by Martin Sibileau, A View From the Trenches

In one sentence, during 2013, I expect imbalances to grow…

Click here to read this article in pdf format: January 15 2013

In the same fashion that I proposed an analytic framework for 2012, I want to lay out today what I think will be the big themes of 2013. Their drivers were established in September 2012, and I sought to give a thorough description of them here, here and here.

An analytic framework for 2013

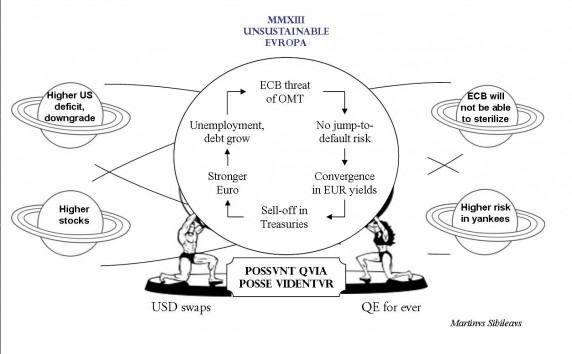

In one sentence, during 2013, I expect imbalances to grow. These imbalances are theUS fiscal and trade deficits, the fiscal deficits of the members of the European Monetary Union (EMU) and the unemployment rate of the EMU thanks to a stronger Euro. A stronger Euro is the consequence of capital inflows driven by the elimination of jump-to-default risk in EMU sovereign debt. Below is a drawing I made to help visualize these concepts:

The drawing shows a circular dynamic playing out: The threat of the European Central Bank to purchase the debt of sovereigns (that submit to a fiscal adjustment program) eliminates the jump-to-default risk of this asset class. As explained and forecasted in September, this threat also forces a convergence in sovereign yields within the EMU, to lower levels. As long as the market perceives that the solvency of Germany is not affected, the Bund yields will not rise to that convergence level. So far, the market seems not to see that (Possunt quia posse uidentur). But the resulting appreciation of the Euro will eventually address that illusion.

This convergence, in my view, is behind the recent weakness in Treasuries. I proposed this thesis last September. However, the ongoing weakness in Treasuries does not mean I was right. In fact, I fear I may have been right for the wrong reasons. The negotiations on the US fiscal deficit and the latest announcement of the Fed with regards to debt monetization quantitative easing to infinity may also be behind this move. But until proven wrong, I will cautiously hold to my thesis.

The above factors drove capital inflows back to the European Monetary Union and strengthened the Euro. I believe this strength will last longer than many can endure. The circularity of this all resides in that the strength of the Euro will make unemployment and fiscal deficits a structural feature of the EMU, forcing the ECB to keep the threat of and eventually implementing the Open Monetary Transactions. The alternative is a social uprising and that will not be tolerated by the Euro kleptocracy.

All this -and particularly the strength of the Euro- is not sustainable. Ad infinitum, it would create a Euro so strong that the periphery would drag coreEuropein its bankruptcy. But while it lasts, the compression in sovereign yield will mask the increasing default risks in Euro corporate debt, specially the one denominated in US dollars. Both have been fuelling the rise in the value of equities globally.

The unsustainable framework rests upon the shoulders of the Federal Reserve, which thanks to the established USD swaps and unlimited Quantitative Easing, has completely coupled its balance sheet to that of the European Central Bank. In the end, as this new set of relative prices between asset classes sets in, it will be more difficult for the European Central Bank to sterilize the Open Monetary Transactions.

History provides an example of the current growth in imbalances

By now, it should be clear that the rally in equities is not the reflection of upcoming economic growth. Paraphrasing Shakespeare, economic growth “should be made of sterner stuff”.

Under the current framework, the European Central Bank can afford to engage in the purchase of sovereign debt because the Fed is indirectly financing the European private sector. The Fed does so with the backstop of USD swaps and tangible quantitative easing, which provides cheap USD funding to European banks and thus avoids a credit contraction of the sorts we began to see at the end of 2011.

This same structure was in place between the Federal Reserve and the central banks of France and England in 1927, 1928 and 1929 and, as a witness declared, “(it) transformed the depression of 1929 into the Great Depression of 1931”. Something tells me that this time however it will be different. It will be worse. That little something is the determination of the new Japanese government to devalue its currency via purchases of European sovereign debt (ESM debt).

How fragile is this Entente?

Most analysts I have read/heard, focus on the political fragility of the framework. And they are right. The uncertainty over theUSdebt ceiling negotiations and the fact that prices today do not reflect anything else but the probability of a bid or lack thereof by a central bank makes politics relevant. Should the European Central Bank finally engage in Open Monetary Transactions, the importance of politics would be fully visible.

However, unemployment is “the” fundamental underlying factor in this story and I do not think it will fall. In the long term, financial repression, including zero-interest rate policies, simply hurt investment demand and productivity. I do not see unemployment dictating the rhythm in 2013, indirectly through defaults. Furthermore, in the meantime, the picture may look different, because “…we should not be surprised if, under zero-interest-rate policies in the developed world, we witness a growing trend in corporate leverage, with vertical integration, share buybacks and private equity funds taking public companies private…”. This is obviously supportive of risk.

No systemic meltdown in 2013?

From earlier letters, you know that I believe quasi-fiscal deficits (i.e. deficits from a central bank) are a necessary condition for a meltdown to occur, and that these usually appear when deposits begin to seriously evaporate. So far, capital is leaving main street (via leveraged share buybacks and dividends), but at the same time, it is being parked at banks in the form of deposits. The case of Wells Fargo and the temporary pause in the flight of deposits from the periphery of the European Union suggest that the process towards a meltdown, if any (and I believe there will be one) will be a long agony. Furthermore, in the short term, at the end of January, European banks, have the option to repay the money lent by the European Central Bank in the Long-Term Refinancing Operations from a year ago, on a weekly basis. I expect them to repay enough to cause more pain to those still long of gold (including me, of course).

Martin Sibileau

Copyright © A View From the Trenches