Upcoming US Events for Today:

- Current Account for the Third Quarter will be released at 8:30am.

- The Housing Market Index for December will be released at 10:00am. The market expects 47 versus 46 previous.

Upcoming International Events for Today:

- Great Britain Consumer Price Index for November will be released at 4:30am EST. The market expects a year-over-year increase of 2.6% versus 2.7% previous.

- Japan Merchandise Trade for November will be released at 6:50pm EST. The market expects Y-1010.0 B versus Y-549 B previous.

Recap of Yesterday’s Economic Events:

| Event | Actual | Forecast | Previous |

| Machine Tool Orders (YoY) | -21.30% | -20.70% | |

| EUR Euro-zone Trade Balance | 10.2B | 11.0B | 9.5B |

| EUR Euro-zone Trade Balance s.a. | 7.9B | 11.0B | 11.0B |

| USD Empire Manufacturing | -8.1 | -1 | -5.22 |

| USD Total Net TIC Flows | -$56.7B | $4.7B | |

| USD Net Long-term TIC Flows | $1.3B | $25.0B | $3.3B |

| CAD Existing Home Sales (MoM) | -1.70% | -0.10% |

The Markets

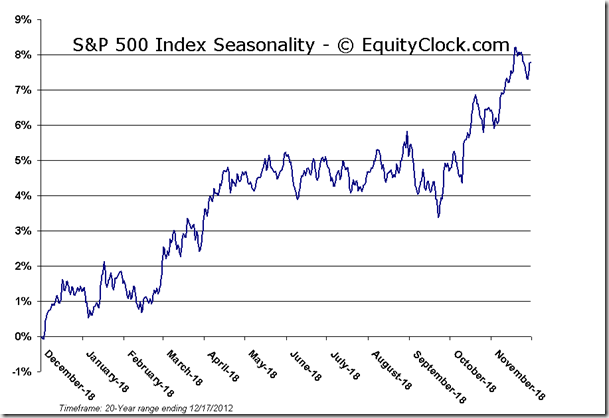

Markets ended strongly higher on Monday, buoyed by optimism that the two sides in the fiscal cliff negotiations were closing in on a deal. Both sides are showing progress in conceding to the sticking points of tax increases and spending cuts. The Dow Jones Industrial Average added 0.76%, the Nasdaq Composite gained 1.32%, and the S&P 500 returned 1.19%. This was the 27th session this year of gains for the S&P 500 exceeding 1%.

As stocks drifted higher, bond prices slipped lower, pushing the yield on the 10-year note above its 200-day moving average for the fifth time this year. Each short-term break above this significant moving average has been rejected as investors remain reluctant to lessen their grasp on these fixed income assets. A follow through of the positive move in yields beyond the 200-day moving average and above resistance around 1.9% would be significantly bullish for risk assets as it would begin to suggest that investors are becoming less risk averse, potentially leading to the long awaited correction in bond prices after the tremendous bull market run in just the last two years. The 10-year treasury yield recently charted a double bottom pattern combined with positive momentum divergences, signaling a positive move ahead. Bond yields and stock prices have diverged significantly over the past two years, leading many to speculate that the two will eventually converge.

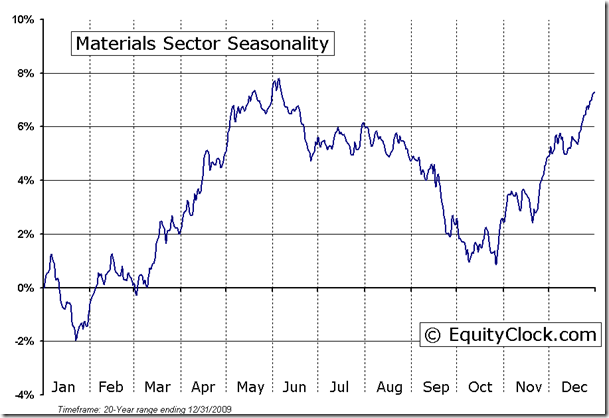

Last week, reverse head-and-shoulders patterns for some of the broad market indices were identified, including for the S&P 500 and Nasdaq Composite. Add to the list the materials sector, which appears to have completed the right shoulder of the bullish setup. Target on a breakout above the neckline of 37 is to $39.50, or almost 7% higher than Monday’s closing values. The materials sector remains seasonally positive through to May, albeit caution is warranted in the month of January. Improving manufacturing and industrial production in the US fuel the gains in the sector over the period of seasonal strength.

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.71. As equity prices pushed strongly higher on Monday, so to did call volumes relative to puts. The significant decline in the put-call ratio hints of complacency, especially in the midst of extreme uncertainty as it relates to fiscal cliff negotiations. As always during periods of complacency, the risk is that a shock event shakes investors loose of recently acquired equity positions, leading to a swift market selloff.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

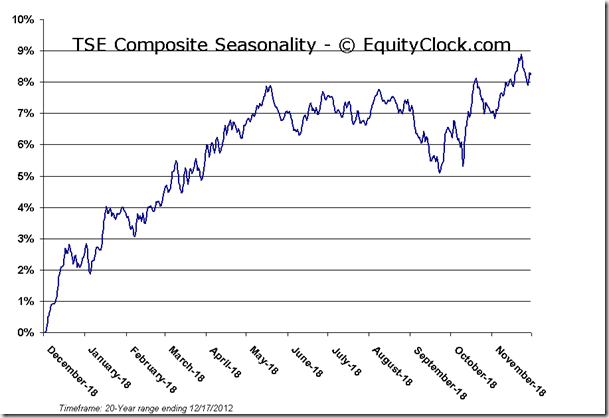

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.70 (up 0.79%)

- Closing NAV/Unit: $12.70 (up 0.70%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 4.28% | 27.0% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.