In Search of the Holy Grail

by Niels Jensen, Absolute Return Partners

Year End, December 2012

“It’s one thing to have an opinion on the macro, but something very different to act as if it’s correct.”

Howard Marks, Oaktree Capital Management

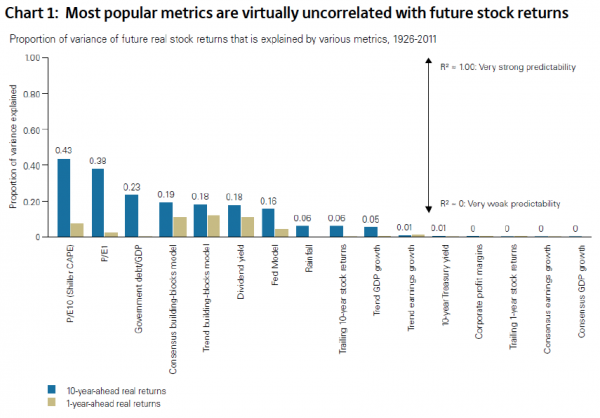

It can be a frustrating, and rather futile, experience to be an economist. Financial markets do not always behave as if there is a connection between economic fundamentals and stock prices, a subject I touched on in the October 2012 letter. In fact, if you believe the findings of a recent Vanguard study, rainfall statistics provide more value than either trend GDP growth or trend earnings growth in terms of their ability to predict future stock market returns (chart 1).

Using U.S. market data going back to 1926, Vanguard analysed the predictive powers of a whole range of metrics. The rather depressing conclusion – at least from an economist’s point of view – is that we are pretty much wasting our time by assigning any value at all to what goes on in the real economy. Of all the metrics tested by Vanguard, only P/E ratios seem to explain some reasonable proportion of future (real) stock market returns, and that is only if you are prepared to take a very long term view (10 years in the Vanguard study).

You may continue reading this complete commentary or download it, in the slidedeck below: