For this week's edition of the SIA Equity Leaders Weekly we are going to revisit the S&P 500 and the TSX Composite to see if things have changed with all of the recent market activity.

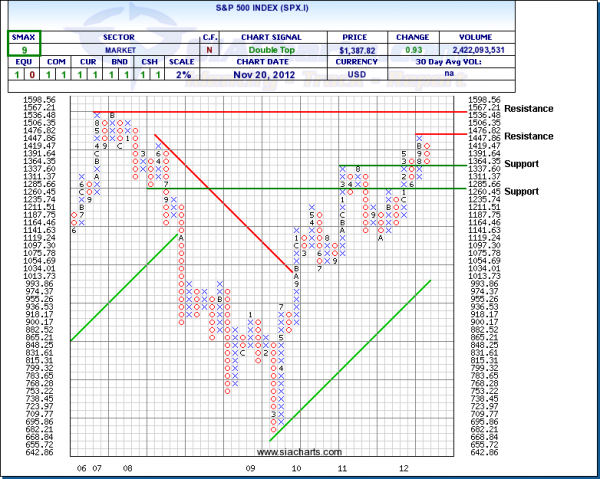

S&P 500 Index (SPX.I)

Looking at the chart to the right we can that the S&P 500, after moving up to new multi-year highs, has now reversed course and has moved back down to its first support level at 1337.60. Should this downward move continue, the next support level is at 1260.45. Overhead resistance is up at the high for the year at 1476.82 and again above that at 1567.21, the high from back in 2007.

The SPX.I continues to show short term strength against the other asset classes, with an SMAX of 9.

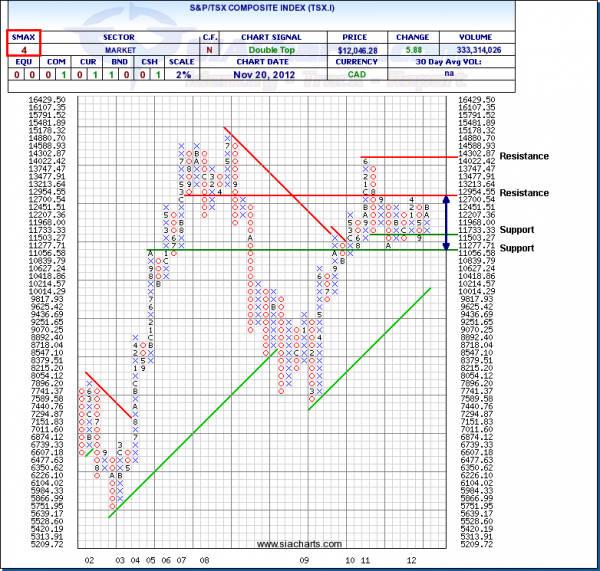

S&P/TSX Composite (TSX.I)

Not much has changed since we last looked at the TSX.I, with the Index still stuck in the channel it has been in for 15 months now between resistance overhead at 12954.55 and support down at 11056.58. Should the TSX start to exhibit some signs of strength, the next resistance level outside the channel is at 14302.87, corresponding with the high from back in 2010.

The TSX.I continues to show short term weakness against the other asset classes with an SMAX of 4.

Important Disclaimer

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Copyright © siacharts.com