Via Michael Naso of FBN Securities,

The S&P 500 achieved its anticipated 4-5% bounce off the recent 7-10% pullback, most of it accomplished in a very light holiday trading week. Much of the gains were attributed to overly effusive optimism over the prospects of resolving the fiscal cliff. Ironically, with Washington abandoned the past ten days for Thanksgiving, we have not heard anything substantive on the negotiations since Senator Reid and Speaker Boehner spoke jointly on the White House Lawn on November 16.

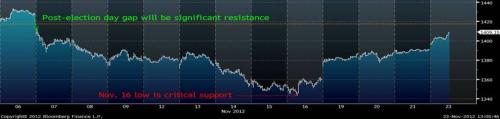

The returns in equities that resulted from this perceived positive outlook has likely run its course as the blue chip index has regained the levels from the morning after the Election.

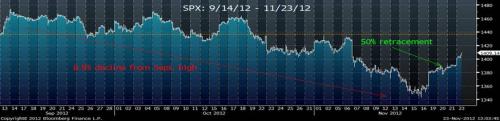

The average monthly NYSE TICK never did reach deeply oversold territory and subsequently has bounced to a neutral +188. With the exception of the August, 2010 pullback, which was too short in duration to trigger a signal (i.e. < +60), this statistic has corresponded with every major bottom since the March, 2009 trough. Modest snapbacks achieved without a confirmation of extremely negative sentiment do not have much durability beyond the short covering that results from funds lifting hedges out of fear of being left behind. Moreover, the S&P 500’s 50% retracement of the selloff from mid-September offers a natural point of resistance such that I expect little extension of this recent move.

Certainly, the mundane increases in open interest for the futures and the outperformance by the blue chips versus smaller capitalization names on a beta adjusted basis hint at such vacuous motivation for the upward move. Consequently, as the week progresses, I would sell into any strength that arises, for the downward inertia should accelerate as the “theta” to the risk premium associated with the fiscal crisis will rise daily in the absence of a compromise.

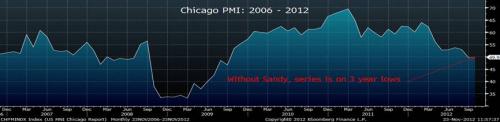

Although an agreement among EU leaders to release the next tranche on Greek debt may fuel some additional moderate gains, investors soon will demand real progress from both sides of the Washington debate if they are to continue purchasing shares in light of data that cannot rise above the muck in Europe and is sullied by Sandy in the U.S. Most notably, analysts currently anticipate a sub-100K print for Nonfarm Payrolls late next week with my Quick and Dirty model currently estimating a sobering and disappointing +63K. The calendar remains fairly light over the next several days with Friday’s month end reading of the Chicago PMI supplying the biggest highlight.

We also receive the Beige Book on Wednesday; however, the Fed seems resigned to replace the expiring Operation Twist program with $45B additional unsterilized bond purchases regardless of the presented state of the economy. I also will pay close attention to Consumer Confidence, released earlier that morning, for it offers an important gauge of the temperature for holiday season retail. With this month’s revision to the University of Michigan figures producing the biggest drop since the height of the financial crisis in 2008, a similar downbeat reading could foreshadow a shopping community concerned about the overall strength of the recovery and how their finances will be impacted in the face of escalating health care costs and the possibility that Congress and the President takes them over the fiscal cliff.

Copyright © FBN Securities