January 3, 2013

by Ashish Shah, AllianceBernstein

Ashish Shah, Gershon Distenfeld and Ivan Rudolph-Shabinsky

When you’re shopping for a car, you take a look under the hood to see what makes the thing run. You also check out the car’s features: does it have heated seats, a rear-view camera, a GPS?

What goes for buying cars goes for investing in high-yield loans. As it turns out, not all loan features are what you’d call investor-friendly.

Recently, many investors have flocked to high-yield loans, assuming that floating-rate coupon payments will provide better insulation against rising interest rates than high-yield bonds will. Historically, though, this hasn’t been the case.

High-yield loans have a number of pitfalls, including “call” features, which allow loans to be repaid when it’s advantageous to the borrower. This can happen at any time after the loan is issued—sometimes as soon as it’s issued. When investors flocked to loans in early 2011, issuers took advantage by calling 15% of bonds in the market in half a year. Many high-yield bonds are callable, too, but usually not for years after they’ve been issued.

Promises, Promises

Then there are covenants, the promises investors demand from a firm before they’ll agree to lend it money. A covenant might require that a company limit additional borrowing, so that its total debt stays under a specific percentage of its equity. This helps ensure that a borrower will have the means to repay a loan.

Investors want more and stronger covenants; borrowers prefer them fewer and weaker. With investors desperate to buy high-yield loans lately, borrowers have had the upper hand. They can go light on covenants and still find willing lenders. According to estimates from Barclays Research, as much as 40% of high-yield loans issued today are “covenant light.”

The Quality Thing

Credit quality comes into play, too. A lot is made of the higher position of loans in the capital-structure pecking order, which may help loan investors recover more of their money in a default than bond investors could.

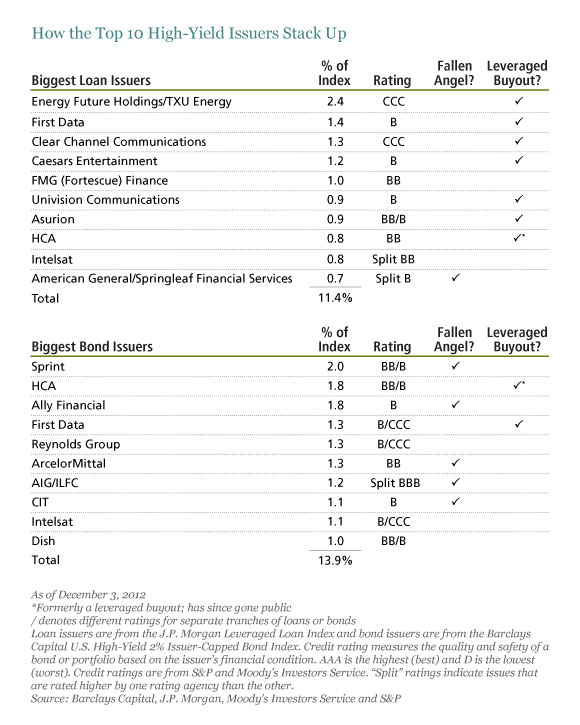

But by some measures, the loan market is of lower quality than the bond market, as seen in the display below. The three biggest high-yield bond issuers are fairly stable companies that were previously rated investment grade (known as “fallen angels”). Two of the top three loan issuers, by contrast, are lower-rated, and all three result from leveraged buyouts (LBOs). In fact, seven of the top 10 high-yield loan issuers today are from LBOs. That’s true for only two of the top 10 high-yield bond issuers.

The weaker overall credit quality and greater risk of default among loans may more than offset their capital-structure superiority. Think of it as being on the top step of a ladder when the floor is more likely to give way. Since there’s not much overlap between high-yield bond issuers and high-yield loan issuers, the quality differences between the markets are important.

Today, investors are overlooking many of the nicks and dents in high-yield loans. Loan performance has been generally strong in 2012, up about 10%, but not as strong as high-yield bond performance. Longer-term returns show a similar relationship: since the bottom of the credit crisis at the end of 2008, loans have returned 87% cumulatively, while bonds have returned 118%.

As for guarding against rising rates, some investors are looking at another possible solution: higher-quality, shorter-duration high-yield bonds. These bonds have historically shown less sensitivity to rate movements, without some of the structural drawbacks of high-yield loans.

When it comes to high-yield loans, we think it’s a good idea to be selective when investing, and consider high-yield loans as part of a more broadly diversified high-yield strategy.

It also makes a lot of sense to kick the tires before you buy.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. Past performance of the asset classes discussed in this article does not guarantee future results.

Ashish Shah is Director of Credit, Gershon Distenfeld is Director of High-Yield Debt and Ivan Rudolph-Shabinsky is Portfolio Manager—Credit, all at AllianceBernstein.