Below is David Rosenberg's take on the current oversold market rip squeeze fest, and where we go from here:

Oversold equity markets are recovering to start off the week and defensive plays like core government bond markets are seeing some profit-taking in the process. US fiscal policymakers said all the right things at Friday's 70 minute meeting and investors are taking solace from early prospects that we won't fall off the cliff (President Obama said in an interview overnight in Bangkok that "I am confident we can get our fiscal situation dealt with"). Platitudes matter in a market seemingly on tenterhooks. Gifts matter too. The President gave John Boehner a bottle of Brunello di Montalcino as an early birthday present is a classic display of the horse trading that will take place to bring a short-term deal to fruition (see page 4 of today's FT). Mr Boehner would be well advised to split the vino with his GOP backbenchers who don't seem to share the President's view that he has a strong mandate to pursue higher top marginal tax rates on income and capital. Either way, austerity is coming our way, it's just a matter in what manner and by how much, and whether it becomes an orderly or disorderly process. The fiscal cliff is really a bit of a ruse in that respect, but the key here is that years of fiscal profligacy is coming to an end and the Fed at this point, having used its bazookas, is now down to firecrackers. The economic outlook as such is completely muddled and along with that the prospect for any turnaround in corporate earnings.

In the near-term, investors don't seem to be in a mood to take any chances in terms of facing a higher tax bite on their winnings— see Investors Rush to Beat Threat of Higher Taxes: Weighing on Markets on the front page of today's NYT (if left unchecked, the top rate on dividends will jump to 39.6% from 15% and capital gains go to 20% from 15%. And there is the additional 3.8% surcharge on most forms of investment income to help defray the costs of Obamacare). While we continue to favour income-equity, utilities are down 9.4% from the October highs and the telecom sector is down closer to 11%, so at the margin, there does seem to have been some effects from the expected tax shifts (ordinarily, these sectors would be outperforming based on the decline in bond yields over the past month, but this time around they have just performed in line with the market).

Moreover, the dividend-payers may have, at least for a short while, become victims of their own success as the S&P Dividend Aristocrats index, for example, hit an all-time high last month and have generated a net 164% return from the March 2009 lows and that compared to +117% for the overall market. The average yield in the investment grade corporate bond space, another area we have favoured, has been cut in half to 2.7% and have generated a decent 10% return year-to-date. There is a great article on page 8 of the FT today on the interest rate outlook and the most insightful comment came from the CIO of BlackRock (Rick Rieder), who said:

We have never seen in history the population ageing and living longer in such a fashion, not just in the U.S. but around the world, and that raises the question of how high growth can go.... we are in the midst of a major defeveraging in the entire developed world, which is going to continue in 2013 and 2014.

That led the writers of the column to conclude, rightfully in my view, that we are in for a "world of slow growth where demand for secure debt outstrips supply and keeps rates low for the foreseeable future." A portfolio manager at PIMCO (Mark Kiesel) also claims this (and I wouldn't argue the point, either):

If you look at the past 10 years, corporate bonds have had a higher return than equities with a third of the volatility investors are looking at earning 4-6 per cent from a diversified portfolio of corporate bonds and that's roughly what you will get from owning equities based on the outlook for earnings and the economy.

The direction and level of interest rates are much more important for income-equity than tax changes are— history is clear about that, despite the near-term disruption. At the same time, disinflation, a very accommodative Fed, superb corporate balance sheet fundamentals and tremendous liquidity all suggest that credit spread strategies will offer superior returns in the future, especially relative to cash which the Fed has already told you is going to be a losing strategy for the next three years in real after-tax terms.

One word we liked above is "diversification" which is more essential in a fat-tailed world where the range of outcomes is extremely wide compared to cycles in the past when the distribution curve was far thinner than is the case today. The more we are out of our comfort zone. the greater the need to have a diversified portfolio. And within that, the combination of disinflation, deleveraging and demographics — the market outlook in 3D — augurs for exposure to income strategies across the various asset classes. Cash flow is king in this sustained 0% short-term interest rate environment. If you like Treasuries, the price for safety is a lack of yield (though potential for capital gain), but the article on page C2 of today's WSJ reaffirms my view that we are potentially in for even lower yield activity ahead (see A Year-End Migration to Treasuries), which when all is said and done, will make corporate bonds and other spread product appear that much more alluring from a relative coupon perspective.

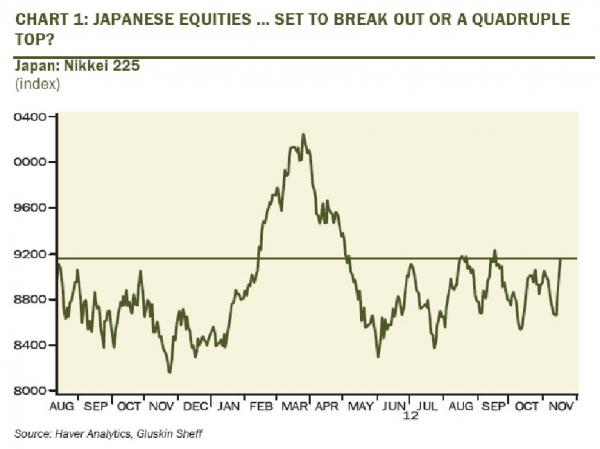

Meanwhile, in addition to eased fears over the fiscal cliff, there is some hope that a Cairo-led cease fire will occur in the Israel-Gaza flare-up and there is additional hope that the upcoming meeting among Eurozone financial officials will resolve the current spat with the IMF over Greece's debt targets. So with investor risk appetite whetted a bit, we have the European stock markets up more than 1%. Asia was up as well but by less, but the real hidden gem yet again was Japan with a 1.4% gain and this followed the 3% advance last week as other markets declined substantially. Japan is operating on its own set of dynamics and the fact that the yen has managed to embark on a weakening path is highly constructive for the country's large-cap exporters. The election on December 16th promises to usher in even more dramatic moves to weaken the yen and stimulate monetary policy — including a move to lift the BOJ's inflation target from 1% to 3%. As an aside, U.S. dollar/yen at 82 is widely viewed as the cut-off level for profitability among Japanese industrial companies — we are just about there. Domo!

In other markets, we see the U.S. dollar struggling as it tests the 100-day moving average. Gold is bid. The commodity-based currencies are faring better as well, as is sterling on the back of some better home price data that were released earlier today. If we do see some sort of market revival in the near-term, the one sector to keep an eye on is technology which has faltered significantly and badly lagged the old-economy machinery stocks during the recent setback (see Tech Sets Correction Course on page C1 of today's WSJ). Tech has slipped now for six weeks in a row, which is a strength we have not seen since 2008 (in addition to Apple, we have seen the likes of Google, IBM, Intel, and Dell all disappoint during the latest earnings reporting season). Margins have been squeezed and are now down to the lowest level in over two years (17% from 19% a year ago). No doubt earnings expectations are being trimmed — the flip-side of sitting on so much cash is reduced growth prospects — but the next question is the extent to which a bleak future is already more than priced in. After all, how many times in the past has the tech sector traded at a P/E discount (11.7x on year-out earnings forecasts) to the overall market (12.5x)?

One last word here on the fiscal cliff. Once we get past that issue, we will confront the inherent inability of the Democrats and the GOP to embark on any grand bargain to blaze the trail for true fiscal reforms. The U.S. has not had a rewrite of its tax code since 1986, which was the year Microsoft went public and a decade prior to Al Gore's invention of the Internet. The tax system is massively inefficient and leads to a gross misallocation of resources that impedes economic progress — rewarding conspicuous consumption at the expense of savings and investment. It is the lingering uncertainty over the road to meaningful fiscal reform that is really the mot cause of the angst — the fiscal cliff is really a side show because who doesn't know that we are going to have a Khrushchev moment?

Everyone at the White House and Congress is well versed about 1937-38. But it is what happens next that matters most for those that have to plan for the long-term — not just tax shifts around an end-of-year calendar date. To this end, have a look at the WSJ front page article today — Investment Fails off a Cliff: US Companies Cut Spending Plans Amid Fiscal and Economic Uncertainty. So I have some news for you: avoiding the fiscal cliff allows a very short window to catch a breath of relief. CEOs realize that averting the fiscal cliff will likely mean a quid pro quo for a slate of tax-code changes in the future and nobody is going to know for a long time how those changes are going to affect them. This is the exact opposite of what we had on our hands in 1980 when Ronald Reagan provided a framework of fiscal reform that ushered in sharply lower marginal tax rates, pledged to work with a Democratic House that was populated with "Reagan Democrats"... do "Obama Republicans" exist?), and the certainty and clarity over the fiscal policy roadmap the President ushered in was so powerful that this alone allowed the recovery and bull market to take hold fully four years before the tax shifts were legislated. This is how vital it is for the government to part the fiscal clouds as soon as possible — avoiding the fiscal cliff does not assure that.

What the country needs is a credible long-term fiscal plan. Only then will capital investment embark on a sustainable uptrend and take the rest of the economy with it. An economy reliant on such an unproductive asset as housing for its prosperity is not that comforting for those of us who believe that what provides a much more enduring IR is renewed growth in the nation's productive private sector capital stock. That begins with business spending.

In a U.S. holiday-shortened week (Happy Thanksgiving!), the noise around the fiscal cliff will take a back seat to an array of housing indicators, Bernanke's sermon tomorrow at the Economics Club of New York (12:15 PM) on the economy and how Black Friday (Thursday?) shopping goes. In Canada, Finance Minister Flaherty talks about the Canadian economic outlook at the Toronto Board of Trade on Thursday at 11:30 AM (as our American friends get ready for a day of Turkey, pumpkin pie and some NFL).