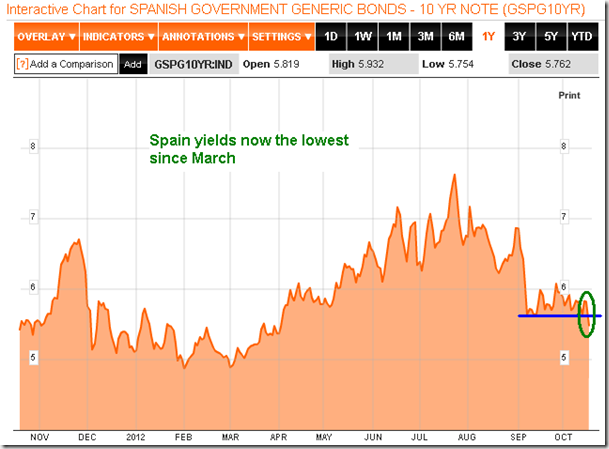

Upcoming US Events for Today:

- Weekly Jobless Claims will be released at 8:30am. The market expects Initial Claims to show 365K versus 339K previous. Continuing Claims are expected to reveal 3275K versus 3273K previous.

- The Philadelphia Fed Index for October will be released at 10:00am. The market expects 0.5 versus –1.9 previous.

- Leading Indicators for September will be released at 10:00am. The market expects an increase of 0.2% versus a decline of 0.1% previous.

Upcoming International Events for Today:

- Great Britain Retail Sales for September will be released at 4:30am EST. The market expects a year-over-year increase of 2.5% versus an increase of 2.7% previous.

The Markets

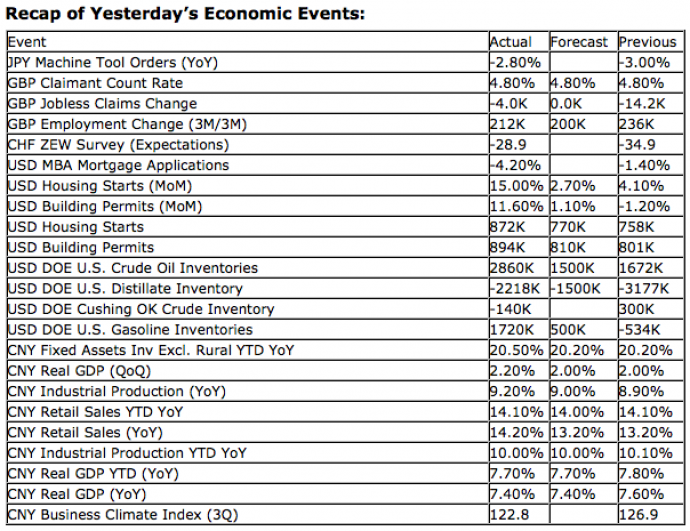

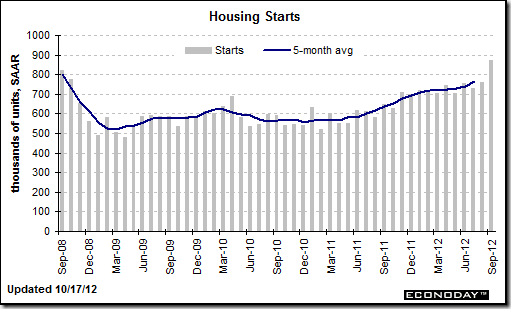

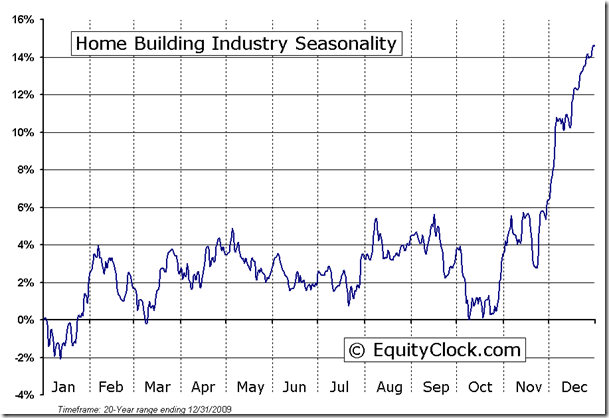

Markets traded higher on Wednesday, boosted by better than expected housing data in the US and optimism pertaining to the debt situation in Europe. Housing starts for September were reported at the highest level in more than four years, fueling speculation that the housing market has turned a corner as record low mortgage rates aid the recovery in the industry.

Homebuilding stocks jumped following the result, trading back around multi-year highs. Still, stocks in the industry remain well off of the highs set prior to the recession, about 38% below the peak in the case of the Homebuilders ETF. Homebuilding stocks enter a period of seasonal strength into the fourth quarter as companies in the industry prepare for the Spring building season. Stocks in the space have been outperforming the market for the past year.

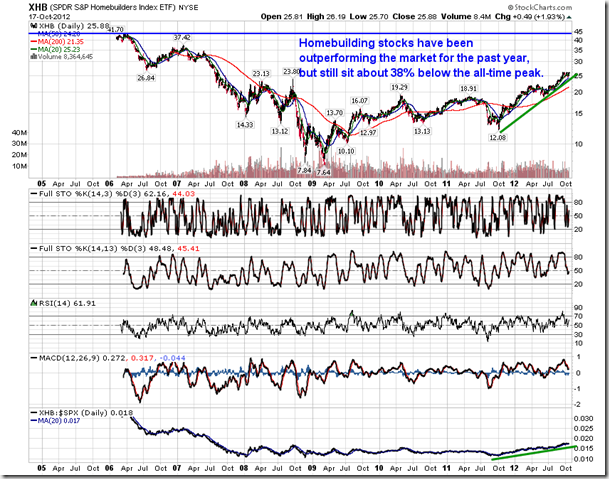

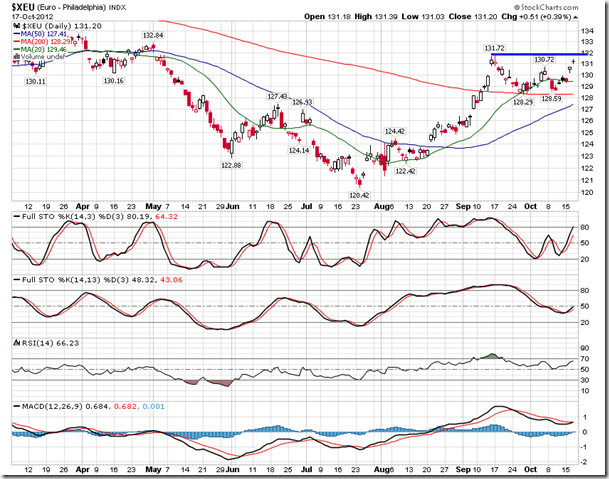

Adding to the optimism on Wednesday was a decision from Moody’s to leave Spain’s investment grade ratings unchanged amid signs the government is moving closer to making a bailout request. Yields in the country fell to the lowest level since March, breaking below the recent consolidation range.

A drop in borrowing costs for the region fueled gains in the Euro, which is pushing back toward the highs set in the Spring. The US Dollar index subsequently pushed towards support around 78.60. Weakness for the US Dollar Index below 78.60 would be very bullish for risk assets, including stocks and commodities. Seasonal tendencies for the currency remain flat to positive through the month of November.

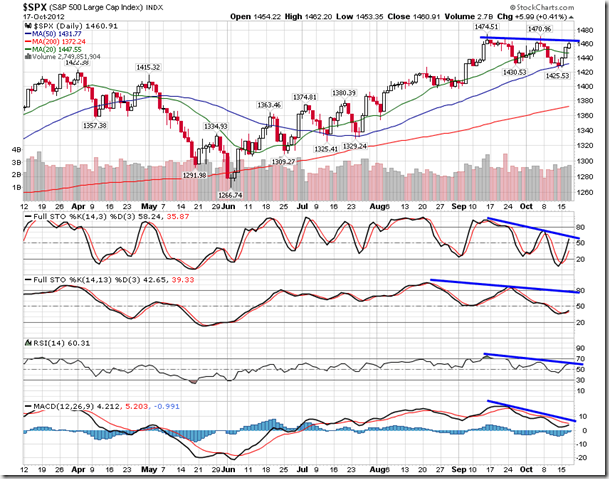

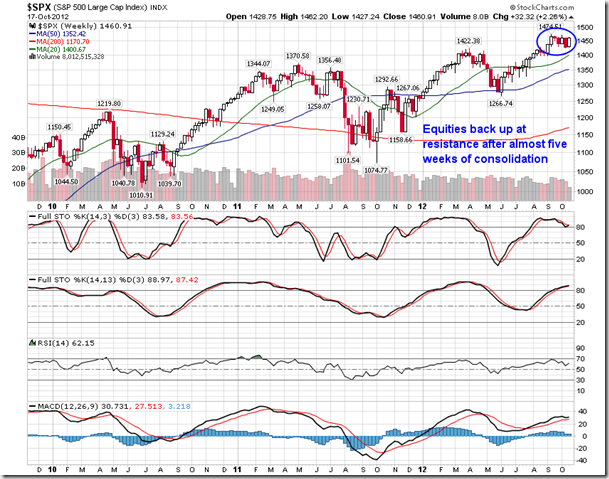

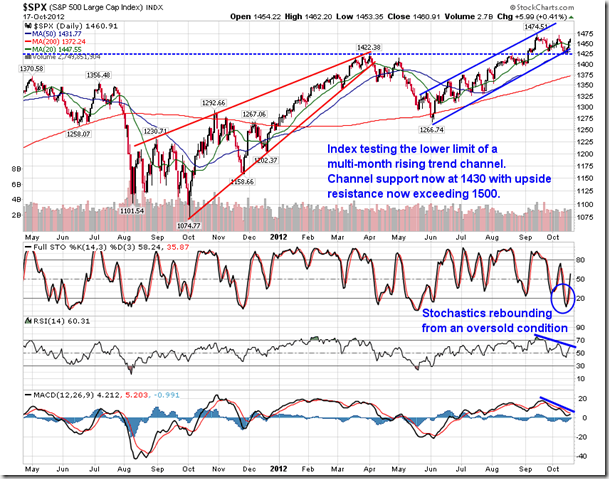

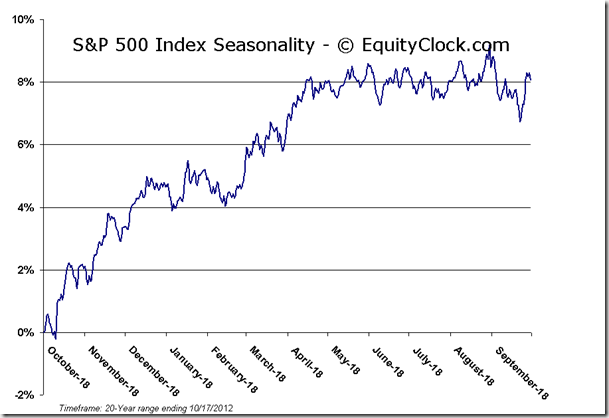

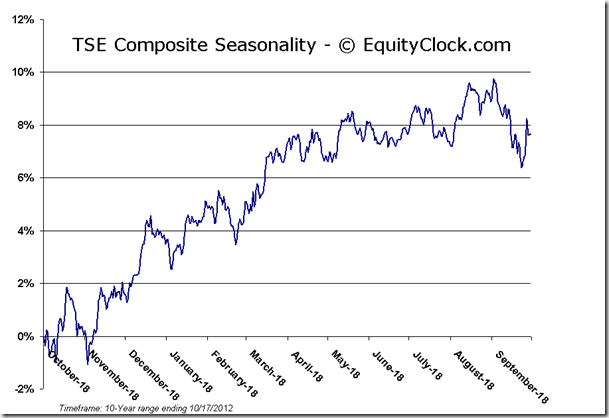

With the gains in equity markets over the past three days, benchmarks, such as the S&P 500, have essentially erased all of last week’s losses and are now back at resistance. Despite all of this bullishness, the short-term trend remains negative as a lower-lows and lower-highs dominate the trading activity. A breakout of this range is critical to resume the intermediate bullish trend that began back in June. Given the period of seasonal strength for equities is right around the corner, the chance of a breakout is likely.

Catalysts that could trigger a breakout include a breakdown of the US Dollar Index below support, continued declines in Spanish bond yields, continued weakness in US treasury prices, earnings optimism and improved growth expectations, a rebound in strength in the Technology sector following a month of declines in shares of Apple, clarity over which candidate will win the US Presidency, and optimism that the fiscal cliff will be solved prior to year-end.

Turning to the earnings front, reaction to reports remains fairly negative with IBM and Intel the latest stocks to take a hit following the release of results. According to Bespoke, the earnings beat rate as of yesterday stood at 59%, while the beat rate on revenues is only 43%, thus far. Investors continue to look for top and bottom line beats as well as strong guidance in order to be reassured of future growth prospects. However, the results are showing that companies are failing to provide this reassurance as reports struggle to overcome already significantly lowered expectations.

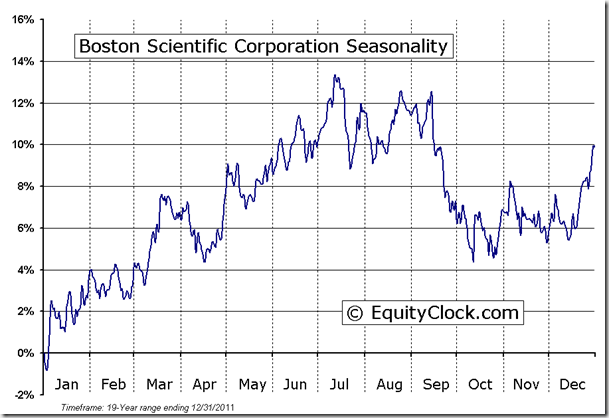

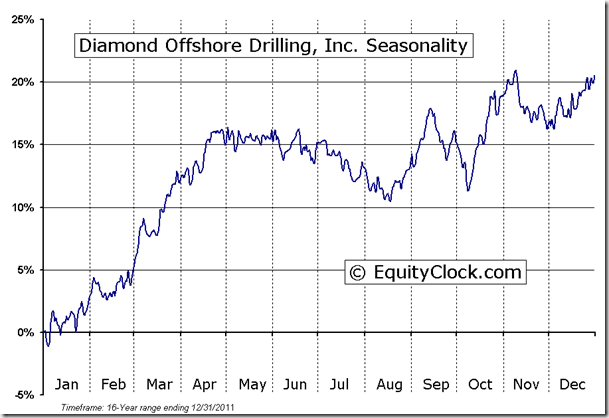

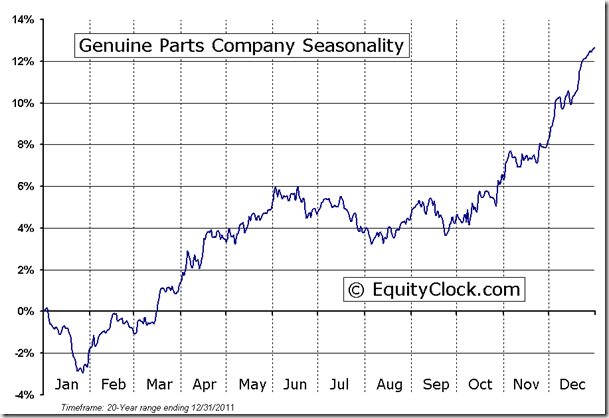

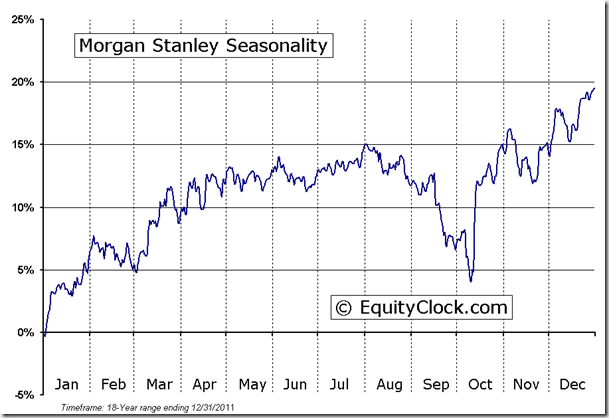

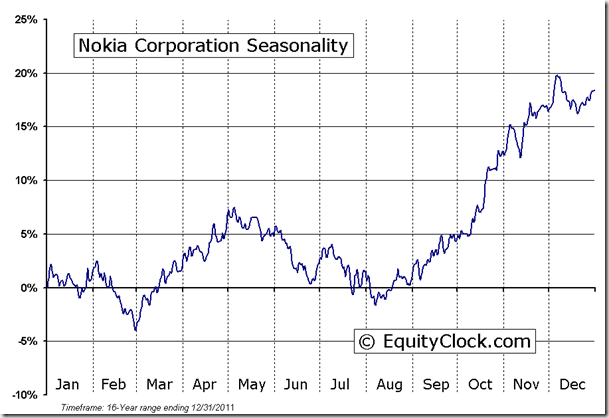

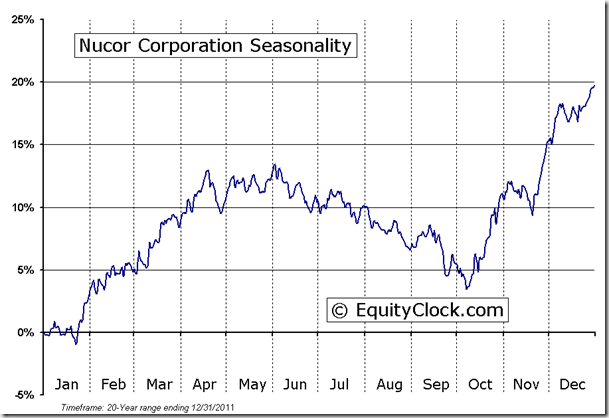

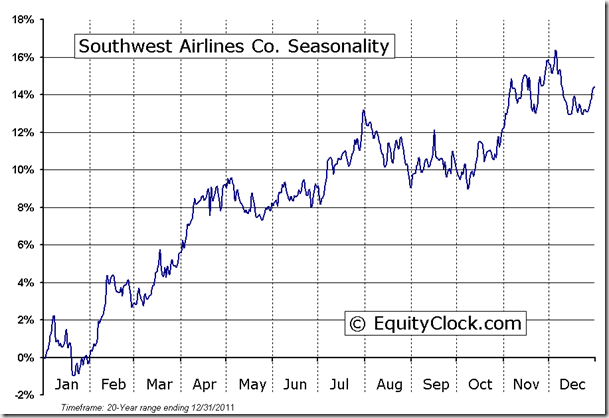

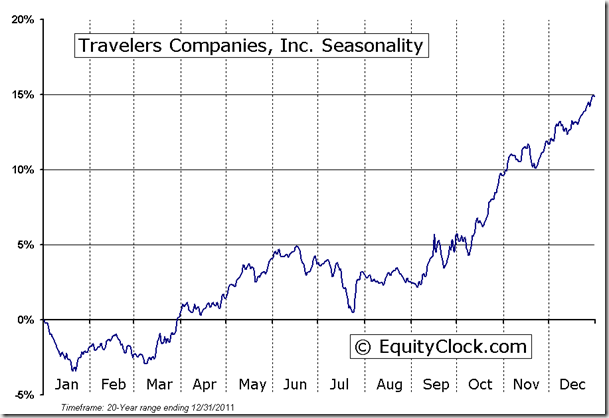

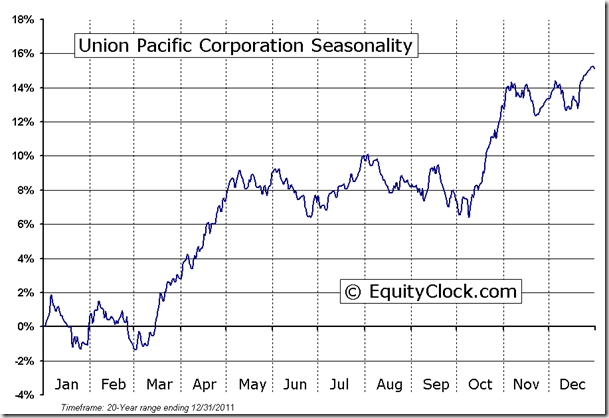

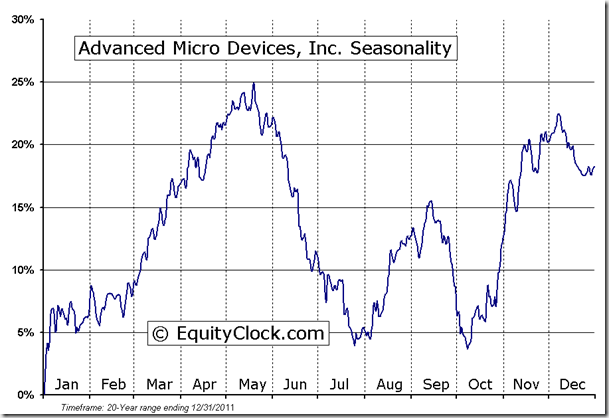

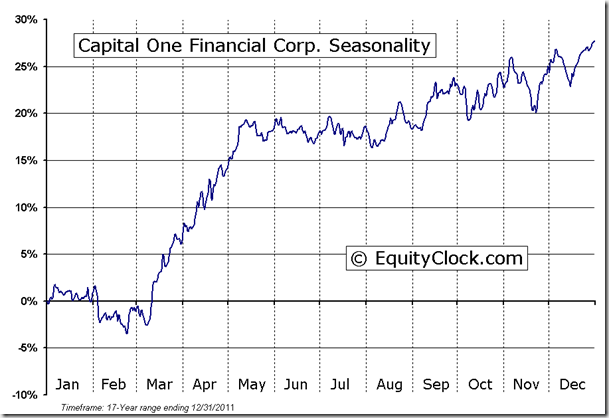

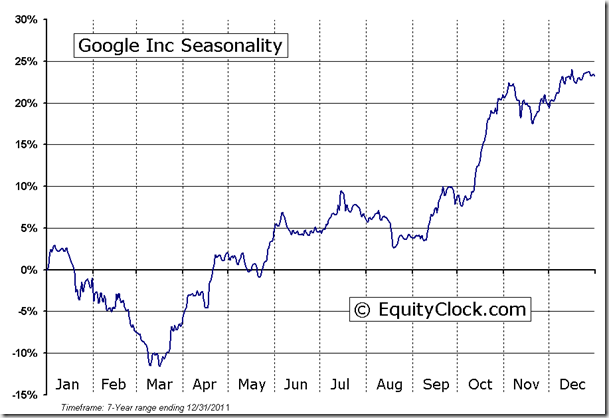

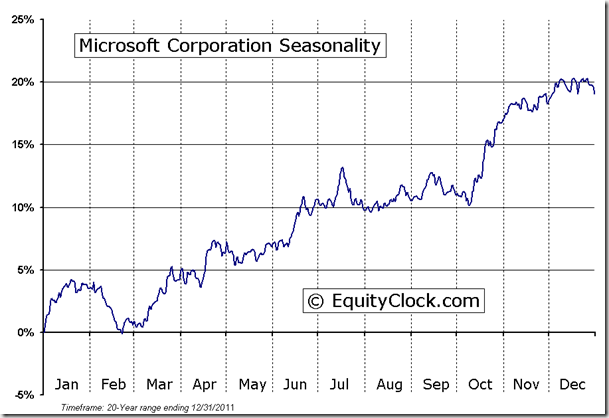

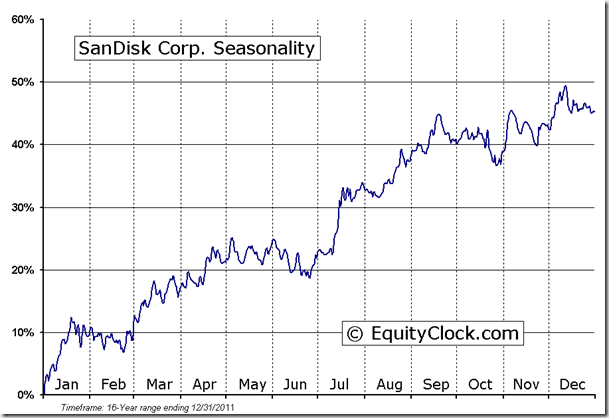

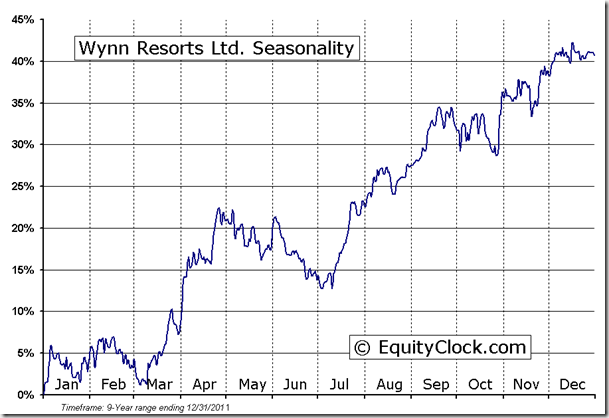

Earnings growth expectations for the fourth quarter continue to top 10%, rebounding from the expected third quarter decline of 2.6% as end of year spending is thought to boost earnings power. Companies reporting earnings today include Baxter, Boston Scientific, Diamond Offshore, Genuine Parts, Morgan Stanley, Nokia, Nucor, Phillip Morris, Southwest Airlines, Travelers, Union Pacific, Verizon, Advanced Micro Devices, Capital One Financial, Google, Microsoft, SanDisk, and Wynn Resorts.

Sentiment on Wednesday, according to the put-call ratio, ended bullish at 0.79

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.65 (up 0.16%)

- Closing NAV/Unit: $12.65 (up 0.08%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 3.87% | 26.5% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.