by Sober Look

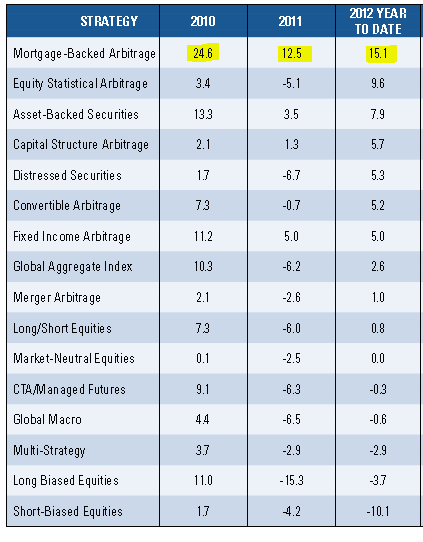

If there is one set of investors that has been cheering Ben Bernanke on, it is the mortgage-focused hedge funds. This group of funds has by far outperformed the hedge fund universe as the Fed decided to take a big chunk of MBS paper out of the market (see discussion) - in addition to the previous securities purchase programs. Other long-biased fixed income hedge funds (such as ABS) have done reasonably well on the back of Fed's action, though most lag their indices. Equity funds on the other hand have struggled for the past two years (except for stat arb) as both the long-biased AND the short-biased equity funds lost money this and last year. It's not clear how that happened but it speaks to the stock picking "prowess" of the hedge fund community.

|

| Hedge Fund Performance (Source: Bloomberg) |

Copyright © SoberLook.com