The new year has already greeted us with our first gift, with the markets taking off nicely to the upside on the first trading day of the year. For this weeks Equity Leaders Weekly, we are going to start the year off with a look at both the S&P 500 and the TSX Composite, to see where things currently stand and what we might expect going forward. With the SIA Asset Allocation Model continuing to have U.S. Equity in the #1 spot and Canadian Equity down in 5th spot, looking at these charts will help to reflect the Asset Allocation and our positioning.

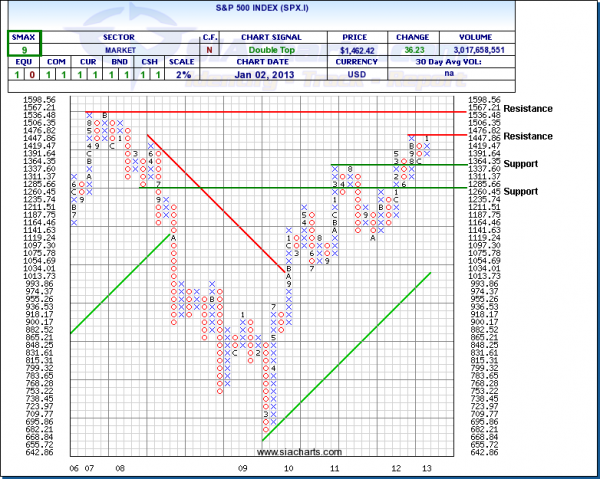

S&P 500 Index (SPX.I)

The chart to the right shows the SPX.I. With the run-up today, we have now seen a reversal back up to the overhead resistance level at 1476.82. Should we see some continued strength in the U.S. equity markets, then the high from back in 2007 may come into play at 1567.21.

To the downside, support remains at 1337.60 and again below that at 1260.45.

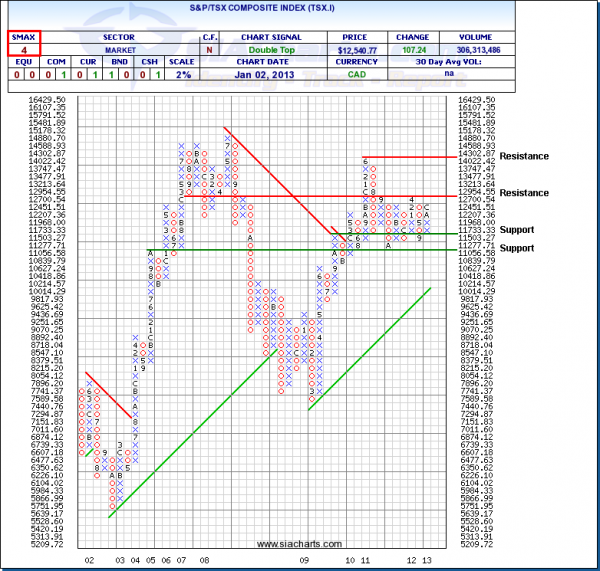

S&P/TSX Composite Index (TSX.I)

The second chart we are going to look at is the TSX.I. Looking to the right, we can see that the TSX has continued to stay towards the top end of the channel that it has been in for the past 16 months, between the top at 12954.55 and the bottom at 11056.58. With the TSX still needing several more percent just to get to the top end of that channel, there will definitely need to be some continued buying pressure in Canadian Equities for there to be a chance of the top of the channel breaking.

With the S&P continuing to be close to the high over the past couple of years and just a few percent off the high from 2007, we can see that the outperformance continues to come from U.S. Equity, as Canadian Equity continues to be mired in a channel and still well off the highs from 2011 and 2008.

Copyright © SIACharts.com