by Vadim Zlotnikov, AllianceBernstein

Revisions to earnings forecasts started to improve in late 2012 as analysts’ worst macroeconomic fears eased. But this year, global companies may find it tougher to boost profits while their pricing power remains weak.

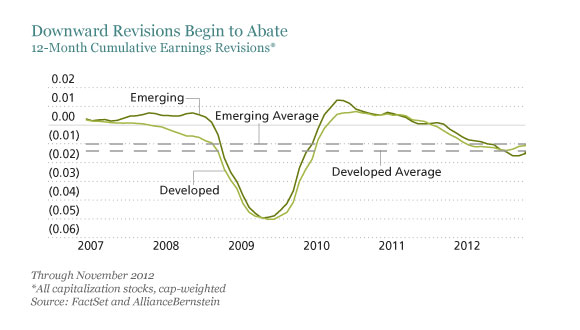

Downward revisions began to abate as fading fears of recession offered hope of healthier earnings in most developed and emerging markets (Display). Although revisions remained weak in Asia, the rebound spanned regions. A sharp bounce in Europe—especially among the most volatile stocks— provided an encouraging sign of corporate resilience from the crisis-stricken continent.

But will it continue? The big question investors must ask today is whether companies are capable of growing their profits ahead of expectations in a challenging market environment.

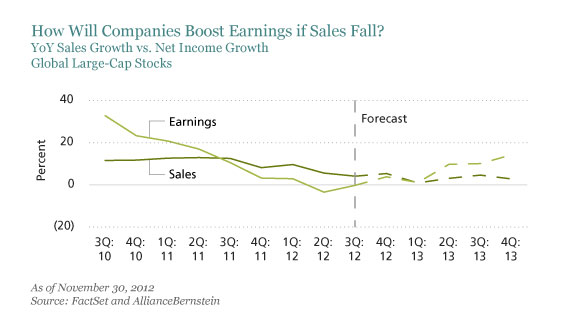

Consensus forecasts shed little light on this question. According to consensus estimates, nominal GDP growth for 2013 is expected to be almost exactly the same as last year in almost every region. That means investors shouldn’t hold their breath expecting economic growth to fuel sales. Indeed, analysts expect sales growth to decelerate—yet they also forecast an acceleration of earnings (Display). In other words, the market thinks companies are capable of boosting profit margins.

But for companies to improve margins when sales are slowing, they must have other ways to generate earnings. In a sluggish sales environment, we think pricing power—the ability to increase the mark-up on materials and labor— is really the key to unlock more earnings from every sales dollar, euro or yen.

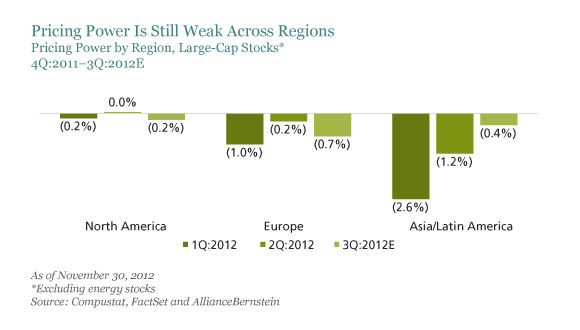

This may be easier said than done. According to our analysis, inventories have been building up across the globe, and in almost every industry from autos to telecom. As inventories build up, the supply glut makes it much harder for companies to charge more for their products.

To make matters worse, pricing power was already generally bleak late last year. We look at the year-over-year change in percent gross margins (excluding depreciation costs) as a proxy for pricing power. Our analysis shows that in North America, Europe, Asia and Latin America, the pricing power of large-cap stocks (excluding energy) had declined during the third quarter of 2012 (Display). Most sectors were struggling to improve gross profit margins without being able to increase prices, and the inventory buildup suggests that it won’t be any easier in early 2013.

In this environment, we would be especially wary of stocks in sectors that have been spending capital aggressively and may struggle to increase margins when sales are slow, such as commodities, energy and industrial stocks.

At the same time, investors who understand the underlying pricing power challenge can gain an edge. Stock pickers should focus on companies that are able to increase prices in their sectors and thereby have a much better chance of achieving their margins and surprising the market, and which are likely to be rewarded disproportionately for beating expectations.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Vadim Zlotnikov is Chief Market Strategist for AllianceBernstein.

Copyright © AllianceBernstein