Upcoming US Events for Today:

- Industrial Production for October will be released at 9:15am. The market expects a month-over-month increase of 0.2% versus 0.4% previous. Capacity Utilization is expected to show 78.4% versus 78.3% previous.

Upcoming International Events for Today:

- Euro-Zone Merchandise Trade for September will be released at 5:00am EST. The market expects 8.5B versus 9.9B previous.

The Markets

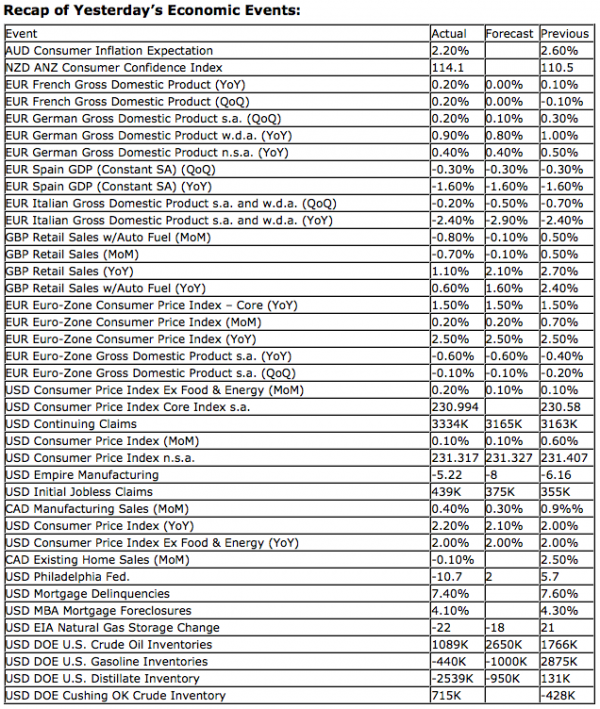

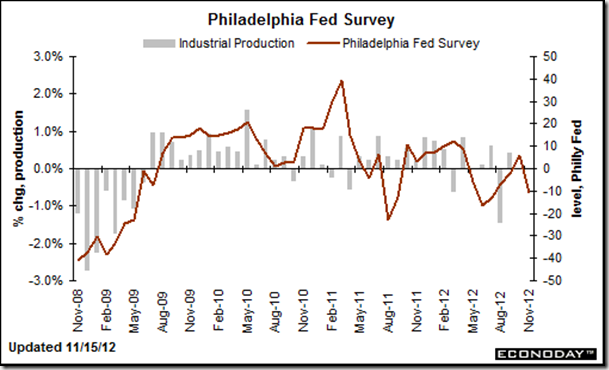

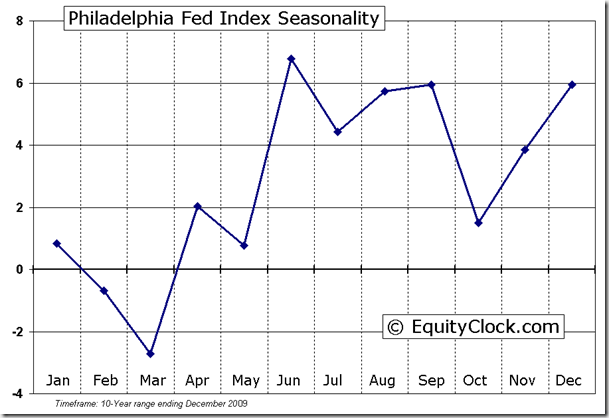

And the market selloff continues. In addition to the fiscal cliff worries, investors battled with weak economic numbers on Thursday as impacts of Hurricane Sandy and slowing global growth become realized. Initial Jobless Claims surged by 78,000 in a surprise jump as residents affected by the east coast hurricane filed for employment insurance due to being unable to work. The initial claims number of 439K is the highest since May of 2011 when struggling economic data following the earthquake in Japan caused a spike in temporary layoffs, particularly in the automobile industry. In addition to the hit on employment, manufacturing was also impacted. The Philly Fed index shocked analysts by reporting a 16 point drop to –10.7 as New Jersey, which is included in the results, realized an average of 2.2 days of lost business activity. Seasonally, manufacturing typically rebounds into the end of the year, coming off of the summer lows, but impacts from Sandy and hesitation amongst businesses ahead of the fiscal cliff threaten this pickup in economic activity.

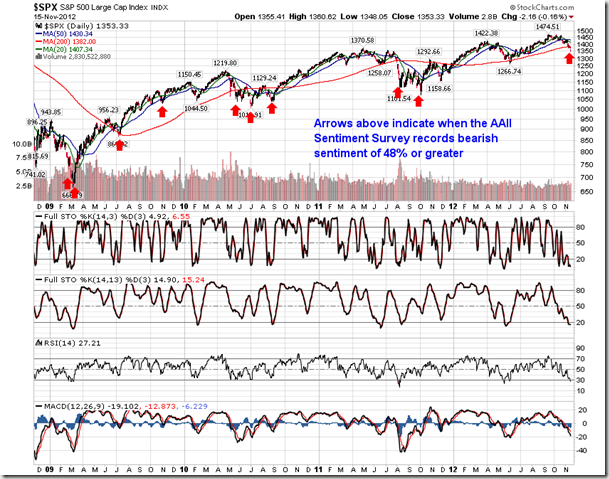

Equity markets remain severely oversold with many indicators becoming the most stretched to the downside since the beginning of June, just prior to the summer rally. Given the oversold extremes, the probability increases that next week’s holiday trade will be successful. Of course Thursday is the US Thanksgiving and markets typically rise on lower volumes during the session prior and the session following the holiday. Thackray’s Investor’s Guide notes that “the day before Thanksgiving and the day after have had an average cumulative return [for the S&P 500] of 0.8% and together have been positive 85% of the time.” Strongly positive seasonal tendencies continue through the end of the month as holiday spending kicks into high gear. The positive effect could be realized as early as the start of next week as investors start taking time off for the holiday and bearish bets slow during the low volume period.

Today is options expiration day, which should help alleviate some of the volatility that the markets have realized over the past week. Seasonally the markets are known to struggle during this November options expiration period, which fuels returns during the following week as markets rebound from what is typically a short-term low. Gains for the S&P 500 index following this week from November 20th through December 6th have averaged just over 2.2% over the last 20-years as a lucrative holiday trade rotates into a profitable month-end.

We’ve talked a bit about some of the extremes that the market has realized over the past few trading days, becoming the most oversold since June of this year, an event that typically coincides with market bottoms, at least in the short-term. Sentiment is also reaching an extreme. According to the American Association of Individual Investors Sentiment Survey for the week ended November 14, bearish sentiment has hit the highest level since August of 2011. Currently, 48.8% of investors declare themselves bearish, while only 28.8% are bullish. The long-term average has pegged bullish investors at 39% and bearish investors at 30%. When bearish sentiment reaches extremes of 48% or greater, equity market gains have been known to follow. The chart below indicates these points when investor pessimism reaches a peak.

Sentiment on Thursday, according to the put-call ratio, ended overly bearish at 1.24.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $11.92 (down 1.41%)

- Closing NAV/Unit: $11.98 (down 0.43%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | -1.63% | 19.8% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.