Economic and Market Update

Will The Fed Lose Its Best Friend?

by James Paulsen, Wells Capital Management (Wells Fargo)

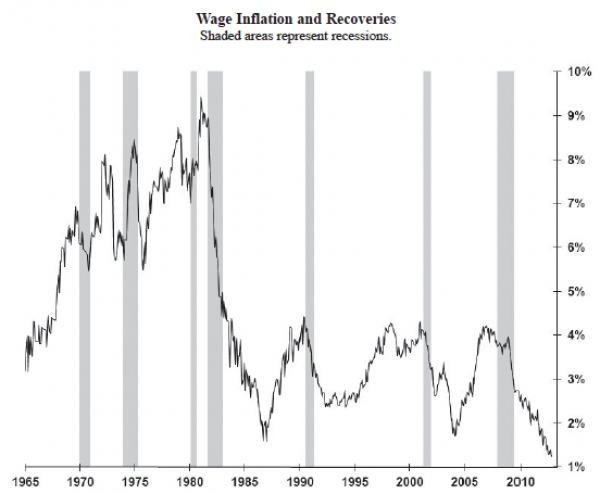

It’s Fed day! By most accounts, the Federal Reserve will announce an additional round of QE (Quantitative Easing) today replacing its expiring OT (Operation Twist) program. Throughout this economic recovery, the Fed’s unconventional and massively accommodative monetary actions have been chronically supported by decelerating wage inflation. Although Fed critics have occasionally been bolstered by a steady rise in the price of gold and by some intermittent surges in commodity prices, without any evidence of a mounting wage-price spiral, the Fed has maintained a mandate to “ease”! How long though will wages remain the Fed’s best friend? Indeed, the accompanying chart suggests wage inflation may soon become the Fed’s worst enemy.

During the 1970s, annual wage inflation responded quickly once an economic recovery began. Irrespective of how high the unemployment rate was (e.g., it was 6 percent in 1970, 9 percent in 1975, and 7.8 percent in 1980), annual wage inflation accelerated nearly simultaneously with the start of a recovery. In the 1970s, instantaneously rising wage pressures gave the Fed little leeway to respond to high unemployment during recoveries. For example, wage inflation rose back above 7 percent in 1976 even though the unemployment rate remained near 8 percent.

The nature of wage cycles has changed abruptly since the 1982 recession. This is the fourth recovery in a row where wage inflation has decelerated well into an economic recovery. The 1982 recession ended in November 1982 but annual wage inflation did not bottom until December 1986 (when the unemployment rate was 6.6 percent). Similarly, the early-1990s recession ended in March 1991 and wage inflation did not rise again until February 1995. Finally, while the early-2000s recovery began in November 2001, wage inflation did not begin to rise again until March 2004. In the last 30 years, wage inflation has not risen again until the recovery is anywhere from about two and one half years old (2001 recovery) to about four years old (both the 1980s and 1990s recoveries).

The current recovery is about three and one half years old and wage inflation has yet to rise providing comfort to the Fed that monetary policy still has ample time to eventually adjust its accommodative posture before it creates inflationary challenges. However, if the last 30 years is any guide, this carefree window may be closing much sooner than widely anticipated.

Many believe the continued deceleration of wage inflation in this recovery is a unique event tied to the severity of the 2008 recession and to the still elevated 7.7 percent unemployment rate. However, the behavior of wages in the contemporary recovery is certainly not unique. Rather, wage inflation is following its pattern of the last three recoveries quite closely. If wages continue to respond as they have in the last 30 years, labor inflation will likely begin to rise again sometime in 2013.

Currently, the Fed’s “crisis-like” monetary policy (i.e., zero interest rates, a massive expansion of its balance sheet with alternative asset purchases, and a multi-year low rate guarantee) may appear entirely appropriate with a cultural mindset which is still suffering from crisis shock, with a still high 7.7 percent unemployment rate and with declining wage inflation. However, investors may want to ponder how “out of line” the current Fed policy may appear should the unemployment rate continue a decline towards 7-ish percent this year and wage inflation surprisingly begins to rise. Could the Fed lose its mandate (falling wage inflation) much sooner (i.e., in 2013) than most can imagine?

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000. WELLS CAPITAL MANAGEMENT® is a registered service mark of Wells Capital Management, Inc.

Copyright © Wells Capital Management