thorp, “While little may be gleaned from changes in investor sentiment, identifying extreme levels of positive or negative sentiment appears to offer a glimpse of where the markets may be headed.” This is the same conclusion that CXO came to recently.

How you feel about a market should not impact how you invest in the market. Wise investors do not let their emotions drive asset allocation decisions. A strategy that targets a fixed allocation to asset classes, rebalanced occasionally, takes emotion out of the equation and increases that probability for earning your fair share of return. Read All About Asset Allocation for more insight.

Copyright © Rick Ferri