by Sherwood Zhang, CFA, Research Analyst, Matthews International Capital Management

Real estate investment trusts (REITs) have long played an important role in investment portfolios. Established more than five decades ago in the U.S., REITs are investment vehicles that pool together income-producing real estate assets, such as hotels, office buildings, warehouses and shopping centers. They have since evolved into a significant asset class, attracting investors looking for a higher yielding investment and one that also has the potential to act as a hedge against inflation.

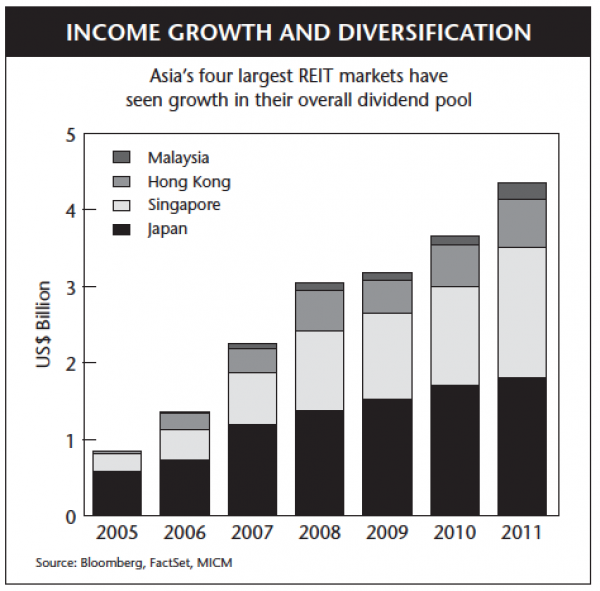

REITs in Asia may similarly become important components of an investor’s global portfolio. Most REIT markets in the greater Asia Pacific region did not take off until the late 1980s (with the exception of Australia), starting with Malaysia’s property trust funds, which held portfolios exclusively in real estate assets. However, in just the past decade, REITs have become a growing force in the region and the Asia Pacific REIT market is now the second-largest REIT market globally, after North America. By 2011, it represented about 21% of the total global REIT market capitalization, with Australia as the largest and oldest of Asia-Pacific’s markets. Japanese REITs were first publicly traded just over a decade ago and Singapore followed suit in 2002. In addition, by country, Hong Kong and Malaysia are now among the top 10 REIT markets globally by total market capitalization. Investors can also find REITs or REIT-like vehicles in Taiwan, South Korea and Thailand, and, increasingly, regulators in other Asian economies are exploring their own REIT markets.

*Investing in the securities of companies in the real estate industry include the following risks: declines in the value of real estate, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses and increases in interest rates. Foreign REITs are generally treated as Passive Foreign Investment Companies, or PFICs, by U.S. Tax Authority. Most U.S.‐based investors must pay income tax on all distributions and appreciated share value, regardless of whether capital gains tax rates would normally apply.

Why Consider Investing in Asian REITs?

Let us first discuss the state of Asia’s professionally managed real estate assets. Over the past 10 years, Asia has seen strong growth in GDP per capita, driven mainly by investments and exports. As Asia’s next stage of growth will likely see greater increases in consumption, the expansion of service industries and ongoing urbanization (Asia is expected to host 21 of the world’s 37 mega-cities by 2025). In addition, commercial real estate seems well-positioned to benefit—more consumers will demand more modern shopping centers; a younger and better-educated workforce should demand more quality office space; growing tourism should create demand for more hotel rooms; and longer life expectancies will require more advanced health care and more care facilities.

Hard assets such as real estate have long been viewed as good hedges against inflation. And, with the exception of Japan, Asia has historically had higher inflation than the West. Thus, Asia’s real estate could be an effective hedge against future inflation. From a replacement value perspective, premium real estate is a compelling means of capturing rising land value, construction material cost and labor cost in Asia. In general, commercial real estate in Asia is still reasonably priced compared to residential property markets in certain Asian countries, as the market has not attracted as many speculators due to its high capital requirements. In terms of rental value and capital value, Asia’s commercial real estate also lags that of the more developed West.

Equity investors in Asia have traditionally gained exposure to the real estate sector through investments in real estate developers across the region. Such developers currently account for about a 5% weighting in the MSCI Asia ex Japan Index. However, Asia’s real estate developers tend to focus more on building and selling residential properties rather than owning and operating commercial real estate assets. Therefore, sales proceeds tend to be more cyclical and less stable than rental income. While there are publicly listed “landlord” companies that may generate stable rental income, those companies do not generally maintain a high payout ratio, and thus investors do not receive the full benefits of owning such assets when cash flow is considered. By contrast, most of Asia’s REITs are required by regulators to distribute much of their net income as cash dividends to investors.

In addition, Asia’s REITs usually specify clearer geographic and asset category focus in their investment mandates than most development firms. For example, they may be listed specifically as hospitality assets in Singapore, retail properties in Hong Kong, or logistics properties in Asia Pacific region. Thus, investors may consider REITs as building blocks to construct diversified portfolios across various asset classes and countries.

Large institutional investors, with more capital at their disposal and the ability to tolerate less liquid investments, may prefer direct ownership of physical properties over owning REITs. However, for international investors REITs may still be compelling for their local operational and financing expertise and management as well as their on-the-ground track record that can impact optimal financial leverage for projects.

Asian REITs Have Delivered an Attractive Total Return

Asia’s REIT markets have performed well over the past five years. In fact, a recent study by the Asia Pacific Real Estate Association found that REITs in Japan, Hong Kong and Singapore have outperformed stocks in these markets since their inception and since the start of the global financial crisis.

In addition, Asia’s REITs have also outperformed their peers in other regions. A five-year investment1 into Asia’s REITs in January 2008 would have achieved a cumulative return of about 42% as measured by the Bloomberg Asia REIT Index. This exceeds the cumulative return for U.S. REITs of about 31% as measured by the FTSE NAREIT All REITs Total Return Index and nearly a 14% total return of global REITs as measured by the FTSE EPRA/NAREIT Developed Total Return Index in the same period.2 Asian REITs also delivered lower volatility3 of approximately 20% compared to both U.S. REITs at about 31% and global REITs at approximately 28%, over the same period.4

While investors may attribute the outperformance of Asia’s REITs to the stronger growth or recovery of Asian economies during this period, there are also structural factors to be taken into consideration. Singapore and Hong Kong have financial leverage limits on REITs to cap debt-to-asset ratios in the range of 35% to 60%, depending on various conditions. REITs in other markets have no ceilings on debt levels. During the recent global financial crisis, several REITs in the U.S. faced severe financial distress due to heavy debt burdens. As a result, investors in these REITs suffered much capital loss. Some Japanese REITs were also financially overextended during this period, and met with financial trouble; however, REITs in Singapore and Hong Kong, by contrast, fared better during that difficult period due to these cautious limits set by regulators.

While REITs in the U.S. ventured into developing speculative properties for residential communities, warehouses or retail during the country’s housing boom prior to 2008, safeguards for REITs in Japan, Hong Kong and Singapore minimized impact from speculative development. For instance, REITs in Japan and Hong Kong have always been restricted from riskier “greenfield development,” or

“In the past decade, REITs have become a growing force in Asia’s investment universe.”

building on previously undeveloped land. Also, REITs in Singapore can only undertake property development when they have investments in a development of up to 10% of its property value.

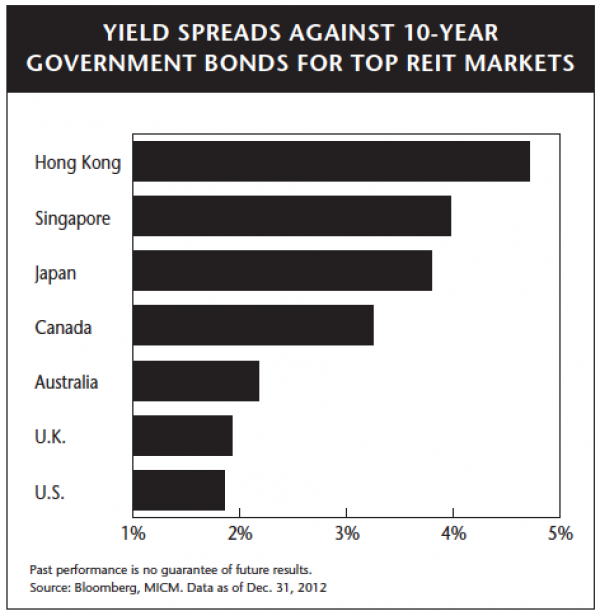

Along with solid historical performance, Asia’s REITs also generate the highest yields across global REIT markets and some of the widest yield spreads over risk-free investments.

Structural Challenges

Naturally, REITs are not immune from volatility, and when property prices fall and rents decline, REIT share prices also tend to decline. Both Tokyo in the late 1980s and Hong Kong in the late 1990s saw soaring real estate prices that led to property crashes.

In addition, a large portion of investment in the region’s quality commercial real estate has been held by a small number of local investors, developers and government-owned firms. However, for these owners, holding assets as long-term investments would stretch their balance sheets as they would require either more equity or debt to sustain. Thus, transferring some assets into a REIT is often a logical financing alternative. At the same time, these original owners can remain as the largest shareholders of the REIT, and sometimes retain responsibility for the daily operation, financing and property management of these assets as an external manager. These REITs also benefit from being able to acquire new property assets during their initial stage of growth. This structure has helped Asia’s REIT markets grow.

However, the external management structure of Asia’s REITs may raise concerns over conflicts of interest. For example, the management fee charged by external managers is primarily based on the property value in the REIT, and the performance fee is typically a percentage of the REIT’s total net property income. Thus, REIT managers are more incentivized to grow the size of the portfolio, while investors in the REIT profit only from share price gain and income growth. Increasing the size of a REIT may not be in the best interest of investors. In addition, when Asian REITs acquire assets to grow their portfolios, very often the seller is the external manager or the largest shareholder. Although regulators require a third-party valuation to be completed and presented to investors for the acquisitions, the fairness of pricing is often questioned.

There have been studies to re-examine regulations over the structure of REITs and compensation for REIT managers, and some initiatives have been taken to ensure better oversight. Investors still need to evaluate a REIT’s corporate governance for its fee structure, manager’s track record, overall reputation and the independence of its board of directors. Should external managers abuse the interest of minority shareholders through inflated asset sales they would lose shareholder support, and thus limit financing options.

Looking Ahead

As more Asian markets mature and develop REIT structures, investors should continue to see compelling opportunities in this emerging sector. And as larger economies such as China, India and Indonesia (which currently have no listed REITs) develop such markets, they have the potential to be some of the largest in the world. With these new REIT markets on the horizon, it should be much easier for international investors to access this compelling asset class’ growing income pool and diversified income source.

Sherwood Zhang, CFA

Research Analyst

Matthews International Capital Management, LLC

Footnotes:

1 Investment is calculated in local currency terms with reinvestment of dividends.

2 Past performance is no guarantee of future results.

3 Volatility is determined by calculating the annualized standard deviation of daily changes in pricing of index performance.

4 Standard Deviation measures the average a return deviates from its mean. It is often used as a measure of risk. Higher standard deviation represents higher volatility.

Copyright © Matthews International Capital Management, LLC