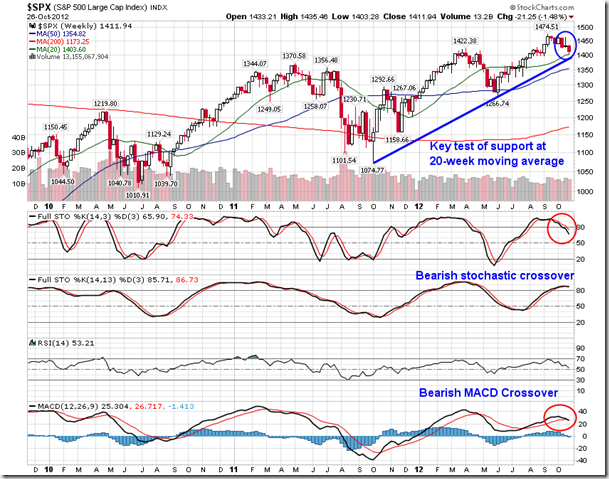

Upcoming US Events for Today:

- Chicago PMI for October will be released at 9:45am. The market expects 51.0 versus 49.7 previous.

Upcoming International Events for Today:

- German Retail Sales for September will be released at 3:00am EST. The market expects a year-over-year decline of 1.2% versus a decline of 0.8% previous.

- Euro-Zone Consumer Price Index Estimate for October will be released at 6:00am EST. The market expects an increase of 2.5% versus an increase of 2.7% previous.

- Euro-Zone Unemployment Rate for September will be released at 6:00am EST. The market expects 11.5% versus 11.4% previous.

- Canadian Gross Domestic Product for August will be released at 8:30am EST. The market expects a month-over-month increase of 0.2%, consistent with the previous report.

- China PMI for October will be released at 9:00pm EST. The market expects 50.3 versus 49.8 previous.

The Markets

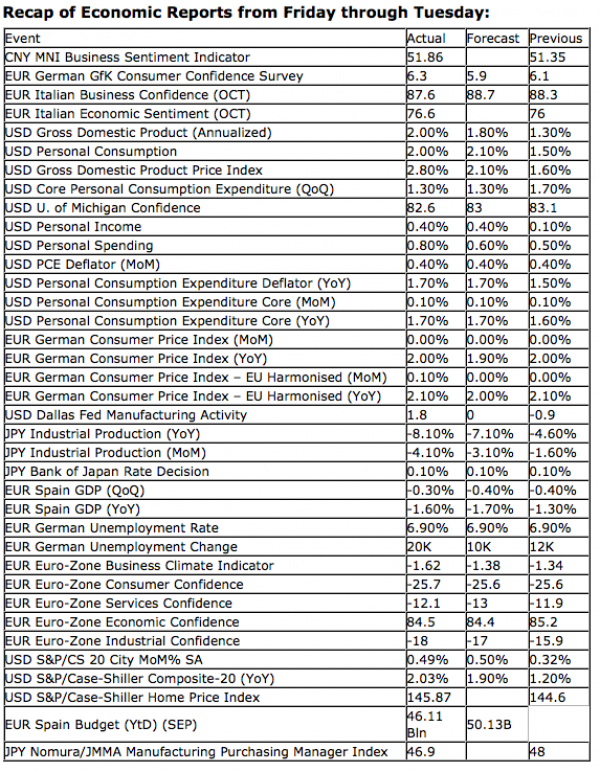

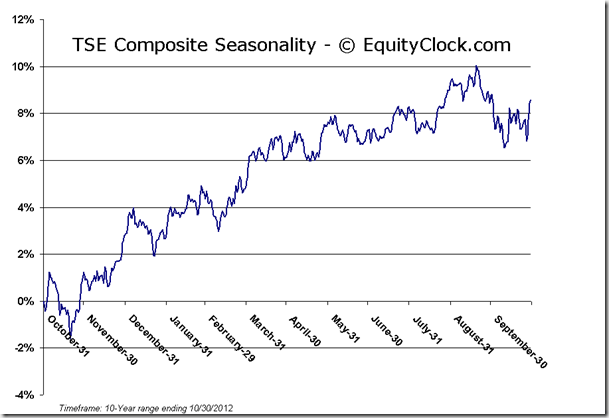

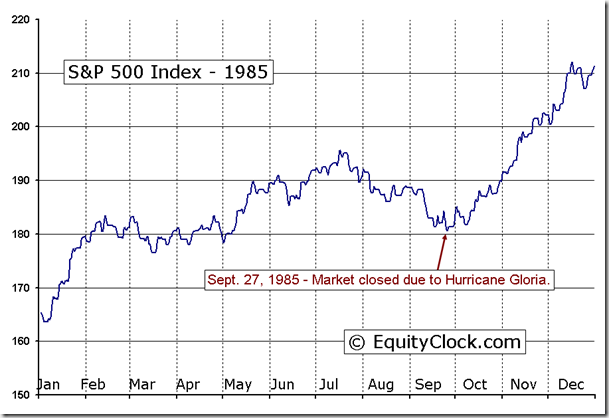

Equity markets closed on Monday and Tuesday as Hurricane Sandy threatened the North-East United States. The so-called “monster storm” forced the closure of the NYSE for the first time since the September 2001 attacks on the World Trade Centre and the first two day closure as a result of weather since 1888. The only other time in the history of the NYSE that the exchange had to close for a full day due to a hurricane was in 1985 when the market closed for Hurricane Gloria. The storm and its impacts are truly unprecedented, the final toll of which will not be realized for many days as New York attempts to get back to normal. Transportation, power, and communications will be key as many are not expected to back up for days, which could lead to imperfect markets as the number of participants could be limited. This volatile trading has already been realized on the S&P/TSX Composite Index, which shot up 50 points from the lows of the day in the last minute of trade on Monday. Earnings and month-end trading could further exacerbate volatility in the days ahead. A number of earnings reports scheduled for Monday and Tuesday have been delayed until the latter half of this week, including Pfizer, Avon, and McGraw-Hill. In the days ahead, over 700 companies are expected to report in the truncated week, with the busiest day of the entire earnings season expected on Thursday with 310 companies scheduled to release results. The trend continues to be 60% of companies beating earnings estimates while just over 40% beat on revenues, the result of which has pressured market values lower since the season began.

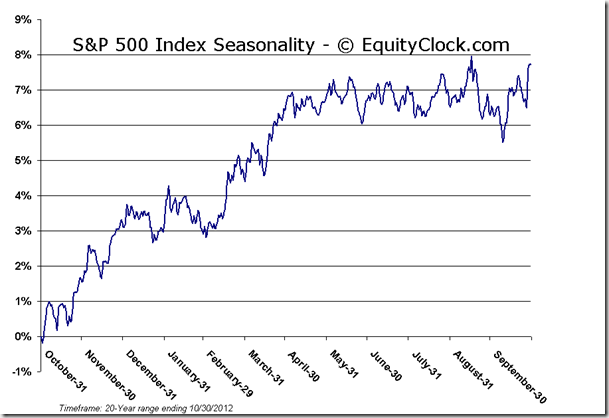

As markets open on Wednesday, investors will be seeking to aggressively execute month-end trades in order to “close the books” prior to the end of October. October 31st is also year-end for a number of funds, leaving them with little time to execute orders for the end of the fiscal year, including fulfilling cash requirements for possible fund redemptions. Typically October month-end is positive for equity markets, resulting in gains for the S&P 500 76.2% of the time on the second to last day of trade. Of course October month-end also marks the average start to the favorable six months of the year when equity markets typically produce their best gains. Technical support for the seasonal move has yet to be realized, however.

Looking at a daily chart of the S&P 500 Index, momentum indicators continue to show a negative trend. Lower-lows and lower highs are starting to be realized with regards to price action. And the 20-day moving average looks set to converge on the 50-day in a bearish-crossover event. The short-term trend is obviously negative and we continue to wait for signs of technical support that might mark an end to the recent slide. A reasonable level of support was tested for the S&P 500 Index on Friday as the benchmark bounced off of its 20-week moving average at 1403, approximately equivalent to the 100-day moving average. The level has been a point of support/resistance in the past and could provide equities with a logical point from which to bounce. Weekly momentum indicators, however, look less than encouraging with MACD sell signals becoming confirmed as of Friday’s close. Weekly stochastics and RSI are also curling over, adding to the technical sell signals that continue to show up. Support for the S&P 500 can be found within a range from 1375, around the 200-day moving average, to 1400, implying that downside risks in the short-term may be limited. The long-term trend of the market remains positive, but the intermediate trend remains broken, having fallen below the rising trendline that extended from the summer lows.

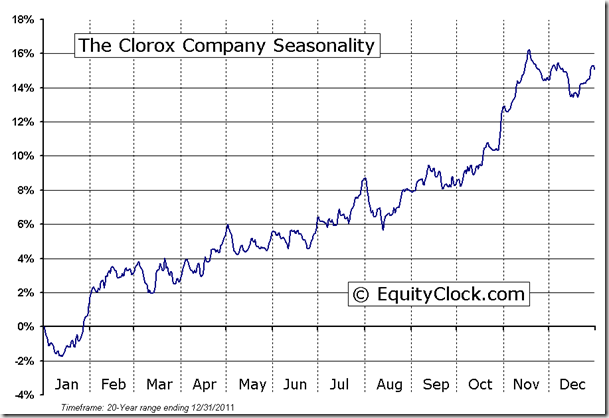

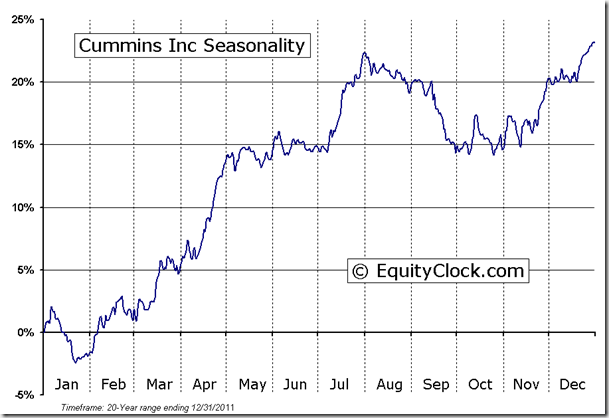

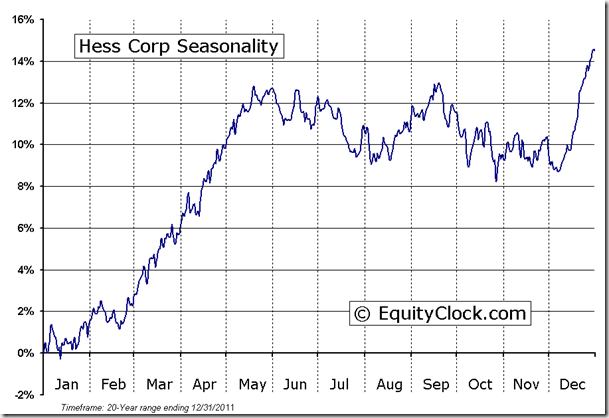

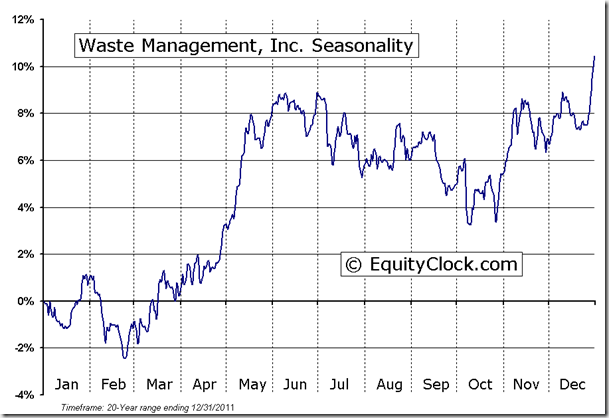

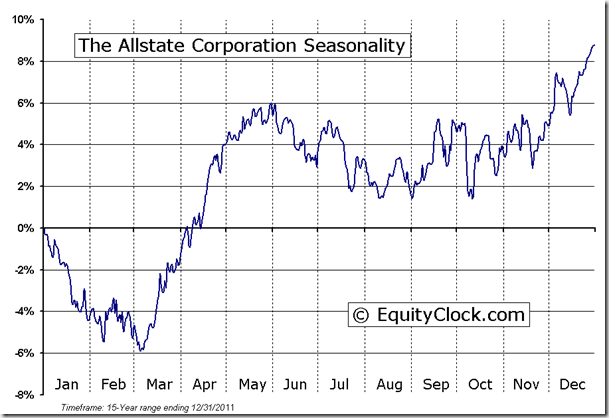

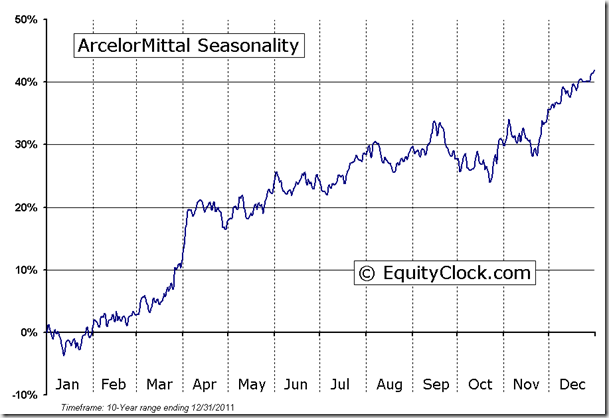

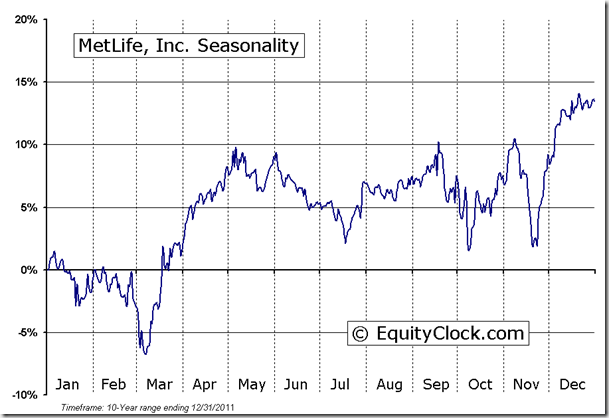

Companies reporting earnings on Wednesday include Arcelor Mittal, Clorox, Cummins, Eaton Corp, General Motors, Hess Corp, Mastercard, Waste Management, Allstate, MetLife, and Visa. The flow of earnings report subside next week, which will allow investors to refocus back on some of the economic reports, which have been fairly good with recent optimistic results pertaining to consumer spending and housing prices. So far companies have reported that average earnings have contracted 1.2% in the third quarter, which is better than the 3.0% contraction that was expected prior to the reporting season. Analysts continue to expect strong fourth quarter growth with earnings expanding by 7.9% for the period.

Sentiment on Friday, as gauged by the put-call ratio, ended approximately neutral at 0.99.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.56 (up 0.48%)

- Closing NAV/Unit: $12.47 (up 0.11%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.40% | 24.7% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.