October 30, 2012

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

Key points

- Business confidence and spending have come to a stand-still, while consumers are feeling better and spending more … what gives?

- The election generally—and the "fiscal cliff" specifically—appear to be keeping corporate investment sidelined.

- However, many of the uncertainties most vexing to businesses are set to fade in the near term.

An interesting dichotomy has developed over the past several months between consumer and business confidence, the former moving up sharply and the latter taking a bit of a dive. Businesses across the spectrum of sectors and industries have been pulling back on investment in everything from software and equipment to office space, and expressing their concerns in a variety of confidence surveys.

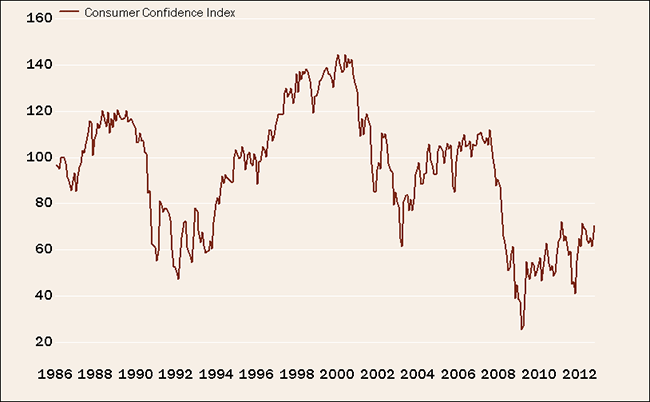

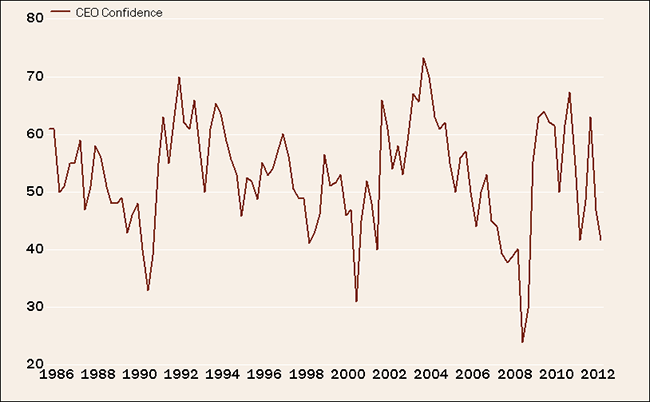

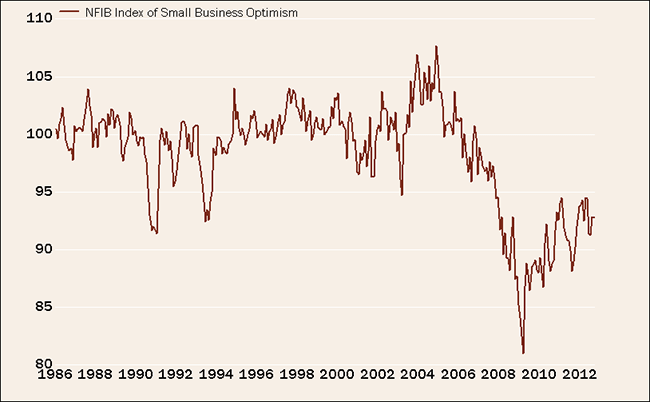

You can see three key surveys of sentiment/confidence below: the first showing consumer confidence, the second CEO confidence (a survey biased toward larger companies) and the third showing small-business confidence. The latter has not taken as big a hit as the CEO survey, but do notice that confidence remains quite weak by historical standards.

Consumers Cheer While Businesses Jeer

Source: The Conference Board, FactSet, as of September 30, 2012.

Source: FactSet, National Federation of Independent Business (NFIB), as of September 30, 2012.

What's on their minds?

Top of mind are the upcoming election and the "fiscal cliff" at year-end, specifically worries about how our politicians will settle what's become a stand-off over spending cuts and taxes, not to mention entitlement reform. Many suggest that consumers are simply whistling past the graveyard regarding the fiscal cliff, but we think their rising confidence has less to do with the fiscal cliff and more to do with the fall in gasoline prices, the strength in the stock market (notwithstanding the shallow pullback recently) and the improvement in housing. All three have historically tracked very closely with consumer confidence and sentiment. And, frankly, there are many consumers who are not even aware of the fiscal cliff.

This divergence was clearly evident within the recently released third-quarter gross domestic product report. The 2.0% real GDP growth rate was nothing to cheer in an absolute sense, but it was a bit higher than expected and would have been closer to 2.7% were it not for the drought in the Midwest. However, the fact that government spending was also a large positive contributor is troubling.

In general, consumer-oriented components of GDP showed nice gains, including the auto, recreation, furniture and housing categories. For housing, it was yet another huge surge, with a contribution of more than 14% from residential investment alone. Remember, the two largest components of US household net worth are housing and stocks, and both have made notable turns for the better in recent quarters.

However, among businesses the situation was grimmer. After surging at an 18% annual rate in the third quarter of 2011, investment in equipment and software was flat in this year's third quarter, and some economists are expecting business investment to post a decline in this year's fourth quarter thanks to ongoing uncertainty about the fiscal cliff. Weak third-quarter earnings have been a tie-in to this malaise as well, and earnings of multi-national/export-oriented companies have been hardest hit.

Tax/regulatory uncertainty trumps demand

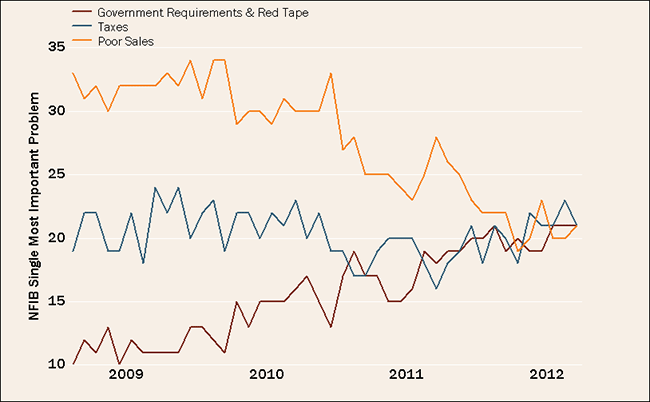

One of the questions in the small-business confidence survey mentioned above asks respondents what's plaguing them most. As you can see in the chart below, concerns about sales/demand have actually come down meaningfully over the past year or two, and joining that as the top reason for concern is uncertainty regarding the combination of tax and regulatory policy.

Sales No Longer Businesses' Top Concern

Source: FactSet, National Federation of Independent Business (NFIB), as of September 30, 2012. Chart represents question posed in the NFIB Small Business Optimism Survey, which is based on the responses of 740 randomly sampled small businesses in NFIB's membership, survey monthly.

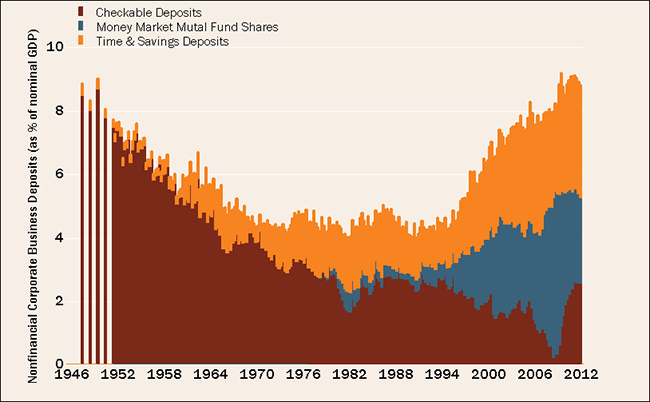

As a result of this plague of uncertainty, businesses are hoarding a nearly unprecedented stash of cash, as you can see in the chart below. Not since World War II have companies held this much excess liquidity; and as reminder, this cash is earning a yield of next-to-nothing. And of course, hiring trends remain much weaker than is typical at this stage in the business cycle.

Corporate Cash Mountain at WWII Levels

Source: FactSet, Federal Reserve, as of June 30, 2012.

We're getting there

I do believe this stand-down by business will not be long-lasting. Corporate balance sheets are in excellent shape and there are signs that global growth (even in the eurozone) may have reached an inflection point, even if still weak in an absolute sense. Purchasing Managers Index data in Europe and generally improving macro fundamentals in China suggest some stabilization in demand and an uptick in production.

The election is the first hurdle to get over, and barring a Hurricane Sandy-related delay and/or an Electoral College "tie," we'll get there in a week. Following that will be the fiscal cliff. I'm particularly pleased that the negotiations, however they may unfold, have at their base the realization that the US tax code needs a major overhaul. Some readers may recall that I sat on President George W. Bush's nine-member bipartisan tax-reform commission in 2005, so it's an issue dear to my heart.

Remember that it's a change in direction that tends to have the greatest impact on both the stock market and psychology. Many of the uncertainties most vexing for businesses are set to fade within the next few months. The election will be decided, we may have a sense of the fiscal cliff outcome and global growth may have troughed.

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Thumbs up / down votes are submitted voluntarily by readers and are not meant to suggest the future performance or suitability of any account type, product or service for any particular reader and may not be representative of the experience of other readers. When displayed, thumbs up / down vote counts represent whether people found the content helpful or not helpful and are not intended as a testimonial. Any written feedback or comments collected on this page will not be published. Charles Schwab & Co. may in its sole discretion re-set the vote count to zero or remove the modules used to collect feedback and votes.