by Don Vialoux, TechTalk

Upcoming US Events for Today:

- Empire State Manufacturing Index for December will be released at 8:30am. The market expects 0.0 versus –5.22 previous.

- Treasury International Capital for October will be released ay 9:00am.

Upcoming International Events for Today:

- Euro-Zone Merchandise Trade for October will be released at 5:00am EST. The market expects 9.9B versus 11.3B previous.

Recap of Friday’s Economic Events:

| Event | Actual | Forecast | Previous |

| CNY HSBC Flash Manufacturing PMI | 50.9 | 50.8 | 50.5 |

| NZD Non Resident Bond Holdings | 62.70% | 62.40% | |

| JPY Industrial Production (MoM) | 1.60% | 1.80% | |

| JPY Industrial Production (YoY) | -4.50% | -4.30% | |

| JPY Capacity Utilization (MoM) | 1.60% | -5.50% | |

| EUR France PMI Manufacturing | 44.6 | 44.9 | 44.5 |

| EUR France PMI Services | 46 | 46 | 45.8 |

| EUR Germany PMI Manufacturing | 46.3 | 47.3 | 46.8 |

| EUR Germany PMI Services | 52.1 | 50 | 49.7 |

| EUR Euro-Zone PMI Manufacturing | 46.3 | 46.6 | 46.2 |

| EUR Euro-Zone PMI Services | 47.8 | 47 | 46.7 |

| EUR Euro-Zone PMI Composite | 47.3 | 46.9 | 46.5 |

| EUR Euro-zone Employment (QoQ) | -0.20% | 0.00% | |

| EUR Euro-zone Employment (YoY) | -0.70% | -0.70% | |

| EUR Euro-zone Consumer Price Index – Core (YoY) | 1.40% | 1.50% | 1.50% |

| EUR Euro-zone Consumer Price Index (MoM) | -0.20% | -0.20% | 0.20% |

| EUR Euro-zone Consumer Price Index (YoY) | 2.20% | 2.20% | 2.20% |

| CAD Manufacturing Shipments (MoM) | -1.40% | -0.10% | 0.00% |

| USD Consumer Price Index (MoM) | -0.30% | -0.20% | 0.10% |

| USD Consumer Price Index Ex Food & Energy (MoM) | 0.10% | 0.20% | 0.20% |

| USD Consumer Price Index (YoY) | 1.80% | 1.90% | 2.20% |

| USD Consumer Price Index Ex Food & Energy (YoY) | 1.90% | 2.00% | 2.00% |

| USD Consumer Price Index n.s.a. | 230.221 | 230.334 | 231.317 |

| USD Consumer Price Index Core Index s.a. | 231.254 | 230.994 | |

| USD Markit US PMI Preliminary | 52.4 | 51.8 | 52.4 |

| USD Industrial Production | 1.10% | 0.30% | -0.70% |

| USD Capacity Utilization | 78.40% | 78.00% | 77.70% |

| USD Manufacturing (SIC) Production | 1.10% | 0.50% | -1.00% |

The Markets

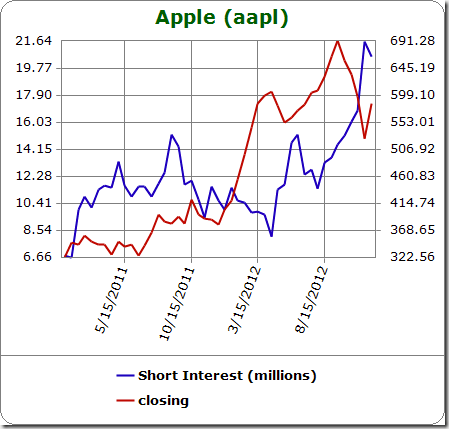

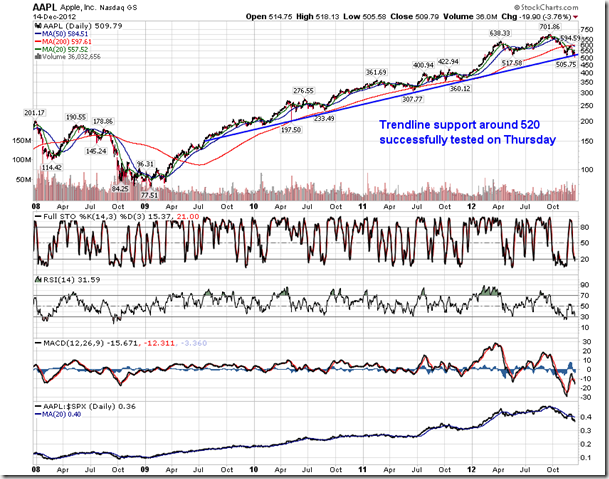

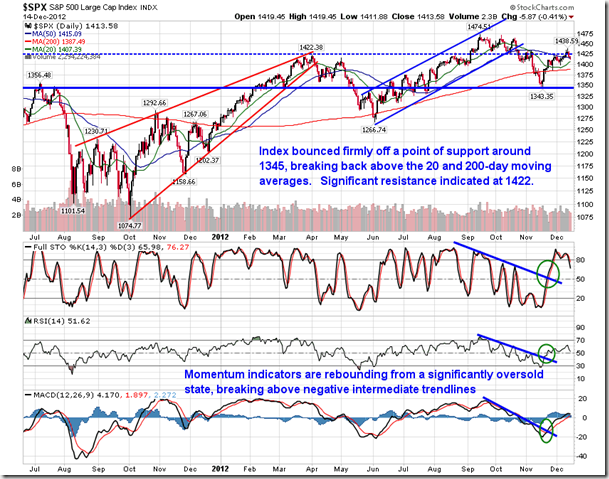

Equity markets ended last week on a negative note as investors continued to sell the strength attributed to the announcement of the latest accommodative monetary policy from the US Fed and focus once again on fiscal cliff negotiations. For the week, the S&P 500 ended lower by 0.32%, the Dow Jones Industrial Average ended down by 0.15%, and the Nasdaq Composite shed 0.23%. Despite the tremendous uncertainties pertaining to the fiscal cliff and all of the seemingly dire forecasts should a resolution not be met, equity markets continue to shrug off the event. Investors remain unwilling to place any significant positive or negative bets without further clarity. Congressional leaders are expected to work right up until Christmas Eve in order to hammer out a deal, but fund managers are likely to start taking vacation time and winding down portfolio positions this week ahead of the end of the year. Should no agreement to the fiscal cliff be achieved, investors are likely to neutralize portfolios ahead of their holidays, including peeling back on short positions in order to avoid a detrimental impact should the market move strongly higher in the remaining weeks of the year. One of the stocks that has dominated market action and is a favourite among money managers is Apple. Short interest in the tech titan has spiked since the end of summer as investors make aggressive bets of a decline in shares of this previously loved stock. A short-covering rally has a high probability of benefiting the stock as we near closer to the holiday season. Apple has been holding around its long-term rising trendline for the past few weeks, correcting a bubble-like move from earlier in the year. Should this level be broken, look for horizontal support in the range of 425 to 450, which would close a significant gap from earlier in the year. Investors are not likely to place negative bets on the stock ahead of earnings on January 22, therefore a rebound of some magnitude may be right around the corner. Seasonal tendencies for the stock remain strongly positive into January. Gains between now and January 14 average 9.55%.

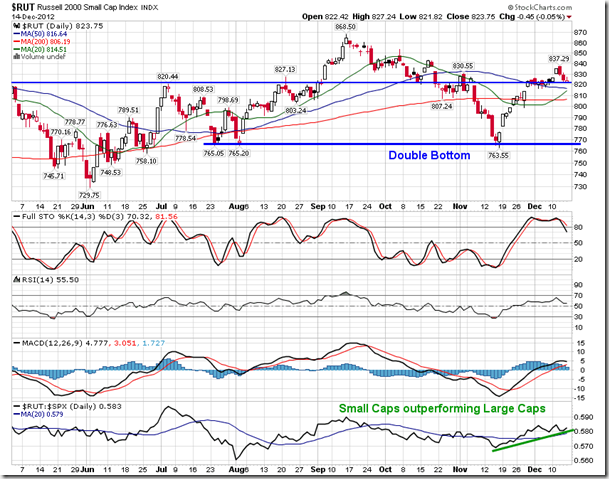

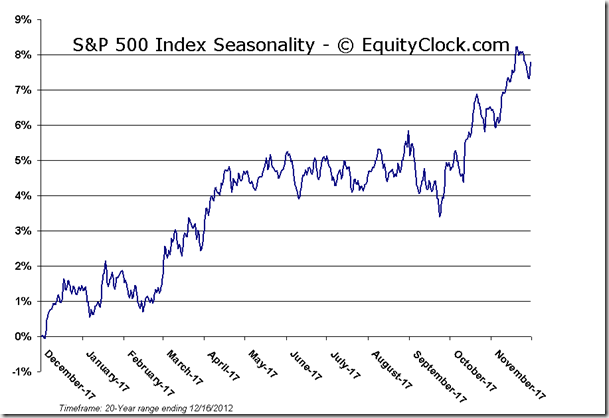

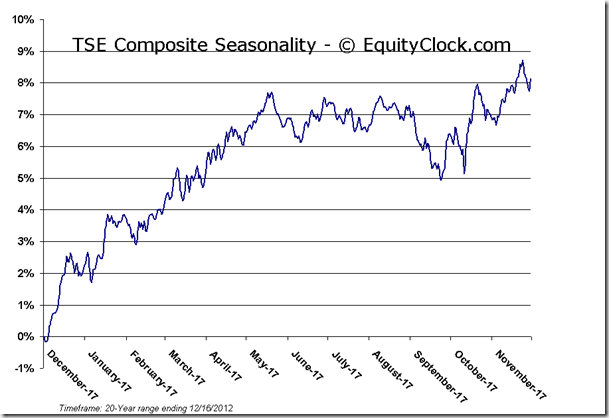

With around two weeks remaining in the year, we have now entered the Santa Claus rally period in which stocks typically drift higher on lower volumes surrounding the Christmas holidays. Gains for the S&P 500 average 1.44% between now and year-end, while the Nasdaq Composite and Russell 2000 Small Cap index average 2.01% and 3.34%, respectively. Albeit extreme fundamental uncertainties remain, equity markets are setting up quite well for a Santa rally again this year. Risk sentiment continues to improve, equity benchmarks are trading above major moving averages, and momentum continues to show positive results, each of which suggest a continuation to the short-term positive trend that began mid-November.

Taking a look at some of the gauges of risk sentiment, all are showing positive relative activity. The semiconductor industry is outperforming the S&P 500, despite the extreme negative pressure that Apple in imposing on the Technology sector. Higher beta small-cap stocks are outperforming large-cap stocks. Even in the commodity market risk sentiment is emerging as copper outperforms the CRB commodity index, while safe-haven Gold shows neutral relative performance. And in the bond market, high yield bonds are outperforming corporate bonds. Each of these are key gauges of risk that investors tend to flock to in order to add beta to portfolios and benefit from bull market conditions. Improving risk sentiment is supportive of higher stock prices.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.89.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.60 (down 0.47%)

- Closing NAV/Unit: $12.61 (down 0.04%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 3.55% | 26.1% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.

Copyright © TechTalk