BMO ETF Portfolio Strategy Report

A New Year, and More Market Resolutions

by Alfred Lee, CFA, CMT, DMS

Vice President, BMO ETFs

Portfolio Manager & Investment Strategist

BMO Asset Management Inc.

alfred.lee(at)bmo.com

In this report, we highlight our strategic and tactical portfolio positioning strategies for the first quarter using various BMO Exchange Traded Funds.

• The fiscal cliff drama finally came to an end on New Year’s day. A compromise deal was reached that prevented an end to spending cuts and an increase in taxes to the middle class. The House of Representatives voted 257-167 to approve the fiscal cliff bill, which allows tax increases to individuals and households making US$400k and US$450k respectively. Over the quarter, the focus of investors will shift towards the already breached U.S. debt ceiling, giving Congress roughly two months to raise its legal borrowing limit.

• The Federal Reserve Board (Fed) announced a fourth round of quantitative easing1 (QE4) at its December FOMC2 meeting, to replace Operation Twist3 which expired at the end of 2012. This rendition of the monetary easing measure was given thresholds, allowing the Fed to keep rates low as long as unemployment remained above 6.5% and inflation expectations remained below 2.5%.

• The power transition in China was also completed over the quarter, paving the way for the country’s new regime. While modernizing China’s infrastructure will continue, it is unlikely it will occur at the same rapid pace of 2009-2010, potentially placing headwinds on commodity related sectors of the S&P/ TSX Composite Index (S&P/TSX). As a result, we continue to favour the lower beta trade for Canadian exposure. The failure of the S&P/TSX in following the 4.3% one day surge of the Shanghai Composite Index on December 14 may provide evidence for this thesis.

• With the growing middle class in emerging markets, the focus of their economic policies continues to shift towards consumer consumption and away from commodity intensive projects. Direct exposure in emerging market equities may therefore be more favourable than indirect exposure through Canadian equities. It is possible that the correlation between the S&P/TSX and emerging market equity stocks will decline in coming years, as developing nations have less of a demand for our base metal exports. Many investors have also started reallocating to emerging market equities, which could lead to tailwinds for the asset class.

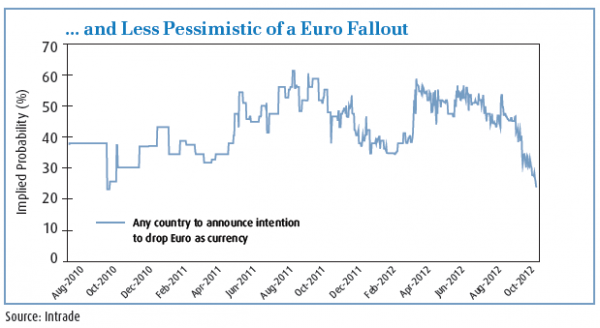

• Although the European economies continue to remain in a malaise, there have been some positive developments. The OMT4 programme has been a game changer over the short-term, as most European sovereign credit spreads remain well below their one-year averages. Certainly, European stocks can outperform in the first quarter of 2013 and even throughout the year, however from a portfolio management context, returns in this area could come with heightened volatility, particularly since it is the region that is most likely to produce a tail-risk event5. The post crisis era, has favoured more defensive-oriented investments with higher risk-adjusted returns. For that reason, we continue to avoid direct exposure to European stocks, despite the opportunities. Similar to the theme we highlighted back in 2011, we believe multi-nationals provide indirect exposure to the European economy.

Things to Keep an Eye on...

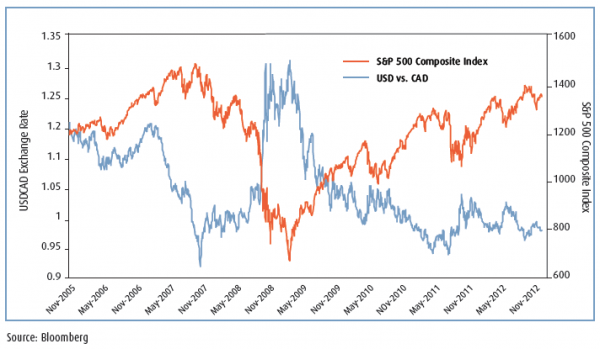

Despite the high debt to GDP ratio of the U.S., the U.S.’s low interest rate policy will continue to encourage carry-trades, where investors borrow in U.S. dollars to fund purchases in riskier assets. During market sell-offs, the U.S. dollar rallies as carry-trade borrowings are paid back. For this reason, the greenback will likely remain inversely correlated to risk assets, making non-currency hedged U.S. equity ETFs less volatile over the long-run.

Recommendation: We have recommended an overweight to U.S. equities since the end of 2010. In that time, U.S. equity indices have outperformed and we continue to believe they provide the best risk-adjusted opportunities amongst broad based equity areas. We now recommend switching from the BMO S&P 500 Hedged to CAD Index ETF (ZUE) to the non-currency hedged exposure to U.S. equities through the BMO S&P 500 Index ETF (ZSP) as a way to lower overall portfolio volatility.

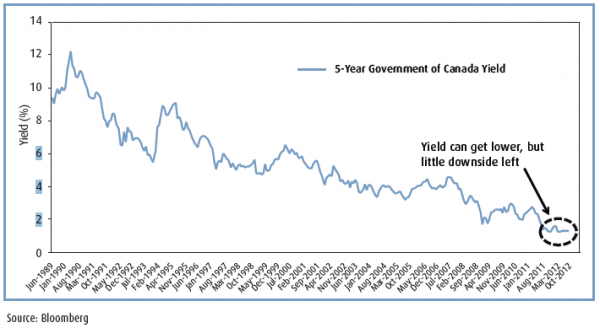

The Fed’s recent announcement of QE4 likely means a prolonged period of low interest rates. This will partially dictate the Bank of Canada’s monetary policy, which will cause yielding assets to continue outperforming growth related investments. A quicker than expected North American recovery, however, could place upward pressure on interest rates. With yields at historic lows, investors should also look for interest rate protection in rate sensitive yielding investments.

Recommendation: Preferred shares have been in high demand given their tax efficient yield and low volatility attributes. With the risk of rising rates, albeit low, we recommend rate reset preferred shares, which provide better protection to rising rates than straight perpetual preferred shares. Investors can obtain diversified exposure to a portfolio of rate resets through the BMO S&P/TSX Laddered Preferred Share Index ETF (ZPR).

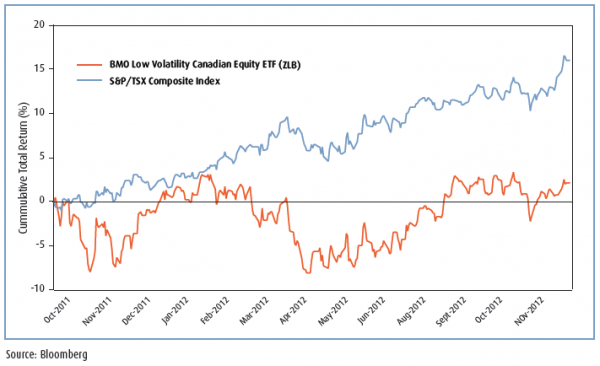

As previously mentioned in this report, we believe commodity related sectors of the S&P/TSX may continue to face heightened volatility with emerging markets being less reliant on reflationary policies. Our core position in Canadian equities, the BMO Low Volatility Canadian Equity ETF (ZLB) has significantly outperformed the S&P/TSX. Since the launch of ZLB on October 27, 2011, its 17.5% total return has easily outpaced the 4.3% total return of the S&P/TSX over the same time period.

Recommendation: Outside periods of unconventional monetary policy, particularly quantitative easing, lower beta trades have outperformed those of a more cyclical or higher beta nature. Our 9.0% position in ZLB has been one of our most efficient equity exposures, offering high risk-adjusted returns. We recommend defensive oriented ETFs over traditional market-cap weighted ETFs for broad based Canadian equity exposure.

Changes to the Portfolio Strategy:

Asset Allocation:

• With continued geo-political risk stemming from a number of regions, in addition to continued macro-economic headwinds, asset allocation remains important in the portfolio construction process. Our strategy for the first quarter of 2013 remains predominantly defensive in the equity portion of our portfolio, with targeted positions in key cyclical areas for growth opportunities. Our view remains that higher yielding non-Canadian credit plays will continue to provide better risk-adjusted returns than certain areas in equities. Fixed Income:

• Our strategy for fixed income remains unchanged for the first quarter of 2013. The BMO Aggregate Bond Index ETF (ZAG) provides low cost exposure to the broad Canadian bond universe, while more targeted fixed income ETFs provide a further tilt toward our preferred duration and credit exposure. We continue to favour corporate bonds as a slowly strengthening Canadian economy could result in a tightening of corporate spreads. With interest rate futures currently pricing in a zero probability of rates increasing by 0.25% or more in the next six-months, we recommend overweighting mid-term corporate bonds for higher yield. Until rates look close to rising, we continue to recommend the BMO Mid-Corporate Bond Index ETF (ZCM) as a tactical tilt in the fixed income portion of our portfolio. Equities:

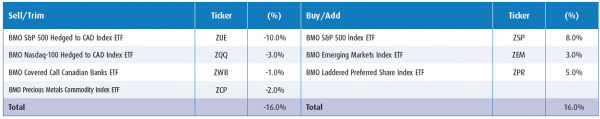

• The underlying macro-economic backdrop in the U.S. continues to improve. Economic data in unemployment and housing in the U.S. has shown signs of improvement. We remain positive on U.S. equities, but are switching our 10.0% exposure in the BMO S&P 500 Index Hedged to CAD (ZUE) to an 8.0% position in the non-currency hedged BMO S&P 500 Index (ZSP), as the currency exposure of the U.S. dollar will provide us with an inverse correlation to risk assets. We have pared back our exposure to U.S. equities by 2.0%, as we have increased our exposure to emerging markets.

• We are slightly decreasing our exposure to the BMO Covered Call Canadian Banks (ZWB). Overall, the Canadian banks are more stable than their global counterparts, but have gone on a considerable run since early June. Consequently we are decreasing our position in ZWB by a slight 1.0%. Our position in preferred shares also provides us with exposure to the Canadian banks, but higher up the capital structure. Although financials remains our largest sector overweight, Canadian banks account for a small position of this allocation.

• The Shanghai Composite Index, an emerging market laggard in terms of equity performance over the last two years, had a one day gain of 4.3% on stronger manufacturing data. Lower inflation in many emerging market countries, may allow for more accommodative monetary policy. Should we get a soft-landing in China, this will be positive for the broader emerging market countries. Though Chinese stocks may face headwinds, there are attractive opportunities in the broader emerging market equities. We are initiating a small position of 3.0% in the BMO Emerging Market Equity Index ETF (ZEM).

• The fourth quarter of the year has historically been a seasonal strong period for technology stocks. However, tech stocks continue to run up against headwinds. While the longer-term potential for technology stocks remain positive, from a tactical perspective, we our eliminating our 3.0% position in the BMO Nasdaq-100 Hedged to CAD Index ETF (ZQQ) as its underlying index, the Nasdaq-100 Index, registered a double-top formation, which usually precedes a short-term sell-off. Non-traditional/Alternative:

• Preferred shares have many characteristics that are beneficial to a portfolio, such as non-correlated returns to bonds and equities, tax efficient yield and lower volatility compared to bonds. As mentioned on the previous page, we prefer rate resets given they are less sensitive to rising interest rates. We are initiating a 5.0% position in the BMO S&P/TSX Laddered Preferred Share Index ETF (ZPR). In addition to being a portfolio of only rate resets, the portfolio utilizes a laddered approach, where the portfolio is divided in five equal term buckets, organized by reset year. The laddered structure allows an equal portion of the portfolio to reset to the current interest rate environment each calendar year, providing an additional layer of protection against rising rates. • We continue to like gold given the ongoing expansionary monetary policy and lower relative interest rates in the U.S. However, the seasonality for gold tends to be the most significant in the last two quarters of the year. Consequently, we are trimming our position in the BMO Precious Metals Commodity Index ETF (ZCP) by 2.0% to 5.0%, still leaving us with a sizable position.

Footnotes:

1. Quantitative easing: An unconventional monetary policy used by some central banks when traditional measures have not produced the desired effect. Money supply is typically increased in an effort to promote increased lending and liquidity.

2. Federal Open Market Committee (FOMC): A committee within the U.S. Federal Reserve that is in charge of determining monetary policy for the country. It makes key decisions on interest rates, money supply and unconventional monetary measures through open market operations.

3. Operation Twist: A program initiated by the U.S. Federal Reserve (Fed) to push down long-term rates by reinvesting the proceeds of selling short-term U.S. Treasuries in issues of longer maturity. By doing so, the Fed aims to stimulate the economy by lowering long-term borrowing costs by flattening the yield curve.

4. Outright Monetary Transactions: A European Central bank program, which enables them to purchase sovereign bonds issued by European member states in the secondary market.

5. Tail-risk: The risk of an outlier or improbable event occurring. Statistically, the event is said to be three standard deviations away from the mean under a normally distributed curve.

DIsclaimer:

The Dow Jones Industrial AverageSM is a product of Dow Jones Opco, LLC, (“Dow Jones Opco”), a subsidiary of S&P Dow Jones Indices LLC and has been licensed for use. “Dow Jones®” and “Dow Jones Industrial AverageSM” are service marks of Dow Jones Trademark Holdings, LLC (“Dow Jones”) and have been licensed to Dow Jones Opco for use for certain purposes. BMO ETFs based on Dow Jones indexes are not sponsored, endorsed, sold or promoted by Dow Jones Opco, Dow Jones or their respective affiliates, and Dow Jones Opco, Dow Jones and their respective affiliates make no representation regarding the advisability of trading in such product(s).

”S&P®” and “S&P 500®” are trade-marks of Standard and Poor’s Financial Services LLC and “TSX” is a trade-mark of TSX Inc. These and other associated trade-marks and/or service marks have been licensed for use by BMO Asset Management Inc. None of the BMO ETFs are sponsored, endorsed, sold or promoted by any of its aforementioned trade-mark owners and the related index providers or their respective affiliates or their third party licensors and these entities make no representation, warranty or condition regarding the advisability of buying, selling or holding units in the BMO ETFs.

Nasdaq®, OMX®, NASDAQ OMX®, Nasdaq-100®, and Nasdaq-100 Index®, are registered trademarks of The NASDAQ OMX Group, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by BMO Asset Management Inc. The BMO Nasdaq 100 Equity Hedged to CAD Index ETF has not been passed on by the Corporations as to its legality or suitability and is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO The BMO Nasdaq 100 Equity Hedged to CAD Index ETF.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager, and separate legal entity from Bank of Montreal.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. The indicated rates of return are the historical annual compound total returns including changes in prices and reinvestment of all distributions and do not take into account commission charges or income taxes payable by any unitholder that would have reduced returns. Please read the prospectus before investing. Exchange traded funds are not guaranteed, their value changes frequently and past performance may not be repeated. ® BMO (M-bar roundel symbol) is registered trade-marks of Bank of Montreal, used under licence.