Pre-opening Comments for Tuesday October 23rd

U.S. equity index futures are sharply lower this morning. S&P 500 futures are down 17 points in pre-opening trade. Index futures are responding to negative guidance issued by Dupont and MMM as well as renewed concerns about European sovereign debt.

Third quarter earnings continue to pour in. Companies reporting this morning included Dupont, Reynolds American, Coach, Harley Davidson, Regions Financial, Xerox, United Technologies, Radio Shack, UPS, Illinois Tool Works and Whirlpool.

The Bank of Canada maintained its overnight lending rate at 1.0%. The Canadian Dollar is slightly higher following the announcement. The Bank of Canada maintained its forecast for GDP growth in Canada at a 2.3% rate in 2013.

Buckingham initiated coverage on the U.S. airline industry with a favourable rating. Delta, United Continental and US Airways were initiated with Buy ratings.

Yahoo added $0.60 to $46.40 after reporting higher than expected quarterly results. In addition, Susquehanna upgraded the stock from Neutral to Buy.

Apple is expected to launch the iPad Mini later today.

Target slipped $0.31 to $61.90 despite announcing sale of its $5.9 billion credit card unit to Toronto Dominion Bank.

Technical Watch

Dupont Co. (NYSE:DD) – $46.40 fell 6.8% after reporting lower than consensus third quarter earnings and revenues and after lowering fourth quarter guidance. The stock has a mixed technical profile. Intermediate trend is neutral. The stock recently fell below its 20, 50 and 200 day moving averages. Short term momentum indicators are neutral. Strength relative to the S&P 500 Index has been negative since the beginning of May. Preferred strategy is to accumulate on weakness closer to support at $45.77.

Leibovit Volume Reversal Signals

Negative Leibovit Volume Reversal signals were recorded by UNG and WRI. Following is a link: http://tinyurl.com/9o6jbjt

Interesting Charts

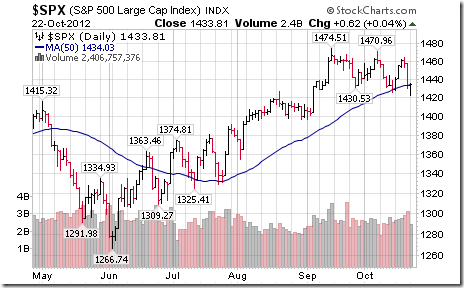

A wild day for U.S. equity indices! Both the S&P 500 and Dow Industrials broke to five week lows in early trading, but charged back by the close. Nice bounce from near their 50 day moving averages!

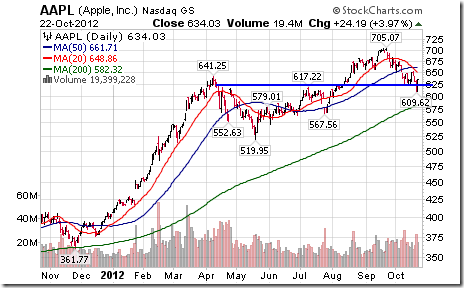

The trigger was strength in Apple in late trading. Apple is bouncing from near the top of a previous trading range. The company is expected to announce new products today.

Notably strong were the coal stocks. The coal ETF completed a classic reverse head and shoulders pattern. Classic technical target on the breakout is $30.39.

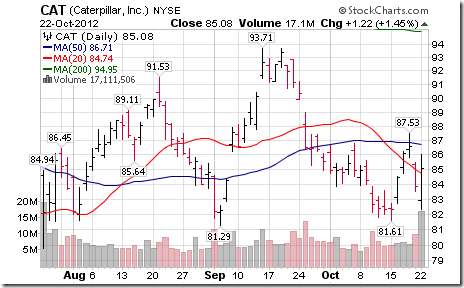

Responses to third quarter reports once again were significant. Caterpillar opened sharply lower after reporting higher than consensus earnings, but lower than consensus revenues. The company also lowered guidance. However, late buying carried the stock to a gain on the day.

Peabody was the leader in the coal sector despite reporting lower earnings. An encouraging sign for Chinese related stocks! Coal stocks also are expected to benefit if Romney becomes President.

The most frequent miss by big cap companies, that have reported third quarter reports to date, is revenues. The main reason for lower revenues is strength of the U.S. Dollar Index in the third quarter relative to the same period last year and its impact when international currencies are translated into U.S. Dollars. Notice that the negative impact on revenues (as well as earnings) due to currency translation virtually disappears in the fourth quarter if the U.S. Dollar Index remains near current levels.

Prairiecropcharts.com Blog

Harold Davis gives his latest comments on specialty grain crops. Following is a link to his comments:

http://www.prairiecropcharts.com/

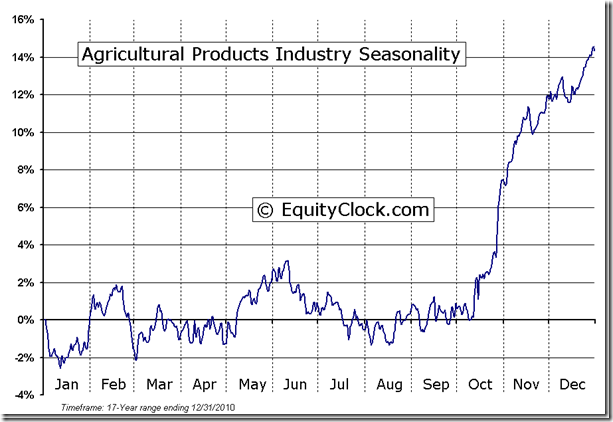

Note from the charts that grain prices once again are increasing, an encouraging sign for the agriculture sector. Not surprising, COW is testing its high. ‘Tis the season!

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Agricultural Products Industry Seasonal Chart

FP Trading Desk Headline

FP Trading Desk headline reads, “Stocks that win from U.S. housing recovery”. Following is a link to the report:

http://business.financialpost.com/2012/10/22/stocks-that-win-from-u-s-housing-recovery/

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

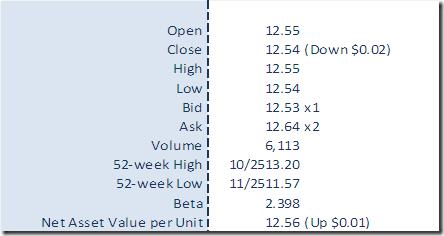

Horizons Seasonal Rotation ETF HAC October 22nd 2012

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/fe44989ee103b8b49acc6d35be371170.png)

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/HLIC/11df4e4e67e3c65c8fc674b81967150c.png)