by Shamaila Khan, AllianceBernstein

Jan 8, 2013

New bond issuance by emerging-market companies boomed in 2012, leading to fears of a bubble. But we think this market growth is positive for investors, rather than a harbinger of soaring debt levels or deteriorating credit quality.

Emerging-market (EM) corporate bond issuance hit a record of more than US$300 billion in 2012, compared with about US$200 billion in 2011. The biggest increase occurred in Asia, where issuance more than doubled.

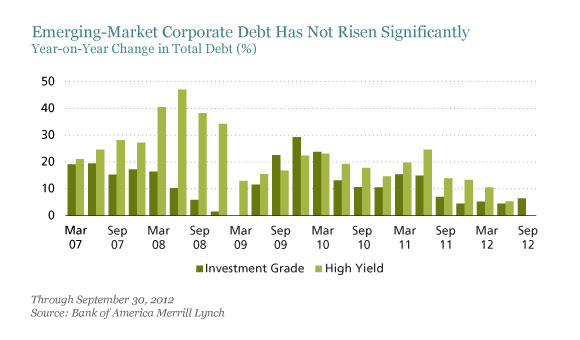

High issuance can be a symptom of excessive and irresponsible borrowing, but global metrics don’t show obvious signs that companies are leveraging up. For example, as shown in the chart below, total debt levels of EM companies have not risen sharply by historical standards.

The boom was partly driven by favorable bond-market conditions, with strong investor demand and interest rates close to record lows. But there was another factor at work as many companies turned to the bond markets instead of the banks for financing. This “disintermediation” trend is a common feature of evolving capital markets. In this case, it was largely a by-product of the euro-area financial crisis.

As European banks became increasingly risk averse and faced funding constraints, they significantly reduced their activity in the EM trade finance and syndicated loan markets. Global syndicated loan issuance shrank to less than half its 2011 levels, with the bulk of that decline occurring in Asia, where European banks had been big players. JPMorgan reports that foreign claims by French banks decreased by 40%, accounting for much of the contraction.

As a result, a host of Asian companies refinanced their debt, many of them—notably in Hong Kong—entering the US dollar bond market. Asian banks also started to take a bigger role in providing trade financing, which in turn led them to seek more US dollar funding through bond issuance.

What does this imply for investors? In short, we believe this growth is good. As we’ve argued previously, the relatively young EM corporate debt market is now large enough to warrant a dedicated EM portfolio allocation. The hard-currency corporate universe today is now over $1 trillion. This scale brings a number of benefits, including greater liquidity and more opportunity to diversify against issuer-specific risk.

Shamaila Khan is an emerging-markets portfolio manager.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Copyright © 2012 AllianceBernstein