70 Second Market Outlook – Metals, Dollar, Bonds, Stocks, Energy

By Chris Vermeulen, Market Shadows

Over the past year some really interesting things unfolded in the market. Investing or even swing trading has been much more difficult because of the wild economic data and daily headline news from all over the globe causing strong surges or sell-offs almost every week.

For a while you could not hold a position for more than a week without some type of news event moving the market enough to either push it deep in the money or trigger a stop loss. This has caused a lot of individuals to give up on trading which is not a good sign for the financial market as a whole.

The key to navigating stocks which everyone thinks are overbought is to trade small position sizes and focus on the shorter time frames like the 4 hour charts. The 4 hours charts are my secret weapon. They provide large price swings which daily chart traders focus on while also showing clear intraday patterns for spot reversals or continuation patterns with precise entry/exit points.

While I could ramble on about why the stock market is primed for major long term growth, I will keep things short and simple with some 4 hour and daily charts for you to see what I’m thinking should unfold moving forward.

Keep in mind, the most accurate trading opportunities that happen week after week are the quick shifts in sentiment which only last 2-5 days at most, which is what most of my charts below are focusing on…

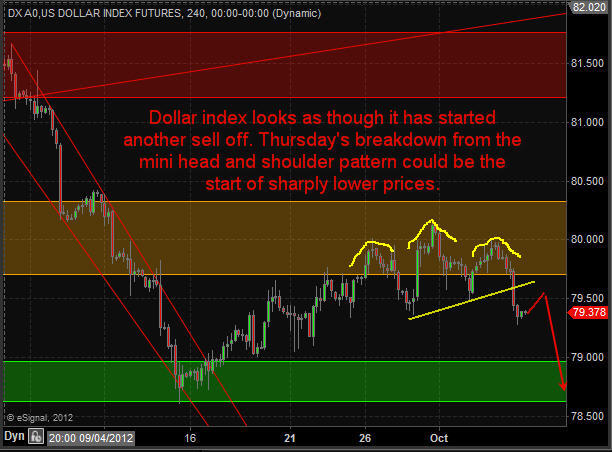

Dollar Index – 4 Hour Chart

This chart shows a mini Head & Shoulders reversal pattern and likely target over the next five sessions. The dollar index has been driving the market for the past couple years so a lower dollar means higher stock and commodity prices.

Dollar Index Trading

Bond Futures – 4 Hour Chart

Money has been flowing into bonds for the past couple weeks with most traders and investors expecting a strong correction in stocks. As you can see the price of bonds hit resistance this week and as of Thursday has started selling off. Money flowing out of this “Risk Off” asset means money will move to the “Risk On” investments like stocks and commodities.

Bond Futures Trading

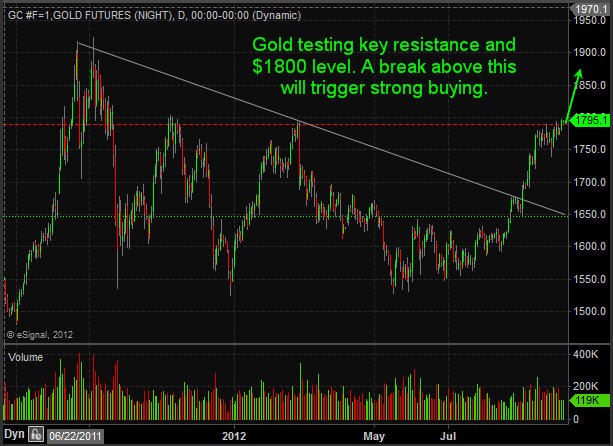

Gold Futures – Daily Chart

Gold is stuck in both categories. It is a “Risk Off” safe haven when people are scared of falling stock prices, and it is also a “Risk On” speculative investment when people are feeling good about the market. Gold has been trading at key resistance for a couple weeks and looks as though it’s starting its next rally.

Gold Futures Trading

Silver Futures – Daily Chart

Silver is in the same boat as gold though it carries much more volatility than gold. Expect 2-4% swings regularly and sloppy chart patterns in this metal.

Silver Futures Trading

SP500 Futures – Daily Chart

As much as everyone hates to buy stocks up at these lofty prices I hate to say it but I think they are going to keep going up and they could do this for a long time yet. If the dollar index continues to break down then I expect the SP500 to rally another 3% from here (1500) in the next 1-2 weeks.

SP500 Futures Trading

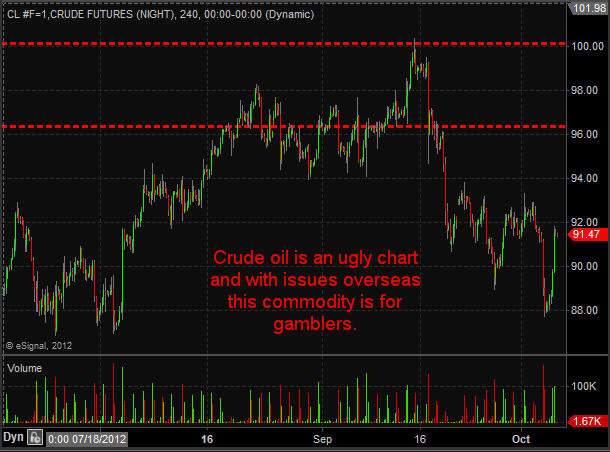

Crude Oil Futures – 4 Hour Chart

I have not been paying much attention to crude oil in the past few months. While it has had big price action, many of those big days took place on news causing an instant price movement making this extra dangerous to trade. I continue to watch rather than engaging.

Crude Oil Futures Trading

Natural Gas Futures – Daily Chart

Natural gas has been a great performer for us in the past 6 months as all the short positions were slowly covered. I just closed out my natural gas ETF trade this week with a 31.9% gain and plan on getting back in once the chart provides another low risk setup.

Natural Gas Futures Trading

Trading Conclusion:

In short, the dollar index along with bonds should will correct over the next few weeks. That will trigger buying in stocks and commodities. Natural gas dances to its own drum beat. The dollar does not have much affect on its price, and most of the time, natural gas is doing the opposite of the broad market.

Get My Pre-Market Trading Analysis Video and Intraday Chart Analysis EVERY DAY, www.TheGoldAndOilGuy.com. ~ Chris Vermeulen

Copyright © ![]() Market Shadows (http://s.tt/1pmc7)

Market Shadows (http://s.tt/1pmc7)