by Catherine Wood, AllianceBernstein

January 23, 2013

In the face of significant uncertainties, US and global equities rallied in 2012 and at the start of the New Year. We think there might be more to come as stocks break out of the bear trap.

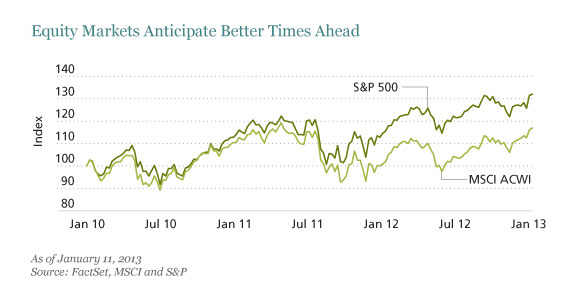

Both the S&P 500 and the MSCI All Country World Index reached toward record highs in 2012 and continued to appreciate during early 2013. Clearly, the markets breathed a sigh of relief as some of the headwinds that had hampered economic growth—primarily the US housing market and China’s political transition—turned into tailwinds.

Equity markets do not yet reflect improvements in the surrounding environment, in our view. For example, after-tax corporate profits, as measured by the National Income and Product Accounts in the US, rose by an estimated 6% to record highs in 2012 and are now 35% above their 2006 pre-crisis peak. But, at the end of 2012, the S&P 500 was only trading slightly above its year-end 2006 close.

In the past, equity markets have discounted the future effectively; yet, since the global financial crisis in 2007/2008, investors’ extreme fear of risks has caused extended periods of what in hindsight, we believe, will be considered irrational equity pricing. As in 2010 and 2011, markets recoiled at times in 2012, fearing an implosion of the euro, a hard landing in China and a double-dip recession in the US. None of those scenarios played out. As we approached the US fiscal cliff during the second half of the year, equity markets seemed to decouple from the negative sentiment and surged in anticipation of better times ahead (Display).

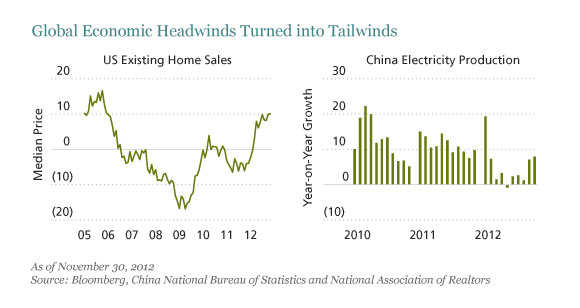

Some of these risks have flipped to the upside (Display). US housing, at the epicenter of the global financial crisis, is turning around decisively. The rise in home prices is compounding the wealth effect from stock price appreciation, adding to consumer and business confidence generally. In Europe, where the regional economy remains sluggish amid efforts to contain the sovereign-debt crisis, equities surged and outperformed the S&P 500 last year as fears of a euro breakup dissipated. And even China seems to have turned the cyclical corner—electricity production is a good gauge of economic activity—having achieved a soft landing and a political leadership transition after a year of intrigue.

Back in the US, the Federal Reserve recently issued a subtle but important shift in guidance, by no longer suggesting that it will maintain its easing policy indefinitely. In its recent directive, the Federal Open Market Committee indicated that as the US economy approaches an unemployment rate of 6.5%, quantitative easing could come to a halt, and might even reverse at some point.

This might happen sooner than expected. According to our forecasts, US unemployment could fall to 6.5% by the end of this year, forcing markets to respond. The good news is that the Fed is signaling an end to emergency measures and massive interest rate distortions now that the economy is clearly developing some traction. For some, rising interest rates might seem like bad news. But we think they would reaffirm a shift back to normal functioning for markets and to a healthier economy that would also support a repricing of stocks in line with their underlying cash flows and profitability.

Healthy competition in the banking sector could also help. Brian Moynihan, Bank of America’s CEO, recently told the Financial Times that he’d instructed his staff to get more aggressive about taking market share this year. If commercial banks provide the spark, we think it could light up unprecedented amounts of kindling that central banks around the world have created during the past four years.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Catherine Wood is Chief Investment Officer—Thematic Portfolios at AllianceBernstein.

Copyright © AllianceBernstein