by Darren Williams, AllianceBernstein

Jean-Claude Juncker’s view that the euro is “dangerously high” isn’t shared by the European Central Bank (ECB). As long as this is the case, the single currency may continue to defy fundamentals and act as an unwelcome headwind for an economy still struggling to break out of recession.

Juncker, outgoing chairman of the Eurogroup panel of euro area finance ministers, recently said that the euro’s exchange rate is “dangerously high”. Clearly, the euro’s recent appreciation is bad news for the economy. But is it really “dangerously high”?

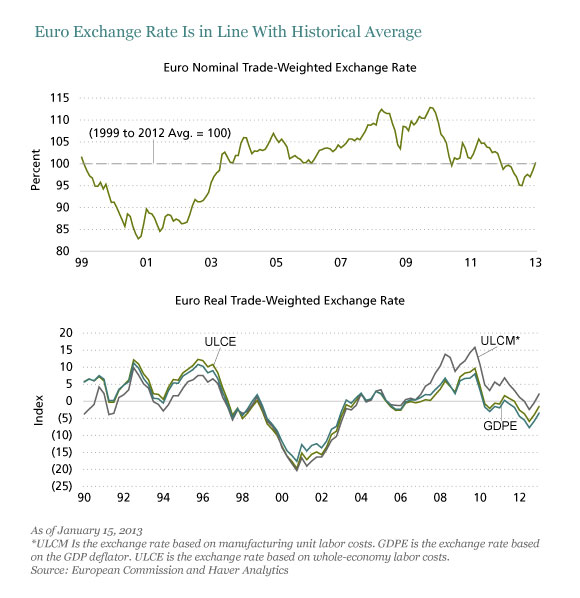

Since reaching a low last July, the euro’s trade-weighted exchange rate has risen by 6%. While this is clearly a significant move, we think it needs to be put in perspective. As the upper display shows, the euro’s nominal trade-weighted exchange rate is currently in line with its historical average and quite low in the context of the last decade.

The real exchange rate tells a similar story. As the lower display shows, the euro’s real exchange rate is now slightly above its long-term average based on manufacturing unit labour costs (ULCM), and slightly below its long-term average using either the GDP deflator (GDPE) or unit labour costs for the whole economy (ULCE). Whichever measure we use, though, the euro does not seem to be seriously misaligned.

But this does not mean we should ignore recent developments. As in other areas, the aggregate position of the euro area masks significant differences between individual member states and a rising euro is likely to push exchange rates in some countries further into overvalued territory. Moreover, the euro area is still stuck in recession and desperately needs all the help it can get. A rising exchange rate does not fit the bill.

So while the euro may not have reached dangerously high levels, Juncker would certainly be right to argue that the direction of movement is dangerous. Unfortunately, the ECB does not (yet) see things the same way—and therein lies the problem. No matter how much the economic outlook may warrant a weaker euro, it will be hard for this to happen if the ECB is happy for the euro to rise while other central banks continue to give the impression they are keen for their exchange rates to fall.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Darren Williams is Senior European Economist at AllianceBernstein.

Copyright © AllianceBernstein