(Editor’s Note: Brooke Thackray is scheduled to appear on BNN Television tomorrow night at 6:00 PM EDT. There will be no Tech Talk for next couple days. Catch up with us again on Thursday November 1st).

Pre-opening Comments for Monday October 29th

The SEC has decided to close U.S. exchanges today while Hurricane Sandy moves through the U.S. east coast. A decision on timing to re-open exchanges likely will be made tomorrow morning. Trading activity in Canadian equity markets is expected to drop significantly. Toronto also is expected to be impacted by the storm.

Economic News This Week

September Personal Income to be released at 8:30 AM EDT on Monday is expected to increase 0.6% versus a 0.1% gain in August. Personal Spending is expected to increase 0.4% versus a 0.1% gain in August.

August Case Shiller 20 City Home Price Index to be released at 9:00 AM EDT on Tuesday is expected to increase 1.7% on a year-over-year basis versus a gain of 1.2% in July.

The October Consumer Confidence Index to be released at 10:00 AM EDT on Tuesday is expected to increase to 72.5 from 70.3 in September.

The October ADP Private Employment Report to be released at 8:15 AM EDT on Wednesday is expected to slip to 140,000 from 162,000 in September.

The October Chicago PMI report to be released at 9:45 AM EDT on Wednesday is expected to improve to 50.4 from 49.7 in September.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to increase to 375,000 from 369,000 last week

Third Quarter Productivity to be released at 8:30 AM EDT on Thursday is expected to slip to 1.6% from 2.2% in the second quarter

The October ISM Report to be released at 10:00 AM EDT on Thursday is expected to slip to 51.0 from 51.5 in September.

September Construction Spending to be released at 10:00 AM EDT on Thursday is expected to increase 0.8% from a decline of 0.6% in August

October Non-farm Payrolls to be released at 8:30 AM EDT on Friday are expected to increase to 125,000 from 114,000 in September. The October Unemployment Rate is expected to increase to 7.9% from 7.8% in September. October Hourly Earnings are expected to increase 0.2% from a gain of 0.3% in September

September Factory Orders to be released at 10:00 AM EDT on Friday are expected to increase 4.5% versus a decline of 5.2% in August.

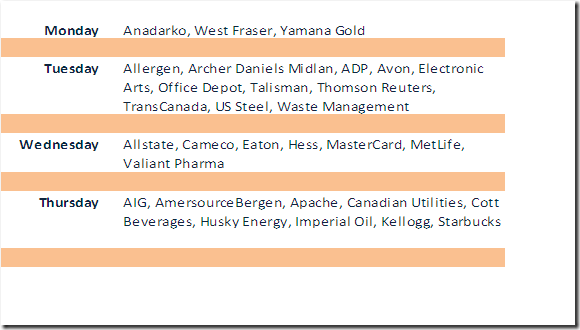

Earnings News This Week

Equity Trends

The S&P 500 Index fell 21.25 points (1.48%) last week. The Index has lost 4.25% from its September 14th high at 1,474.51. Intermediate trend is down. Support is at 1,396.56. The Index remains below its 20 and 50 day moving averages. Short term momentum indicators are oversold, but have yet to show signs of bottoming.

Percent of S&P 500 stocks trading above their 50 day moving average fell last week to 45.80% from 58.00%. Percent continues to trend down.

Percent of S&P 500 stocks trading above their 200 day moving average fell last week to 64.00% from 70.40%. Percent continues to trend down.

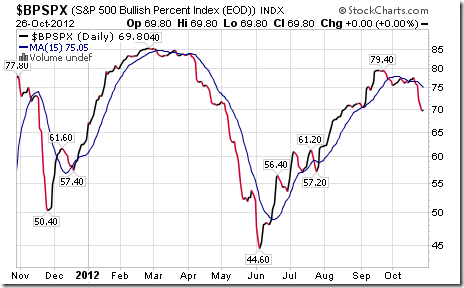

Bullish Percent Index for S&P 500 stocks fell last week to 69.80% from 76.20% and remains below its 15 day moving average. The Index remains intermediate overbought and trending down.

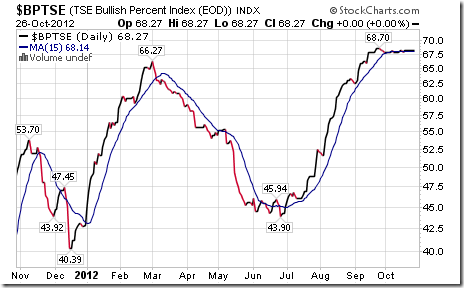

Bullish Percent Index for TSX Composite stocks was unchanged last week at 68.27% and remained above its 15 day moving average. The Index remains intermediate overbought.

The TSX Composite Index dropped 115.68 points (0.93%) last week. Intermediate trend is neutral. Support is at 12,137.18 and resistance is 12,529.77. The Index remains above its 200 day moving average and moved back above its 50 day moving average on Thursday. Short term momentum indicators are neutral. Strength relative to the S&P 500 Index remains positive.

Percent of TSX Composite stocks trading above their 50 day moving average fell last week to 49.00% from 57.83%. Percent continues to trend down.

Percent of TSX Composite stocks trading above their 200 day moving average fell last week to 54.62% from 59.04%. Percent continues to trend down.

The Dow Jones Industrial Average fell 236.30 points (1.77%) last week. Intermediate trend changed from neutral to down on a break below support at 13,296.43. Next support is at 12,977.09. The Average remains below its 20 and 50 day moving averages. Short term momentum indicators are oversold, but have yet to show signs of bottoming. Strength relative to the S&P 500 Index has turned from neutral to negative.

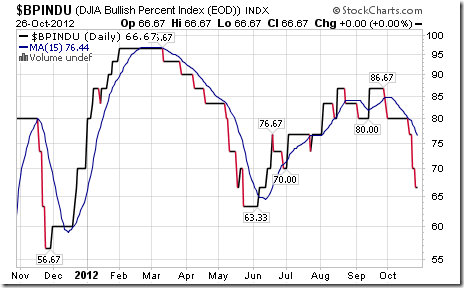

Bullish Percent Index for Dow Jones Industrial Average stocks fell last week to 66.67% from 76.67% and remains below its 15 day moving average. The Index continues to trend down.

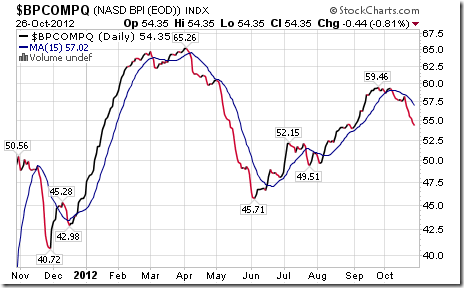

Bullish Percent Index for NASDAQ Composite Index stocks dropped last week to 54.35% from 56.88% and remained below its 15 day moving average. The Index continues to trend down.

The NASDAQ Composite Index dropped 17.67 points (0.59%) last week. Intermediate trend is down. The Index remains below its 20 and 50 day moving averages and is showing early signs of stabilizing near its 200 day moving average. Short term momentum indicators are oversold, but have yet to show signs of bottoming. Strength relative to the S&P 500 Index remains negative, but showing early signs of change.

The Russell 2000 Index fell 7.75 points (0.94%) last week. Intermediate trend is down. Resistance is at 868.50. The Index remains below its 20 and 50 day moving averages and is showing signs of stability near its 200 day moving average. Short term momentum indicators are oversold, but have yet to show signs of bottoming. Strength relative to the S&P 500 Index remains negative, but is showing early signs of change.

The Dow Jones Transportation Average eased 17.67 points (0.59%) last week. Intermediate trend is neutral. Support is at 4,870.74 and resistance is at 5,231.15. The Average remains below its 50 and 200 day moving averages and moved above its 20 day moving average on Friday. Short term momentum indicators are neutral. Strength relative to the S&P 500 Index remains positive.

The Australia All Ordinaries Composite Index fell 85.58 points (1.85%) last week. Intermediate trend is up. Resistance may be forming at 4,602.50. The Index remains above its 50 and 200 day moving average, but slipped below its 20 day moving average on Friday. Short term momentum indicators have rolled over from overbought levels and are trending down. Strength relative to the S&P 500 Index remains positive.

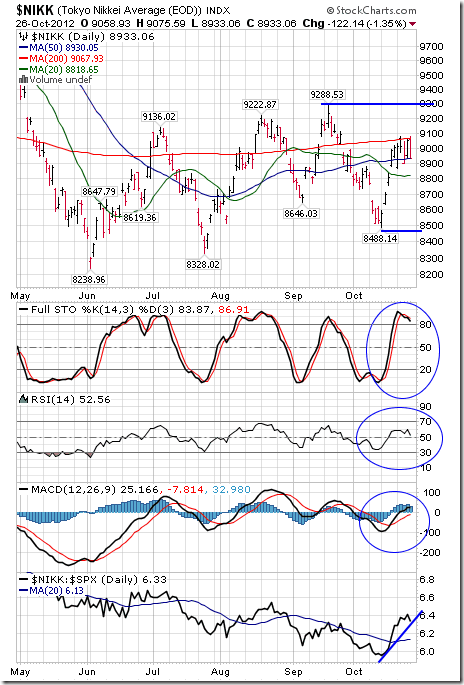

The Nikkei Average dropped 69.92 points (0.77%) last week. Intermediate trend is neutral. Support is at 8,488.14 and resistance is at 9,288.53. The Index remains above its 20 and 50 day moving averages and below its 200 day moving average. Short term momentum indicators are mixed with Stochastics already overbought. Strength relative to the S&P 500 Index recently turned positive.

The Shanghai Composite Index fell 62.09 points (2.92%) last week. Intermediate trend is down. Support is at 1,999.48 and resistance is at 2,145.00. A break above resistance completes a reverse head and shoulders pattern. Short term momentum indicators are oversold and are trending down. Strength relative to the S&P 500 Index remains positive.

The Europe 350 ETF slipped $0.52 (1.38%) last week. Intermediate trend is up. Support is at $36.43 and resistance is at $38.55. Units remain above their 50 and 200 day moving averages, but fell below its 20 day moving average. Short term momentum indicators are trending down. Strength relative to the S&P 500 remains positive.

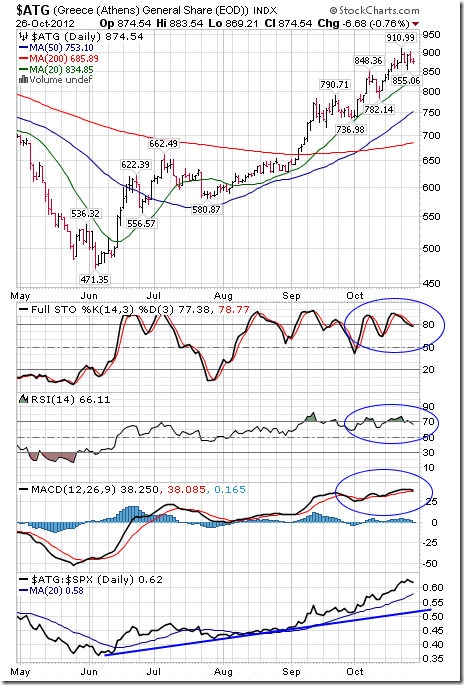

The Athens Index gained another 3.90 points (0.45%) last week. Intermediate trend is up. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought and showing early signs of peaking. Strength relative to the S&P 500 Index remains positive.

Currencies

The U.S. Dollar Index added 0.45 (0.57%) last week. Intermediate trend is neutral. Support is at 78.60 and resistance is at 84.10. The Index remains below its 50 and 200 day moving average, but moved above its 20 day moving average. Short term momentum indicators are trending higher.

The Euro fell 0.84 (0.65%) last week. Intermediate trend is neutral. Resistance is at 131.72 and support is at 128.29. The Euro remains above a 20, 50 and 200 day moving averages. Short term momentum indicators are trending down.

The Canadian Dollar slipped 0.33 cents U.S. (0.33%) last week. Intermediate trend is down. Resistance is at 103.73. The Canuck Buck remains below its 20 and 50 day moving average and is testing its 200 day moving average. Short term momentum indicators are trending down and are approaching oversold levels.

The Japanese Yen eased 0.53 90.41%) last week. Intermediate trend is down. The Yen remains below its 20, 50 and 200 day moving averages Short term momentum indicators are trending down and showing early signs of bottoming.

Commodities

The CRB Index fell 9.21 points (3.01%) last week. Intermediate trend changed from up to down when the Index broke support at 302.45. The Index remains below its 20 and 50 day moving averages and fell below its 200 day moving averages. Short term momentum indicators are trending down and oversold. Strength relative to the S&P 500 Index remains negative.

Gasoline slipped $0.03 per gallon (1.12%) last week. Intermediate trend is down. Gasoline remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are oversold and showing early signs of bottoming. Strength relative to the S&P 500 remains negative.

Crude Oil plunged $4.37 per barrel (4.82%) last week. Intermediate trend changed from neutral to negative on a break below support at $87.70. Crude remains below it s20, 50 and 200 day moving averages. Short term momentum indicators are oversold. Strength relative to the S&P 500 Index remains negative.

Natural Gas added 0.14 (3.91%) last week. Intermediate trend is up. Gas remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought. Strength relative to the S&P 500 Index remains positive.

The S&P Energy Index fell 10.94 points (1.98%) last week. Intermediate trend returned to down on a break below support at 540.01. The Index remains above its 200 day moving average, but fell below its 20 and 50 day moving averages. Short term momentum indicators are trending down. Stochastics already are oversold. Strength relative to the S&P 500 Index remains neutral.

The Philadelphia Oil Services Index dropped 9.78 points (4.26%) last week. Intermediate trend is neutral. The Index fell below its 20, 50 and 200 day moving averages. Short term momentum indicators are trending down. Stochastics already are oversold. Strength relative to the S&P 500 Index remains neutral.

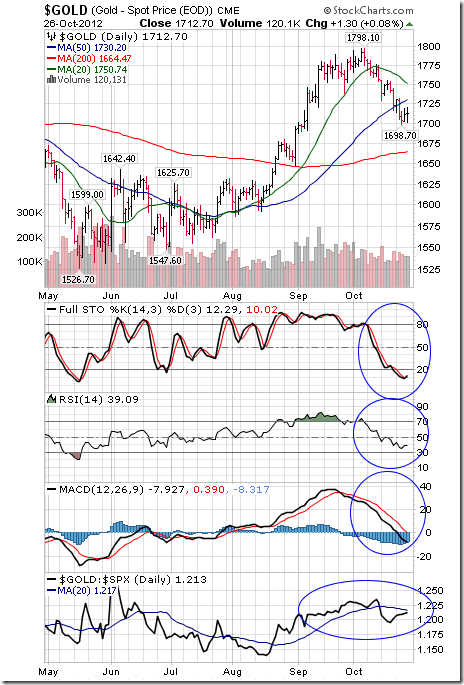

Gold fell $10.20 per ounce (0.59%) last week. Intermediate trend is up. Gold remains above its 200 day moving average, but remains below its 20 day moving average and fell below its 50 day moving average. Short term momentum indicators are oversold, but have yet to show signs of bottoming. Strength relative to the S&P 500 Index remains neutral.

The AMEX Gold Bug Index slipped 4.36 points (0.88%) last week. Intermediate trend is down. The Index remains above its 50 and 200 day moving averages and below its 20 day moving average. Short term momentum indicators are trending down. Stochastics already are oversold and may be showing early signs of bottoming. Strength relative to Gold remains slightly negative.

Silver slipped $0.05 (0.16%) last week. Intermediate trend is up. Silver remains above its 200 day moving average and below its 20 and 50 day moving averages. Short term momentum indicators are oversold, but have yet to show signs of bottoming. Strength relative to gold remains negative.

Platinum dropped $71.20 per ounce (6.23%) last week. Intermediate trend changed from up to neutral on a break below support at $1,596.00. Platinum remains below its 20 and 50 day moving averages and fell below its 200 day moving average. Strength relative to gold remains negative.

Palladium dropped $28.05 (4.47%) last week. Intermediate trend changed from up to down on a break below support at $617.45. Strength relative to gold remains negative.

Copper dropped $0.08 per lb. (2.20%) last week. Intermediate trend is down. Copper remains below its 20 day moving averages and fell below its 50 and 200 day moving averages. Short term momentum indicators are oversold, but have yet to show signs of bottoming. Strength relative to the S&P 500 Index has changed from neutral to negative.

The TSX Global Metals and Mining Index dropped 13.13 points (1.41%) last week. Intermediate trend is up. The Index remains above its 20 and 50 day moving averages and below its 200 day moving averages. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index remains positive.

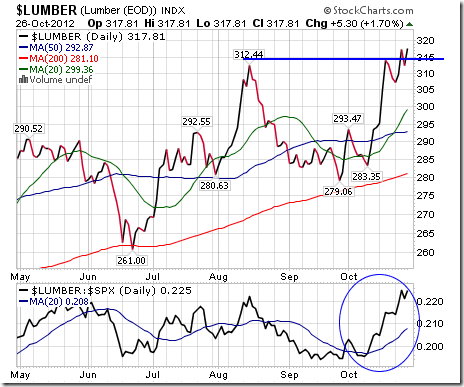

Lumber gained $9.40 (3.05%) last week. Intermediate uptrend was confirmed on a break above resistance at $312.44. Lumber remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are trending up.

The Grain ETN slipped $0.34 (0.58%) last week. Intermediate trend is down. Short term momentum indicators are trending up. Strength relative to the S&P 500 Index is turning positive.

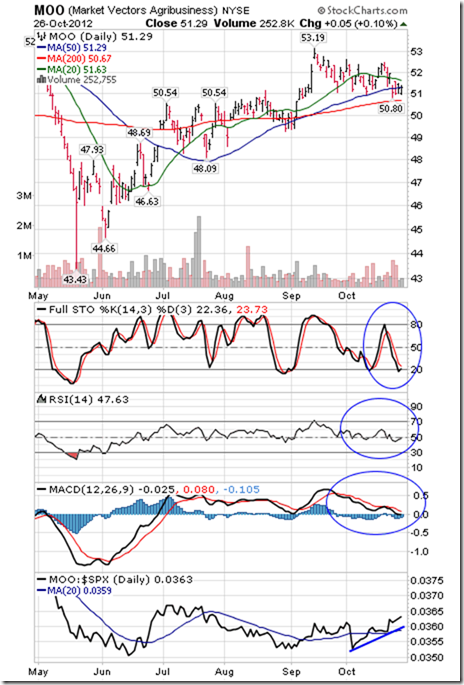

The Agriculture ETF slipped $0.09 (0.18%) last week. Intermediate trend is up. Units remain above their 200 day moving average, fell below its 20 day moving average and recovered on Friday to its 50 day moving average. Short term momentum indicators are oversold. Strength relative to the S&P 500 Index has turned from neutral to positive. ‘Tis the season!

Interest Rates

The yield on 10 year Treasuries slipped 1.8 basis points last week. Intermediate trend is up. Resistance is at 1.892% and support is at 1.599%. Yield found resistance near its 200 day moving averages. Short term momentum indicators are neutral.

Conversely, price of the long term Treasury ETF added 0.90 (0.74%) last week.

Other Issues

The VIX Index gained 0.75 (4.40%) last week. Intermediate trend is up.

The volume of third quarter earnings reports by S&P 500 companies is winding down. Of the 272 S&P 500 companies that have reported to date, 62.5% reported higher than consensus earnings and 25.4% have reported lower than consensus earnings. Generally, earnings have slightly exceeded consensus (Up 1.1% to date versus estimate for all companies of -2.6%), but revenues have been slightly less than consensus. Of greater importance, approximately 60% of companies that have reported to date have lower fourth quarter guidance. Responses to individual reports have been exceptional in both directions. Look for more of the same this week. However, over-all impact on equity markets is expected to be muted.

The volume of third quarter earnings reports by TSX companies reaches a peak this week.

Economic focus this week is on the October U.S. employment report on Friday. Consensus is that data will be little changed from September. However, this report is notorious for its variance from consensus. Other economic reports released during the week are expected to show a modest recovery in economic growth.

Macro events outside of North America also are expected to add to mildly bullish equity sentiment. Economic data from Europe is expected to be less bad. China’s official PMI to be reported on Thursday is expected to hold above the 50.0 level.

Short term momentum indicators for a wide variety of indices and sectors are oversold and intermediate technical indicators generally remain in a downtrend.

Cash positions held by corporations and individuals are huge and growing. Cash positions will start to be employed when the next President is determined by the market and when the Fiscal Cliff is resolved (regardless of whom becomes President).

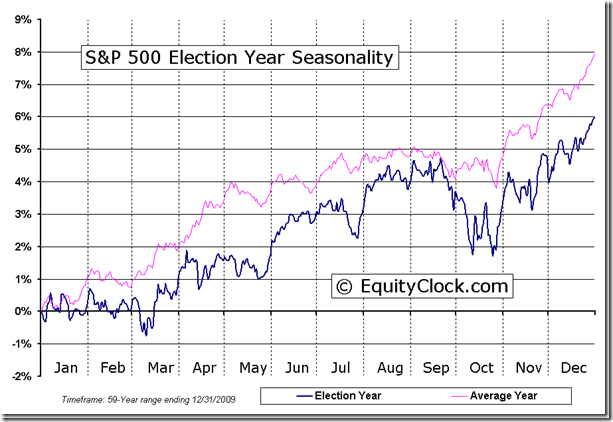

North American equity markets have a history of moving higher just prior to the U.S. Presidential election until just after Inauguration Day in the third week in January.

Long term seasonal influences on average turn positive this week. Following is a link to Tech Talk’s column that appeared at www.globeandmail.com on Friday:

Headline reads, “For seasonal traders, this Monday is the day to buy stocks”.

Following is full text:

The best time during the past 61 years to enter North American equity markets has been at the opening of trade on October 28th. This year, the optimal date is the opening of trade on Monday October 29th. How does the entry point look this year?

Thackray’s 2012 Investor’s Guide notes that the best period to own U.S. equities during the past 61 years has been from October 28th to May 5th. A $10,000 investment in the S&P 500 Index purchased each year on October 28th since 1950 and sold each year on May 5th during the past 60 periods increased in value to $1,057,851 by May 5th 2011. The trade was profitable in 53 of the past 61 periods. In contrast, a $10,000 investment in the S&P 500 Index purchased each year on May 6th and sold each year on October 27th fell in value to $6,862. Calculations did not include dividends or commission costs.

The best period to own Canadian equities is identical. Data for the past 34 years shows that a $10,000 investment in the TSX Composite Index purchased each year on October 28th since 1977 and sold each year on May 5th increased in value to $200,778 by May 5th 2011.The trade was profitable in 29 of the past 35 periods. In contrast, a $10,000 investment purchased each year on May 6th and sold on October 27th fell in value to $6,674.

The main reason for the period of seasonal strength is a response by equity markets to a series of positive annual recurring events from late October to early May. Annual recurring events include transactions for tax purposes, anticipation of quarterly and annual corporate reports, the timing of analyst opinion changes, key economic reports, and special holidays, including the U.S. Thanksgiving holiday and the Christmas holiday.

The beginning of the period of seasonal strength at the end of October typically happens just after a majority of S&P 500 companies have reported third quarter results. Prior to the end of October during the third quarter earnings report period, U.S. equity markets have a history of exceptional volatility. This year was no exception.

The October 28th to May 5th favourable period of investment is best known as the “Buy when it snows, sell when it goes” strategy. By coincidence, the phrase is particularly relevant this year. Calgary experienced its first snow storm yesterday.

Negative return indicated in the data during the May 6th to October 27th periods does not imply a “Sell in May, go away” strategy. “Sell in May and go away” is a myth. The S&P 500 Index has gained in 38 out of the past 61 periods and the TSX Composite has advanced in 20 of the past 35 periods. However, gains were modest and the losses were higher relative to the period of seasonal strength. The May 6th to October 27th periods is plagued by higher volatility and fewer annual recurring events that influence equity markets.

The October 28th entry date for the annual seasonal trade is an average date. The optimal date to enter the trade each year is fine-tuned using short term momentum indicators. The optimal date normally occurs on the average date plus or minus three weeks. Last year, the optimal entry date was October 5th.

What about this October? Short term momentum indicators for the S&P 500 Index and TSX Composite Index already are oversold, but have yet to show signs of bottoming. A trigger recording a momentum buy signal is likely to occur during the next few days.

Year-end “window dressing” by U.S. mutual fund companies could have an impact on U.S. equity markets this year. Most major mutual fund companies have a fiscal year end on October 31st. Managers of these funds frequently add best performing equities prior to November 1st in order to “pretty up” their portfolio for unit holder reporting purposes. Net result is a positive bias in equity markets during the last four trading days of October.

Thackray’s 2012 Investor’s Guide notes that the last four trading days in October has recorded an exceptional return on investment in U.S. equity markets. Average return per period from 1950 to 2010 for the S&P 500 Index was 1.0 per cent. Moreover, the first three trading days in November have provided above average returns.

Given current short term oversold condition in the U.S. equity market, chances of a successful trade this year starting this Friday and continuing to November 5th are above average.

An opportunity to enter into North American equity markets at current or lower prices for a seasonal trade lasting until spring has arrived. A wide variety of Exchange Traded Funds are available that track major U.S. and Canadian equity indices.

Don Vialoux is the author of free daily reports on equity markets, sectors, commodities and Exchange Traded Funds. He is also a research analyst at Horizons Investment Management, offering research on Horizons Seasonal Rotation ETF (HAC-T). All of the views expressed herein are his personal views although they may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment. Horizons Investment is the investment manager for the Horizons family of ETFs. Daily reports are available at http://www.timingthemarket.ca/

The Bottom Line

The entry point for the seasonal trade this year is here. The TSX Composite Index reached a low of 12,132 on October 15th. The low for the S&P 500 Index and Dow Jones Industrial Average has yet to be confirmed, but both indices showed evidence on Friday that they are trying to bounce from near key support levels. Downside risk is limited and upside potential into early next year is above average. Average gain during an election year by the S&P 500 Index from November 1st to February 1st is 5.0%. Preferred strategy is to accumulate equities and Exchange Traded Funds with favourable seasonality at this time of year that already are showing technical signs of performance or outperformance relative to the market (S&P 500 for U.S. markets and TSX Composite for Canadian markets). Sectors include agriculture, forest products, transportation, industrials, steel, consumer discretionary, semiconductors, home builders, China and Europe.

The latest weekly update on ETFs in Canada to October 27th is available at

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

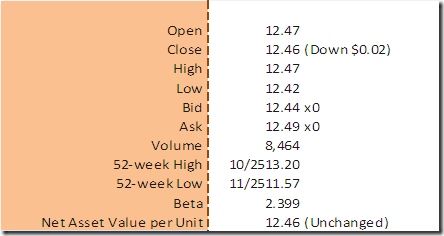

Horizons Seasonal Rotation ETF HAC October 26th 2012