Pre-opening Comments for Friday October 26th

U.S. equity index futures are lower this morning. S&P 500 futures were down 2 points in pre-opening trade. Index futures are responding to concerns about Hurricane Sandy and its potential impact on the U.S. East Coast.

Third quarter earnings reports continue to pour in. Companies that reported after the close yesterday included Expedia, Amazon.com, Apple, Goodyear Tire, Comcast, Cerner, Merck and Legg Mason.

Index futures recovered following release of U.S. third quarter annualized real GDP. Consensus was growth at 1.8% versus 1.3% in the second quarter. Actual was growth at a 2.0% rate.

Japan announced a $5.3 billion economic stimulation program

Apple added $1.96 to $611.50 after reporting slightly less than consensus third quarter earnings but slightly higher than consensus third quarter revenues.

Expedia added $8.75 to $60.00 after reporting higher than expected third quarter earnings. In addition, Raymond James, Lazard Capital and Benchmark upgraded the stock and RBC Capital raised its target price.

Agnico Eagle added $0.07 to $56.43 following an upgrade by CIBC from Sector Underperform to Sector Perform.

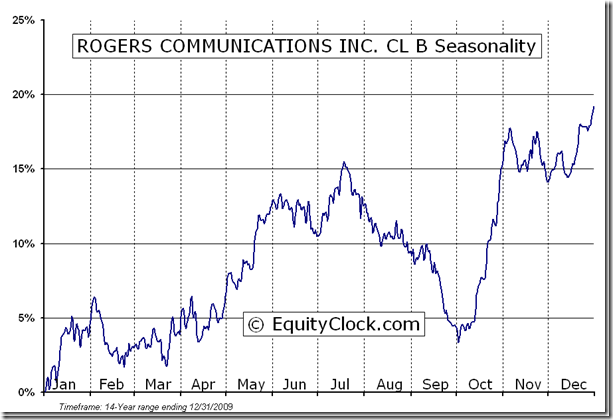

Rogers Communication (RCI.B $43.46 Cdn.) is expected to open higher after Goldman Sachs upgraded the stock from Sell to Neutral.

Target added $0.57 to $63.69 after Buckingham upgraded the stock from Neutral to Buy.

Caterpillar eased $0.30 to $83.23 after Goldman Sachs downgraded the stock from Conviction Buy to Buy.

Technical Watch

Expedia, Inc. (NASDAQ:EXPE) – $60.00 gained 17.1% after announcing higher than expected quarterly results. In addition, Raymond James, Lazard Capital and Benchmark upgraded the stock. The stock has a positive technical profile. Intermediate trend is up. The stock is expected to open just below its all-time high at $60.29. The stock is expected to open above its 20 and 50 day moving averages. Short term momentum indicators are recovering from oversold levels. Strength relative to the S&P 500 Index has been positive since the end of April. Preferred strategy is to accumulate the stock at current or lower prices.

Rogers Communications, Inc. (TSE:RCI.B) – $43.46 Cdn. is expected to open higher after Goldman Sachs upgraded the stock from Sell to Neutral. The stock has a positive technical profile. Intermediate trend is up. The stock popped earlier this week on better than expected quarterly results. The stock remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought. Strength relative to the TSX Composite Index has been positive since the beginning of May. Seasonal influences are positive. Preferred strategy is to accumulate the stock on weakness closer to previous resistance at $41.19.

Rogers Communications Inc. (TSE:RCI.B) Seasonal Chart

Interesting Charts

The TSX Composite Index finally has started to significantly outperform the S&P 500 Index after a period of underperformance during the past year.

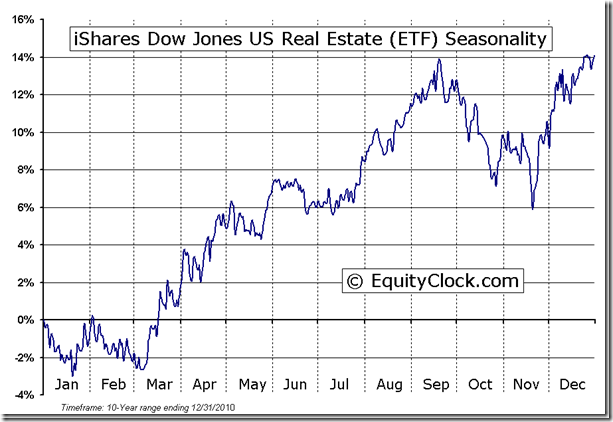

The seasonally weak U.S. real estate sector remains under technical pressure.

Toronto Money Show Webcast featuring

Jon and Don Vialoux

Jon and Don presented at the Toronto Money Show last Saturday. Following is a link to a copy of the webcast:

http://www.moneyshow.com/video/Webcast/101/9B1DBE6D56714A60A126C26B924FAAAB1/Timing-the-Market-Using-a-Combination-of-Technical-Fundamental-and-Seasonal-Analysis/

Adrienne Toghraie’s “Trader’s Coach” Column

|

Why Not You?

By Adrienne Toghraie, Trader’s Success Coach

There are many professions, businesses and avocations that may be out of your reach, because to be successful at them requires that you have an enormous amount of resources. This is not the case in trading. Yes, you do have to have resources but not those of a Herculean or a Mensa intellectual. So why is it so difficult for most?

They think that it takes a complicated strategy to make a great deal of money.

In my experience most of the best traders that I have worked with

had very simple rules.

They believe that it takes a well-educated person.

I have found that too much book knowledge very often gets in the way.

They are convinced that only those with insider’s information really get a shot at trading success.

Insider information is a key factor for the success of many traders, but I have never worked with such people. And I have worked with many successful traders over the past twenty years being in this business.

They think that you have to start out being super rich.

On this one, I would agree that the more money you have, the faster you can become wealthier, but you still have to have the right foundation. Consistently building on a small amount of capital has been the success story for many of my clients.

Another turtle that won the race

Josh started simulated trading when he was sixteen. He did not have money at the time so he asked his parents for gifts of money for his birthday and holidays. With those meager savings and most of the money he earned during the summer, Josh had a base of five thousand dollars to start trading when he was nineteen. That five thousand grew to over ten million by the age of thirty. Here is how he did it:

· Josh treated trading like a computer game and was thrilled when he learned to beat who he thought of as his opponent, the markets.

· He listened to chat rooms and went to local investment clubs as if he were a reporter getting a story.

· Josh learned to build on his success and the lessons he learned from his failures kept him on a winning course of progress.

· Since discipline was a key factor, Josh created discipline in his trading and in the other areas of his life.

· Josh waited to get proven results from simulated trading before trading real money.

· When Josh was steadily showing a profit for six months, he presented the results at a family party. He picked up another twenty thousand to trade.

· After two years of solid profits, he showed the results to a trading group who hired him to be one of their traders.

Many people have asked me over the years who I consider to be my best clients, and who have received the most benefit from my services. Josh is one of the traders that I would put on the top of my list. I met Josh in one of my Webinars when he was ready to take his trading to a new level and he certainly did.

Conclusion

While most people fail trading the markets, there are those who choose to take the right steps and beat the odds. The fastest way to success is to make good choices, learn from your mistakes and be consistent about your discipline.

Free Webinar –Fear in Trading

Presented by Adrienne Toghraie, Trader’s Success Coach

Tuesday, November 6th at 4:30 pm (NY time)

Register at

http://tradingontarget.omnovia.com/registration/pid=11211347638317

iShares Dow Jones US Real Estate (ETF) (NYSE:IYR) Seasonal Chart

Eric Wheatley’s Listed Options Column

Hi everybody,

I had an email conversation recently with someone who wasn’t happy with his covered calls. I’ll keep the details to myself, but basically this experienced investor got nailed with what is the main disadvantage of writing options to reduce volatility.

He had purchased stock XYZ when it was close to $20. It came down to $14.50 soon thereafter. He was still bullish on the stock, so he decided to keep the position open and wrote some 15-strike calls to cover it, which brought in $1.50.

Of course, the stock rallied back up to the $18-$19 range. If he hadn’t written the calls, he would be close to even, but, having placed a ceiling on his gains at $15, he locked-in a loss. He’s a pretty loyal reader, so he wanted me to comment.

I came up with:

a) You bought a stock, it dropped. Too bad. It happens to everyone. Take it, learn your lesson and don’t dwell on it. It’s happened before and it’ll happen again.

b) When the stock was at $14.50, you made a conscious decision to write a call instead of liquidating the position. You did this because you thought the stock was a good long term hold. You even bought a little more at that price to average your cost basis down (he didn’t buy enough to overcome the loss, but still). As it turns out, you made quite a bit more than if you had taken your losses like the stand-up citizen I know you to be.

c) Writing options comes with the inherent caveat that you’re giving up upside. You’re being compensated for this and, usually, that compensation more than makes up for the gains forgone. In this case however, it didn’t. This happens.

d) Here is where it gets interesting: you like to write longer-dated options. Six months or more. THIS is exactly why that isn’t a great idea.

e)

An option’s time premium erodes at the square root of time. This means that shorter-term options are relatively more expensive than longer-dated options. In practice therefore, selling two three-month calls will bring in more cash than selling one six-month call, notwithstanding transaction and liquidity costs.

The other reason it is better to sell shorter-term options is that the granularity is better. What I mean here is that the valleys as described above won’t be as deep over the long term. There will be occasions when you may get whipsawed, but overall the premiums taken in will smooth out the gaps and you’ll do better.

*****************

A few articles from the Twitter feed from this week:

· The real economic impact of QE3. Aggregate demand, aggregate supply and counterproductive wealth creation.

· A nice historical analysis piece. The lessons of Black Monday 25 years on.

· China’s achilles heel. No matter what happens, this will have to be dealt with sooner or later.

In this week’s French-language blog: gourmet cat food, 99 cents for gas and the problem with the human process of estimation.

Cheers!

Éric Wheatley, MBA, CIM

Associate Portfolio Manager, J.C. Hood Investment Counsel Inc.

eric@jchood.com

514.604.2829;1.855.348.2829

Twitter: @jchood_eric_en

Blogue en français : gbsfinancier.blogspot.ca

*****************

Little knownfact about John Charles Hood #48

John Charles Hood, ummmm, isn’t very interesting this week.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Tech Talk’s ETF Column at www.globeandmail.com

Stay tuned tomorrow for an important column focusing on “Buy when it snows, Sell when it goes”. The period of seasonal strength in North American equity markets is approaching.

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

Horizons Seasonal Rotation ETF HAC October 25th 2012

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/c9eeffe791de5175212fdff92f5b7ec6.png)

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/HLIC/c82fe4eb74a7fef617ff8c1fa0a580cb.png)